Small business banking standards are established rules and regulations that banks follow when providing financial services to small businesses. These standards help ensure that small businesses have access to fair and equitable banking services. They also help to protect small businesses from fraud and abuse. Small business banking standards are important because they help to create a level playing field …

Read More »Small Business Banking

Unlock the Secrets of Small Business Banking Compliance: Discoveries and Insights

In the realm of finance, compliance plays a crucial role, particularly for small businesses. Small business banking compliance refers to the adherence to regulations and guidelines set forth by financial institutions and regulatory bodies to ensure the integrity and security of banking practices. It encompasses a wide range of aspects, including anti-money laundering (AML) measures, know-your-customer (KYC) protocols, and data …

Read More »Uncover the Secrets: A Deep Dive into Small Business Banking Laws

Small business banking laws are a set of regulations that govern the relationship between small businesses and banks. These laws are designed to protect the interests of both parties and to ensure that the financial system operates smoothly. There are a number of different small business banking laws, including those that govern:

Read More »Unlock the Secrets of Small Business Banking Regulations

Small business banking regulations refer to the rules and guidelines established by government agencies and financial institutions to govern the banking activities of small businesses. These regulations aim to protect both the businesses and the financial system as a whole by ensuring the safety and soundness of financial transactions and promoting fair and competitive practices. Small business banking regulations are …

Read More »Unveil Hidden Risks in Small Business Banking: Discover Strategies for Success

Small business banking risks encompass the potential financial and operational hazards that small businesses face when utilizing banking services. These risks can arise from various factors, including lending practices, fraud, cybersecurity threats, and economic conditions. Managing small business banking risks is crucial for the financial stability and success of small businesses. Effective risk management strategies involve carefully evaluating loan terms, …

Read More »Uncover the Hidden Truths: Small Business Banking Disadvantages Revealed

Small business banking disadvantages refer to the potential drawbacks and limitations associated with banking services tailored specifically for small businesses. These disadvantages can include higher fees, limited product offerings, and stricter lending criteria compared to banking services designed for larger businesses or individuals. Understanding the disadvantages of small business banking is crucial for business owners to make informed decisions about …

Read More »Uncover the Secrets: Small Business Banking Advantages for Growth and Success

Small business banking advantages encompass the various benefits and services provided by financial institutions specifically tailored to meet the unique needs of small businesses. These advantages can range from specialized loan products and lines of credit to cash management solutions, advisory services, and tailored financial planning. Small business banking plays a crucial role in supporting the growth and success of …

Read More »Unveiling the Secret Sauce of Small Business Banking: Discover the Key to Financial Success

Small business banking benefits encompass the advantages and services provided by financial institutions specifically designed to meet the needs of small businesses. These benefits extend beyond basic banking services and may include specialized products, personalized advice, and tailored support to facilitate the financial management and growth of small businesses. Recognizing the unique challenges and opportunities faced by small businesses, banks …

Read More »Unlock Hidden Gems: Discover the Power of Small Business Banking Perks

Small business banking perks are benefits offered by banks and credit unions to attract and retain small business customers. These perks can include a variety of services and discounts, such as free checking accounts, low-interest loans, and access to financial advice. Small business banking perks can be a valuable resource for small businesses, as they can help to save money …

Read More »Unlock Hidden Gems: Unveiling the Secrets of Small Business Banking Incentives

Small business banking incentives are financial perks and benefits offered by banks and credit unions to attract and retain small business customers. These incentives can vary widely, but common examples include: Low interest rates on loans Free or low-cost checking and savings accounts Business credit cards with rewards programs Access to online banking and other financial tools Small business banking …

Read More »Unlock the Secrets to Small Business Banking Discounts

Small business banking discounts are a type of financial incentive offered by banks to small businesses. These discounts can take many forms, such as reduced interest rates on loans, lower fees on checking and savings accounts, and free or discounted access to financial services. These discounts can help small businesses save money on their banking needs, which can be a …

Read More »Unlock the Secrets of Small Business Banking Deals: Discoveries and Insights

Small business banking deals are financial products and services tailored to meet the specific needs of small businesses. These deals often include features such as low interest rates, flexible repayment terms, and access to financial advice and support. Small business banking deals can be a valuable resource for small businesses, as they can help them save money, manage their finances …

Read More »Discover the Secrets of Small Business Banking Offers

Small business banking offers encompass a wide range of financial products and services tailored specifically to meet the unique needs of small businesses. These offerings may include business checking accounts, loans, lines of credit, and merchant services. By leveraging these tailored solutions, small businesses can effectively manage their cash flow, access capital for growth, and streamline their financial operations. The …

Read More »Discover the Ultimate Guide to Small Business Banking Promotions

Small business banking promotions are incentives offered by banks and credit unions to attract new small business customers or encourage existing ones to increase their business. These promotions can vary widely, but commonly include cash bonuses, low interest rates on loans, and free or discounted services. Small business banking promotions can be a valuable way for small businesses to save …

Read More »Unlock Hidden Perks: Small Business Banking Bonuses Unveiled

Small business banking bonuses are financial incentives offered by banks to attract new small business customers or reward existing ones for specific actions, such as opening a new account, maintaining a certain account balance, or using specific banking services. These bonuses can vary widely in terms of their value and requirements, but they typically range from cash bonuses of a …

Read More »Unlock the Hidden Rewards of Small Business Banking

Small business banking rewards are financial incentives offered by banks and credit unions to small business owners for using their banking services. These rewards can take various forms, such as cash back, points, miles, or discounts on banking fees. Small business banking rewards programs can provide several benefits to small business owners. They can help businesses save money on banking …

Read More »Uncover Hidden Gems: Your Guide to Small Business Banking Statements

Small business banking statements are financial records that provide a summary of all the transactions that have occurred in a small business’s bank account over a specific period of time. They typically include information such as the date and amount of each transaction, the type of transaction (e.g., deposit, withdrawal, check, etc.), and the current balance in the account. Banking …

Read More »Unlock the Power of Small Business Banking Checks: Discoveries and Insights

Small business banking checks are negotiable instruments used by businesses to make payments to vendors, employees, and other parties. They are similar to personal checks, but they are drawn on a business’s bank account and typically have the business’s name and logo printed on them. Small business banking checks offer a number of advantages over other payment methods, such as …

Read More »Small Business Banking Transfers: Uncover Hidden Gems and Insights

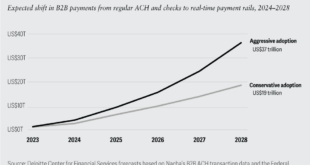

Small business banking transfers enable small businesses to manage their finances efficiently. These transfers allow businesses to move funds between their business accounts and other accounts, such as personal accounts, vendor accounts, or tax authorities. Small business banking transfers can be initiated online, through mobile banking apps, or in person at a bank branch. Small business banking transfers are important …

Read More »Unlock Hidden Insights: Master the Art of Small Business Banking Withdrawals

Small business banking withdrawals are financial transactions that reduce the balance of a small business’s bank account. These withdrawals can be made for a variety of reasons, such as paying for expenses, repaying loans, or distributing profits to owners. Small business banking withdrawals are an important part of managing a small business’s finances. They allow businesses to pay their bills, …

Read More » Ini Balikpapan All about Banking Finance

Ini Balikpapan All about Banking Finance