Luxury real estate financing refers to the financial products and services specifically tailored to meet the unique needs of high-end real estate transactions. These services encompass a range of financing options, including jumbo loans, bridge loans, and portfolio loans, which are designed to accommodate the elevated costs associated with luxury properties. The importance of specialized financing for luxury real estate …

Read More »Private Banking

Unlock the Secrets of Mortgage Financing: Discover Innovative Solutions for Private Banking

Mortgage financing solutions encompass a range of financial products and services designed to assist individuals and entities in obtaining financing for the purchase or refinancing of residential or commercial properties. These solutions typically involve lending arrangements between borrowers and lenders, with the property serving as collateral. Mortgage financing solutions play a crucial role in facilitating homeownership and real estate investment, …

Read More »Unlock the World of Private Banking Loans: Discover Exclusive Insights and Tailored Solutions

Private banking loans are a type of loan offered by private banks to high-net-worth individuals and families. These loans are typically characterized by their large loan amounts, flexible terms, and personalized service. Private banking loans can be used for a variety of purposes, such as financing a business venture, purchasing a luxury home, or consolidating debt. There are a number …

Read More »Discover Unveiled: Equity Investment Strategies That Will Transform Your Portfolio

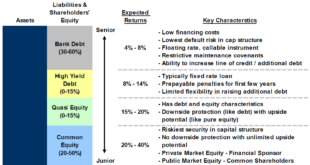

Equity investment strategies involve investing in stocks, which represent ownership shares in publicly traded companies, with the primary goal of capital appreciation and dividend income. These strategies encompass a range of approaches, including value investing, growth investing, income investing, and momentum investing, each tailored to specific investor objectives and risk tolerance. Equity investment strategies play a crucial role in building …

Read More »Uncover the Secrets of Fixed Income Investment Solutions

Fixed income investment solutions are financial products that provide investors with a steady stream of income over a specified period. These solutions typically invest in bonds, which are loans made to corporations or governments. Bonds pay interest payments to investors on a regular basis, and the principal is repaid when the bond matures. Fixed income investment solutions can provide investors …

Read More »Unveil the Hidden Gems of Hedge Fund Investing: Discoveries and Insights

Hedge funds are investment vehicles that pool money from a variety of investors and use sophisticated strategies to generate capital gains. Hedge funds are actively managed, meaning that a portfolio manager makes investment decisions based on their research and analysis. Hedge funds can invest in a wide range of asset classes, including stocks, bonds, commodities, and currencies. Hedge funds offer …

Read More »Uncover the Secrets of Venture Capital: A Comprehensive Guide for Private Banking

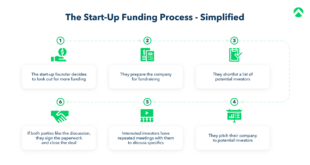

Venture capital investment services provide funding to early-stage, high-growth companies with the potential for high returns. These services typically involve investing in companies that are not yet profitable but have the potential to become major players in their respective industries. Venture capital investment services can be a valuable source of funding for companies that need capital to grow and expand …

Read More »Unlock the Secrets of Private Equity Investment Opportunities

Private equity investment opportunities refer to investments made in privately held companies, typically by investment firms or funds. These opportunities provide investors with the potential for high returns, as private equity firms often seek to improve the performance of their portfolio companies through operational and financial improvements. Private equity investments can take various forms, including leveraged buyouts, growth capital investments, …

Read More »Unveiling the Secrets of Real Estate Investment Services

Real estate investment services encompass a wide range of professional services related to the investment, management, and disposition of real property. These services are typically provided by real estate investment firms, which are companies that specialize in acquiring, developing, and managing real estate assets on behalf of investors. Real estate investment services can be highly beneficial for investors seeking to …

Read More »Discover Uncharted Investment Horizons: A Journey into Alternative Investments

Alternative investment opportunities encompass assets outside traditional investments like stocks and bonds. They include private equity, real estate, commodities, hedge funds, venture capital, and infrastructure. Alternative investments offer diversification, potentially higher returns, and a hedge against inflation. Historically, they have played a significant role in enhancing portfolio performance, especially during periods of market volatility.

Read More »Discover the Secrets to Smart Investing: Unlock the Power of Portfolio Management

Portfolio management services encompass a range of professional financial services designed to manage investment portfolios on behalf of individuals, institutions, and other entities. These services typically include investment planning, asset allocation, portfolio construction, risk management, and ongoing monitoring and rebalancing. Portfolio management services are essential for investors who seek professional guidance in managing their investments. They can help investors achieve …

Read More »Unlock Investment Secrets: Discover the Power of Advisory Services

Investment advisory services encompass the provision of professional guidance and recommendations regarding investment decisions. These services are offered by qualified individuals or firms known as investment advisors, who possess specialized knowledge and expertise in financial markets. Investment advisory services play a pivotal role in assisting individuals and organizations in achieving their financial objectives. By leveraging their insights and experience, investment …

Read More »Uncover Hidden Tax Savings: The Ultimate Guide to Tax Optimization Solutions

Tax optimization solutions encompass strategies and methodologies employed to minimize tax liabilities while adhering to tax regulations. These solutions involve analyzing tax laws, identifying deductions, credits, and exemptions, and implementing tax-saving strategies. Effective tax optimization not only reduces tax payments but also enhances financial performance. It ensures compliance with complex tax codes, optimizes cash flow, and improves profitability. Businesses and …

Read More »Unlock the Secrets of Legacy Planning: Discover Strategies for a Lasting Impact

Legacy planning services encompass a range of professional guidance and support designed to help individuals and families plan for the orderly management and distribution of their assets after their lifetime. These services involve the creation of legal documents such as wills, trusts, and powers of attorney, as well as providing advice on estate tax minimization, charitable giving strategies, and other …

Read More »Unveiling Asset Protection Secrets: Shield Your Wealth Today

Asset protection refers to legal strategies designed to shield assets from potential liabilities, creditors, or lawsuits. Common asset protection strategies include trusts, limited liability companies (LLCs), and offshore accounts. These strategies provide several benefits, including the safeguarding of assets in the event of a lawsuit, the preservation of wealth during estate planning, and the reduction of tax liability. Historically, asset …

Read More »Unlock the Secrets of Trust and Estate Planning: Discoveries and Insights

Estate planning is the process of anticipating and arranging, during a person’s life, for the management and disposal of that person’s estate after death. Estate planning typically involves the use of a will, a trust, or a combination of both. There are many reasons why people choose to do estate planning. Some of the most common reasons include:

Read More »Unlock Financial Freedom: Discover the Secrets of Personal Finance Consultants

Personal finance consultants are financial professionals who assist individuals and families with managing their finances. They provide guidance on a wide range of financial topics, including budgeting, saving, investing, and retirement planning. Personal finance consultants can be especially helpful for people who are struggling with debt, have complex financial situations, or are simply looking to improve their financial well-being. They …

Read More »Unlock the Secrets to Wealth Preservation: Discover the Power of Wealth Advisory Services

Wealth advisory services encompass a comprehensive range of financial advice and guidance tailored to high-net-worth individuals, families, and institutions. These services aim to preserve and grow wealth by providing personalized strategies that align with clients’ specific financial goals, risk tolerance, and tax considerations. Wealth advisors serve as trusted partners, offering expert insights and support to help clients navigate complex financial …

Read More »Discover the Exclusive World of Boutique Banking Services for Private Wealth

Boutique banking services cater to high-net-worth individuals and businesses, offering tailored financial solutions and personalized advice. Unlike traditional banks, boutique banks prioritize exclusive, client-centric relationships, providing bespoke services customized to specific needs. The significance of boutique banking lies in its ability to provide comprehensive wealth management, investment banking, and capital raising services. With a deep understanding of their clients’ objectives, …

Read More »Unlock the Secrets of Executive Banking Services for Limitless Growth

Executive banking services offer a comprehensive suite of financial products and services tailored to meet the unique needs of affluent individuals and businesses. These services typically include personalized investment advice, sophisticated lending options, and exclusive wealth management strategies. Executive banking services are essential for individuals and businesses seeking to optimize their financial well-being. These services provide clients with access to …

Read More » Ini Balikpapan All about Banking Finance

Ini Balikpapan All about Banking Finance