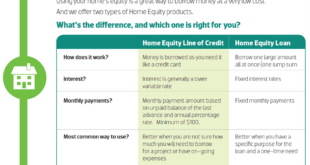

Home equity loan refinancing options allow homeowners to replace their existing mortgage with a new one, typically at a lower interest rate. This can result in significant monthly savings and can free up cash flow for other expenses. Refinancing a home equity loan can have several benefits, including:

Read More »Home Equity Loan

Unveiling the Secrets: Exceptional Home Equity Loan Incentives

Home equity loan incentives are financial perks offered by lenders to encourage homeowners to take out home equity loans. These incentives can take various forms, such as reduced interest rates, closing cost credits, or cash bonuses. Lenders may offer these incentives during specific promotional periods or to attract new customers.

Read More »Unveiling the Secrets of Home Equity Loan Discounts: Discover the Path to Financial Freedom

Home equity loan discounts are a type of loan that allows homeowners to borrow money against the equity they have in their homes. These loans are typically offered at lower interest rates than other types of loans, making them a good option for homeowners who need to borrow money for home improvements, debt consolidation, or other expenses. Home equity loan …

Read More »Discover Unbeatable Home Equity Loan Promotions: Unlock the Secrets

Home equity loan promotions are special offers or incentives provided by lenders to encourage borrowers to take out home equity loans. These promotions can include low interest rates, closing cost assistance, or other perks. Home equity loan promotions can be a great way to save money on your home equity loan. By taking advantage of a promotion, you can lock …

Read More »Unlock the Secrets of Home Equity Loan Deals: Discover the Hidden Opportunities

A home equity loan deal is a type of loan that allows homeowners to borrow money against the equity they have built up in their homes. Home equity loans are secured loans, meaning that they are backed by the borrower’s home. This makes them a less risky investment for lenders, which can result in lower interest rates for borrowers. Home …

Read More »Unlock Hidden Savings with Home Equity Loan Specials: Insider Tips Revealed

Home equity loan specials are a type of loan that allows homeowners to borrow money against the equity they have built up in their homes. This type of loan can be used for a variety of purposes, such as consolidating debt, making home improvements, or paying for education. Home equity loan specials often come with lower interest rates and fees …

Read More »Unlock Home Equity Riches: Secrets to Unveil Your Financial Potential

Home equity loan programs allow homeowners to borrow money against the equity they have built up in their homes. This type of loan is secured by the home itself, meaning that the lender can foreclose on the property if the borrower defaults on the loan. Home equity loans can be used for a variety of purposes, such as home improvements, …

Read More »Home Equity Loan Assistance: Unlocking the Secrets to Mortgage Relief

Home equity loan assistance programs are designed to help homeowners who are struggling to make their mortgage payments. These programs can provide financial assistance in the form of a loan modification, forbearance, or other relief options. Home equity loan assistance programs can be a lifeline for homeowners who are facing foreclosure. There are a number of different home equity loan …

Read More »Unlock the Hidden Power of Home Equity Loan Funding

Home equity loan funding is a type of loan that allows homeowners to borrow money against the equity they have in their homes. The loan is secured by the home itself, and the interest rate is typically lower than that of a personal loan. Home equity loans can be used for a variety of purposes, such as home improvements, debt …

Read More »Discover the Hidden Truths of Home Equity Loan Down Payments for Financial Empowerment

A home equity loan down payment is a sum of money paid upfront when taking out a home equity loan. It typically ranges from 5% to 20% of the loan amount and serves as a cushion for the lender in case of a default. By making a down payment, borrowers demonstrate their financial commitment and reduce the risk associated with …

Read More »Unlock the Secrets: Master the Home Equity Loan Closing Process

A home equity loan closing process refers to the final step in securing a home equity loan, where borrowers sign the loan documents and receive the loan proceeds. It involves several key steps, including a title search, appraisal, and loan approval. Understanding the home equity loan closing process is crucial for borrowers to ensure a smooth and successful loan experience. …

Read More »Unveiling the Secrets of Home Equity Loan Documents: A Journey to Financial Clarity

Home equity loan documents refer to the legal agreements and disclosures that outline the terms and conditions of a home equity loan. These documents provide essential information about the loan, including the loan amount, interest rate, repayment schedule, and the borrower’s rights and responsibilities. Home equity loan documents are important because they protect both the borrower and the lender. For …

Read More »Discover the Secrets of Home Equity Loan Appraisals: Unlock Your Home's Value

A home equity loan appraisal is a professional assessment of the value of your home. It is typically required by lenders before they will approve a home equity loan or line of credit. The appraisal will help the lender determine how much you can borrow and what the interest rate will be. Home equity loan appraisals are typically performed by …

Read More »Unlock the Secrets to a High Home Equity Loan Credit Score

Home equity loan credit score is a crucial factor that lenders consider when evaluating your application for a home equity loan. It is a number that represents your creditworthiness, based on your credit history and other financial information. A higher credit score typically means that you are a lower risk to the lender, and you may qualify for a lower …

Read More »Unlock Tax Savings: Discover the Secrets of the Home Equity Loan Interest Deduction

A home equity loan interest deduction is a tax break that allows homeowners to deduct the interest they pay on their home equity loans. This can save homeowners a significant amount of money on their taxes, especially if they have a large home equity loan. To qualify for the deduction, the loan must be secured by the taxpayer’s primary residence, …

Read More »Unlock Home Equity Loan Tax Benefits: Discover Hidden Savings

A home equity loan is a type of secured loan that allows homeowners to borrow against the equity they have built up in their homes. Home equity loans can be used for a variety of purposes, such as home improvements, debt consolidation, and education expenses. One of the potential benefits of a home equity loan is that the interest paid …

Read More »Unveiling Secrets: Home Equity Loan Tax Deduction Decoded!

A home equity loan tax deduction is a tax break that allows homeowners to deduct the interest paid on a loan secured by their home. This can be a valuable tax savings, especially for homeowners who have a large mortgage balance. To qualify for the home equity loan tax deduction, the loan must be secured by the taxpayer’s primary residence …

Read More »Unveiling the Secrets: Home Equity Loan Terms and Conditions Demystified

Home equity loans are a type of secured loan that allows homeowners to borrow against the equity they have built up in their homes. Home equity loan terms and conditions will vary depending on the lender and the borrower’s creditworthiness, but they typically involve a fixed interest rate and a loan term of 5 to 30 years. Home equity loans …

Read More »Discover the Secrets of Home Equity Loan Interest: Unlocking Financial Insights

Home equity loan interest is the interest charged on a loan secured by your home equity. This type of loan allows you to borrow against the value of your home, up to a certain percentage of the home’s appraised value. Home equity loans typically have lower interest rates than other types of personal loans, making them a good option for …

Read More »Uncover the Secrets of Home Equity Loan Rates: A Guide to Saving Money

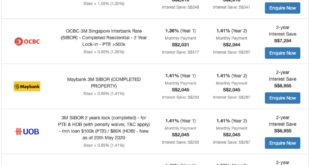

Home equity loan rate comparison is the process of reviewing and comparing interest rates and terms offered by different lenders for home equity loans. Home equity loans allow homeowners to borrow against the equity they have built up in their homes, and comparing rates can help you secure the most favorable loan terms. Comparing home equity loan rates is important …

Read More » Ini Balikpapan All about Banking Finance

Ini Balikpapan All about Banking Finance