Life insurance planning involves assessing your financial situation and needs to determine the appropriate amount and type of life insurance coverage. It considers factors such as your income, debts, family responsibilities, and future financial goals. Life insurance provides financial protection for your loved ones in the event of your untimely death. It can help cover expenses such as funeral costs, …

Read More »Private Banking

Discover the Hidden Gems of Private Banking Insurance

Private banking insurance refers to insurance products and services tailored to the unique needs of high-net-worth individuals and families, typically offered by private banks. These offerings encompass a range of coverage, such as bespoke property and casualty insurance, yacht and aviation insurance, and specialized investment-linked policies. Notably, private banking insurance often provides enhanced coverage limits, personalized risk management strategies, and …

Read More »Unlock the Secrets of Trust and Fiduciary Services: A Guide to Wealth Preservation and Growth

Trust and fiduciary services encompass managing and administering assets for individuals and entities, ensuring their wishes and interests are upheld. These services involve a high level of trust and responsibility, as fiduciaries are legally and ethically bound to act in the best interests of their clients. The importance of trust and fiduciary services cannot be overstated. By engaging such services, …

Read More »Unveiling the Secrets of Estate Administration Services

Estate administration services encompass a wide range of legal, financial, and administrative tasks associated with managing the estate of a deceased individual. These services ensure the orderly distribution of assets, settlement of debts, and fulfillment of the decedent’s final wishes as expressed in their will or trust. Estate administration is a complex and often time-consuming process that requires specialized knowledge …

Read More »Unlock the Secrets of Succession Planning: Insights for Private Banking

Succession planning solutions encompass strategic initiatives employed by organizations to ensure a seamless transfer of leadership and critical roles during planned or unplanned departures. These solutions involve identifying, developing, and preparing potential successors to take on key positions within the organization. A comprehensive succession planning process includes assessing future leadership needs, evaluating current talent, creating development plans, and establishing a …

Read More »Unveiling the Secrets of Multi-Generational Wealth Planning

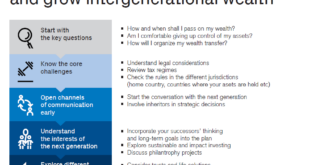

Multi-generational wealth planning is a comprehensive approach to managing and preserving wealth for the benefit of multiple generations within a family. It involves developing a long-term strategy that considers the financial goals, values, and aspirations of each generation, with a focus on preserving and growing wealth while minimizing taxes and other potential risks. The benefits of multi-generational wealth planning are …

Read More »Unlock Limitless Wealth Potential: Discover the Transformative Power of Family Office Services

Family office services provide comprehensive wealth management and advisory solutions to affluent families and high-net-worth individuals. These services encompass a wide range of financial, legal, tax, and administrative tasks, tailored to meet the unique needs and objectives of each family. Family office services gained prominence in the early 20th century as wealthy families sought centralized management of their complex financial …

Read More »Unleash the Power of Charitable Giving: Discover Game-Changing Strategies

Charitable giving strategies are plans designed to maximize the impact and efficiency of donations to charitable causes. These strategies can involve various approaches, such as choosing the most effective charities, optimizing tax deductions, and structuring donations to align with personal financial goals. There are numerous benefits to employing charitable giving strategies. First, it allows donors to make more informed decisions …

Read More »Unlock the Power of Philanthropy: Discoveries and Insights for Private Banking

Philanthropic advisory services are professional services that provide guidance and support to individuals, families, and organizations in the effective management and distribution of their charitable giving. These services can include a wide range of activities, such as developing philanthropic strategies, identifying and evaluating potential grantees, and managing charitable trusts and foundations. Philanthropic advisory services can be beneficial for a variety …

Read More »Unlock Retirement's Secrets: Discover Proven Strategies for a Secure Future

Retirement planning services encompass financial advice and guidance to individuals and businesses approaching retirement. These services help individuals prepare for a financially secure retirement by creating a personalized retirement plan that outlines investment strategies, tax-efficient savings options, and income distribution strategies. Retirement planning is crucial as it helps individuals maintain their desired lifestyle during their retirement years, ensuring financial stability …

Read More »Unlock Your Financial Destiny: A Revolutionary Guide to Comprehensive Financial Planning

Comprehensive financial planning is a holistic approach to managing your finances that takes into account all aspects of your financial life, including your income, expenses, savings, investments, and retirement planning. It is a process that helps you to identify your financial goals, develop a plan to achieve them, and track your progress over time. There are many benefits to comprehensive …

Read More »Unveiling the Secrets of Wealth Consolidation: Discoveries and Insights for Private Banking

Wealth consolidation services encompass a range of financial strategies designed to simplify and optimize an individual’s financial portfolio. These services often involve consolidating multiple financial accounts, investments, and other assets into a single, cohesive plan. By streamlining financial management, wealth consolidation can provide numerous benefits, including reduced costs, increased efficiency, and improved investment performance. The importance of wealth consolidation lies …

Read More »Unveiling the Secrets of Luxury Lifestyle Financing

Luxury lifestyle financing allows individuals to borrow money against their assets or future income to fund high-end purchases and experiences. This service provides access to a wide range of financing options tailored for luxury assets, such as real estate, yachts, private jets, and art collections. Lifestyle financing can offer numerous benefits, including accessing exclusive investment opportunities, managing cash flow, and …

Read More »Unlock the Secrets of High-Limit Credit Facilities for Limitless Growth

High-limit credit facilities are financial products designed to meet the borrowing needs of individuals and businesses with substantial credit requirements. These facilities typically offer higher credit limits than traditional credit cards or personal loans, providing access to larger sums of money for various purposes such as business expansion, real estate investments, or debt consolidation. The importance of high-limit credit facilities …

Read More »Unveil the Secrets of Private Banking Credit Cards: A Journey to Financial Empowerment

Private banking credit cards are exclusive financial products tailored to high-net-worth individuals and offer a suite of premium benefits and services. These cards often come with dedicated wealth management services, personalized financial advice, exclusive travel rewards, and premium concierge services. Private banking credit cards provide cardholders access to exclusive events, luxury travel experiences, and lifestyle privileges.

Read More »Unlock Corporate Financing Secrets: Discover the Path to Growth and Success

Corporate financing options encompass the various methods through which companies raise capital to fund their operations and growth. These options play a pivotal role in shaping a company’s financial strategy and long-term success. Corporate financing options offer numerous advantages. They enable companies to access funds for expansion, innovation, and acquisition of assets. Additionally, they provide flexibility in tailoring capital structures …

Read More »Unveiling the Secrets of Commercial Lending: Discoveries and Insights for Success

Commercial lending services encompass a range of financial products and services designed to meet the borrowing needs of businesses. These services play a critical role in supporting economic growth and development by providing businesses with access to capital for various purposes, such as expanding operations, purchasing equipment, or financing real estate acquisitions. Commercial lending services offer several key benefits to …

Read More »Unveiling the Secrets of Business Financing: Solutions for Growth

Business financing solutions refer to the various methods and strategies used by businesses to raise capital for their operations, investments, and growth. These solutions can range from traditional bank loans and lines of credit to alternative financing options such as venture capital, crowdfunding, and merchant cash advances. Business financing solutions play a crucial role in the success and sustainability of …

Read More »Unlock the Secrets of Art and Collectibles Financing: Discoveries and Insights for Private Banking

Art and collectibles financing is the process of using art or collectibles as collateral for a loan. This type of financing can be used to purchase artwork or collectibles, or to finance other expenses, such as home renovations or education costs. Art and collectibles financing has a number of benefits. First, it can allow you to purchase high-value items that …

Read More »Unveiling the Secrets of Aircraft and Yacht Financing: Your Guide to Elite Assets

Aircraft and yacht financing is a specialized type of lending that is used to finance the purchase of aircraft or yachts. This type of financing is typically provided by banks, credit unions, and other financial institutions. Aircraft and yacht financing can be used for both new and used aircraft and yachts, and can be structured to meet the specific needs …

Read More » Ini Balikpapan All about Banking Finance

Ini Balikpapan All about Banking Finance