A business loan customer is an individual or organization that has taken out a loan specifically designed for business purposes. Business loans can be used for a variety of purposes, such as starting a new business, expanding an existing business, or purchasing equipment or inventory. Business loan customers typically have good credit and a strong business plan. Business loans can …

Read More »Business Banking

Unveiling the Hidden Truths: A Deep Dive into Business Loan Customer Beliefs

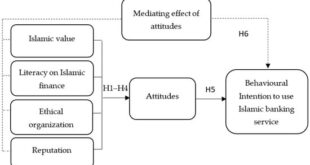

Business loan customer beliefs are the perceptions and attitudes that customers have towards business loans. These beliefs can influence customers’ decisions about whether or not to apply for a business loan, as well as the terms of the loan they choose. For example, a customer who believes that business loans are too expensive may be less likely to apply for …

Read More »Business Loan Customer Attitudes: Unveiling Surprising Insights and Strategies

Business loan customer attitudes refer to the perceptions, feelings, and beliefs that customers have towards business loans and the institutions that offer them. These attitudes can be influenced by a variety of factors, including the customer’s financial situation, past experiences with business loans, and the overall economic climate. Positive business loan customer attitudes are important for banks and other lending …

Read More »Unlock the Secrets to Delighting Business Loan Customers

Business loan customer values refer to the specific characteristics and qualities that are important to customers when they are considering taking out a business loan. These values can vary depending on the individual customer and the specific loan product, but some common factors that customers may consider include the loan amount, interest rate, repayment terms, and customer service. Understanding business …

Read More »Unlock the Secrets of Business Loan Customer Lifestyles

Understanding the financial behaviors and spending patterns of business loan customers is crucial for lenders to assess risk and make informed decisions. Business loan customer lifestyles encompass the spending habits, saving patterns, and investment strategies of individuals or businesses that have taken out business loans. Analyzing business loan customer lifestyles provides valuable insights into their financial stability and creditworthiness. Lenders …

Read More »Unlock the Secrets: Business Loan Aspirations Revealed

Business loan customer aspirations refer to the goals, motivations, and unmet needs of individuals and businesses seeking financing through business loans. Understanding these aspirations is crucial for lenders to effectively tailor their products and services to meet the evolving demands of borrowers. Business loan customer aspirations are influenced by various factors, including industry trends, economic conditions, and individual business objectives. …

Read More »Unlock the Secrets of Business Loan Customer Motivations: A Comprehensive Guide

Business loan customer motivations encompass the underlying reasons why businesses seek loans to finance their operations and expansion. These motivations are diverse and can include: Acquiring capital to purchase equipment, inventory, or real estate Expanding operations into new markets or product lines Hiring and training new employees Covering unexpected expenses or cash flow shortfalls Improving infrastructure or technology Understanding business …

Read More »Unveiling Business Loan Customer Behaviors: Secrets to Success

Business loan customer behaviors refer to the financial habits and decision-making patterns of individuals and businesses that take out business loans. These behaviors can include loan application patterns, repayment habits, and loan utilization patterns. Understanding business loan customer behaviors is important for lenders because it can help them to: Assess the creditworthiness of potential borrowers Develop loan products and services …

Read More »Discover the Hidden Psyche of Business Loan Customers: Unlocking Secrets for Success

Business loan customer psychographics involves the study of the psychological characteristics, values, attitudes, and behaviors of individuals who take out business loans. It’s a crucial aspect of understanding the target market for business loan products and services. Understanding business loan customer psychographics offers several benefits. Firstly, it enables lenders to tailor their loan offerings and marketing campaigns to specific customer …

Read More »Unlock the Secrets of Business Loan Customer Demographics for Unstoppable Growth

Business loan customer demographics refer to the characteristics and behaviors of individuals or businesses that take out business loans. These characteristics can include factors such as age, location, industry, business size, and credit score. Understanding business loan customer demographics is important for lenders because it allows them to better understand the needs of their target market. This information can be …

Read More »Unlock the Secrets to Thriving Business Loan Customer Segments

Business loan customer segments refer to the distinct groups of businesses that banks and other lenders target with their loan products. These segments are typically defined based on factors such as industry, size, revenue, and creditworthiness. Understanding and segmenting business loan customers is crucial for lenders as it allows them to tailor their products and services to meet the specific …

Read More »Unlock the Secrets of Business Loan Customer Targeting for Unparalleled Success

In the realm of finance, understanding the specific characteristics and needs of potential borrowers is crucial for businesses seeking to offer tailored financial products and services. Business loan customer targets refer to the distinct groups of businesses that a lender identifies as having a high probability of being interested in and eligible for their loan offerings. These targets are meticulously …

Read More »Unveil the Secrets of Business Loan Customer Objectives

Business loan customer objectives refer to the specific goals and aspirations of businesses that seek funding through loans. These objectives can vary widely depending on the nature of the business, its industry, and its current financial situation. Common objectives include expanding operations, purchasing equipment, hiring additional staff, or launching new product lines. Understanding these objectives is crucial for lenders when …

Read More »Unlock Your Business Goals with Business Loans: A Path to Success

Business loan customer goals are the specific objectives that businesses aim to achieve by obtaining a loan. These goals can vary widely depending on the individual business and its circumstances, but some common goals include: Expanding operations Purchasing new equipment Hiring new employees Marketing and advertising Research and development Understanding the customer’s goals is essential for lenders, as it helps …

Read More »Unveiling Business Loan Opportunities: A Path to Growth and Success

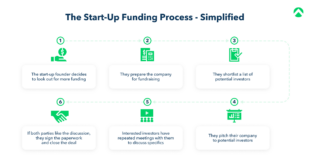

Business loan customer opportunities encompass the potential avenues for businesses to obtain financing to meet their various needs. These opportunities can include traditional bank loans, lines of credit, and alternative lending options. Exploring business loan customer opportunities is crucial for businesses seeking to expand, invest, or manage cash flow. These opportunities provide access to capital, enabling businesses to seize growth …

Read More »Unlocking Business Loan Secrets: Unveiling Customer Pain Points for Enhanced Lending

Business loan customer pain points refer to the challenges and frustrations experienced by customers when applying for or managing business loans. These pain points can arise from various factors, including complex application processes, lengthy approval times, lack of transparency, limited loan options, and poor customer service. Identifying and addressing these pain points is crucial for lenders to improve the customer …

Read More »Unlock Business Loan Secrets: Uncover Hidden Challenges and Discover Success

Business loan customer challenges encompass the difficulties and obstacles faced by customers seeking business loans. These challenges can arise from various factors, including stringent eligibility criteria, complex application processes, lengthy approval times, and high-interest rates. Understanding business loan customer challenges is crucial for lenders to improve their products and services. By addressing these challenges, lenders can enhance the customer experience, …

Read More »Uncover Winning Strategies: The Ultimate Guide to Business Loan Customer Priorities

In the world of business lending, understanding the priorities of loan customers is crucial for financial institutions to develop products and services that meet their needs. Business loan customer priorities encompass the key factors that influence a business’s decision-making process when seeking external financing. A comprehensive understanding of these priorities enables lenders to tailor their loan offerings, interest rates, repayment …

Read More »Unveiling the Secrets: Business Loan Customer Requirements

Business loan customer requirements refer to the criteria that banks or lending institutions use to assess the eligibility of businesses for loans. These requirements may include factors such as the business’s financial history, creditworthiness, industry, and repayment capacity. Meeting business loan customer requirements is important for businesses that need financing to grow or expand their operations. By understanding and meeting …

Read More »Unlock the Secrets of Business Loan Customer Desires

Business loan customer desires refer to the specific needs and preferences of businesses seeking loans from financial institutions. These desires can vary depending on the company’s size, industry, and financial situation. However, some common desires include: Favorable interest rates: Businesses want to secure loans with low interest rates to minimize borrowing costs. Flexible loan terms: Businesses prefer loans with flexible …

Read More » Ini Balikpapan All about Banking Finance

Ini Balikpapan All about Banking Finance