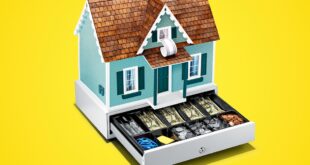

Home equity loan rates today refer to the interest rates charged by lenders for home equity loans, which allow homeowners to borrow against the equity they have built up in their homes. These rates can vary depending on a number of factors, including the lender, the borrower’s creditworthiness, and the loan amount. Home equity loans can be a good way …

Read More »Home Equity Loan

Unveiling Home Equity Loan Options: Unlock Financial Empowerment

Home equity loan options are a type of loan that allows homeowners to borrow money against the equity they have built up in their homes. Equity is the difference between the current market value of your home and the amount you still owe on your mortgage. Home equity loans can be used for a variety of purposes, such as home …

Read More »Unlock the Secrets: Unraveling Home Equity Loan Payments

Home equity loan payments are a type of loan that allows homeowners to borrow money against the equity they have built up in their homes. The amount of money that can be borrowed is typically based on the home’s appraised value and the amount of outstanding mortgage debt. Home equity loan payments are typically made monthly and are calculated based …

Read More »Uncover Hidden Risks of Home Equity Loans: A Comprehensive Guide

Home equity loans or second mortgages are secured loans that use your home equity as collateral. Home equity loans are popular because they offer lower interest rates than personal loans. However, there are some risks associated with home equity loans that you should be aware of before you take one out. Importance of Understanding Home Equity Loan Risks

Read More »Unveil the Hidden Truths: Home Equity Loan Pitfalls Revealed

Home equity loan disadvantages refer to the potential drawbacks and risks associated with this type of loan, which allows homeowners to borrow against the equity they have built up in their property. These loans are secured by the home itself, meaning that if the borrower defaults on the loan, the lender can foreclose on the property. There are several key …

Read More »Unlock the Secrets: Home Equity Loan Advantages You Never Imagined

A home equity loan is a type of secured loan that allows homeowners to borrow money against the equity they have built up in their homes. Home equity loans can be used for a variety of purposes, such as home improvements, debt consolidation, or education expenses. They typically have lower interest rates than personal loans, but they also come with …

Read More »Unlock Hidden Gems: Surprising Home Equity Loan Benefits Revealed!

A home equity loan is a type of secured loan that allows homeowners to borrow money against the equity they have built up in their homes. Home equity loans can be used for a variety of purposes, such as home improvements, debt consolidation, or education expenses. There are many benefits to taking out a home equity loan. Home equity loans …

Read More »Unlock Smart Borrowing: Unraveling Home Equity Loan Offers

Home equity loan offers are a type of loan that allows homeowners to borrow money against the equity they have built up in their homes. This can be a great way to access cash for a variety of purposes, such as home renovations, debt consolidation, or education expenses. Home equity loan offers typically have lower interest rates than personal loans …

Read More »Uncover the Secrets of Home Equity Loan Preapproval: A Guide to Homeownership Success

Home equity loan preapproval is a conditional commitment from a lender to extend a home equity loan up to a specified amount, subject to the home appraisal and the borrower’s financial situation remaining the same. It involves a preliminary assessment of the borrower’s creditworthiness, income, and property value. Preapproval can strengthen a home offer and provide peace of mind during …

Read More »Unravel the Secrets of Home Equity Loan Repayment: Discoveries and Insights

Home equity loan repayment refers to the gradual settlement of a loan secured against the equity in a residential property. This type of loan allows homeowners to borrow against the difference between the current market value of their home and the amount they still owe on their mortgage. Home equity loans can be a valuable source of financing for various …

Read More »Unveil the Hidden Truths: Home Equity Loan Fees Demystified

Home equity loan fees are charges associated with obtaining a home equity loan, a type of secured loan that allows homeowners to borrow against the equity they have built up in their homes. These fees can include application fees, appraisal fees, origination fees, lender fees, and other closing costs. These fees can vary depending on the lender, the loan amount, …

Read More »Unveiling the Secrets of Home Equity Loan Eligibility

Home equity loan eligibility refers to the criteria that a borrower must meet in order to qualify for a home equity loan, which is a type of secured loan that is backed by the borrower’s home equity. Lenders will typically consider factors such as the borrower’s credit score, debt-to-income ratio, and the amount of equity that the borrower has in …

Read More »Unlock Home Equity Loan Secrets: Discover Limits and Leverage Your Home's Potential

Home equity loan limits are maximum amounts that you can borrow against the equity in your home. The limit is based on a percentage of your home’s appraised value, typically 80% to 90% for first mortgages and 80% or less for second mortgages. For example, if your home is appraised at $200,000, you may be able to borrow up to …

Read More »Discover Home Equity Loan Secrets for Guaranteed Approval

Home equity loan approval refers to the process of getting a loan against the equity you have built up in your home. It entails meeting certain criteria set by lenders to determine your eligibility for the loan. These criteria often include factors like your credit score, debt-to-income ratio, and the amount of equity you have in your home. Home equity …

Read More »Unveiling the Secrets of Home Equity Loans: A Comprehensive Guide to Qualifications

Home equity loan qualifications refer to the criteria that lenders use to assess an applicant’s eligibility for a home equity loan. These qualifications typically include factors such as the applicant’s credit score, debt-to-income ratio, and the amount of equity they have in their home. Qualifying for a home equity loan can be important for homeowners who need to access cash …

Read More »Unveiling the Secrets: A Comprehensive Guide to Home Equity Loan Applications

A home equity loan application is a request for a loan that is secured by the equity in your home. The equity in your home is the difference between the value of your home and the amount you owe on your mortgage. Home equity loans can be used for a variety of purposes, such as home improvements, debt consolidation, and …

Read More »Unlock Hidden Truths: Home Equity Loan Closing Costs Decoded

When you take out a home equity loan or a second mortgage, you’re borrowing against the equity you have in your home. In addition to the interest you’ll pay on the loan, you’ll also have to pay closing costs. These costs can add up to several thousand dollars, so it’s important to factor them into your budget when you’re considering …

Read More »Unlock Home Equity Secrets: Discover Hidden Opportunities with Refinancing

A home equity loan refinance is a type of secured loan that allows homeowners to borrow money against the equity they have built up in their homes. This can be a great way to access cash for large expenses, such as home renovations, debt consolidation, or education costs. Home equity loans typically have lower interest rates than personal loans and …

Read More »Unlock Home Equity Secrets: Home Equity Loans vs. HELOCs

A home equity loan and a home equity line of credit (HELOC) are both ways to borrow money using your home as collateral. However, there are some key differences between the two options. A home equity loan is a lump sum loan that is secured by your home. The interest rate on a home equity loan is typically fixed, and …

Read More »Unlock Secrets and Insights: Your Guide to Home Equity Loan Interest Rates

Home equity loan interest rates refer to the interest charged on loans secured by a borrower’s home equity. Home equity is the difference between the current market value of a home and the amount owed on the mortgage. Home equity loans can be used for various purposes, such as home improvements, debt consolidation, or education expenses. The interest rate on …

Read More » Ini Balikpapan All about Banking Finance

Ini Balikpapan All about Banking Finance