Small business banking biometrics is the use of biometric technology to identify and authenticate small business owners and employees for banking purposes. This can include using fingerprints, facial recognition, or voice recognition to access accounts, make transactions, and more. Small business banking biometrics is becoming increasingly popular as a way to improve security and convenience for small businesses. There are …

Read More »Small Business Banking

Unlock the Power of Crypto for Your Small Business

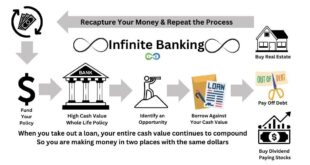

Small business banking cryptocurrency leverages cryptocurrency and blockchain technology to provide financial services to small businesses. These services can include everything from accepting cryptocurrency payments to obtaining loans and managing finances. Small business banking cryptocurrency offers several advantages over traditional banking. First, it can be more convenient and efficient. Small businesses can open accounts and conduct transactions online, often without …

Read More »Unveil the Secrets of Small Business Banking Blockchain: Discoveries and Insights

Small business banking blockchain refers to the application of blockchain technology to banking services specifically tailored for small businesses. It leverages distributed ledger technology to enhance various aspects of banking, including payments, lending, and record-keeping. By incorporating blockchain’s inherent advantages, such as immutability, transparency, and security, small business banking blockchain solutions offer numerous benefits. They streamline processes, reduce costs, improve …

Read More »Unlock the Power of Small Business Banking Fintech: Discoveries and Insights for Growth

Small business banking fintech refers to the use of technology to provide financial services specifically tailored to the needs of small businesses. This can include a range of services, such as online banking, mobile banking, and lending. Small business banking fintech companies typically offer a more convenient and affordable way for small businesses to manage their finances. There are a …

Read More »Unlock the Power of Small Business Banking Robotics: Insights and Discoveries for Growth

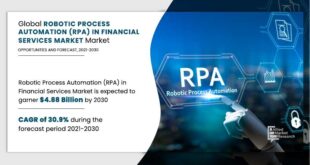

Small business banking robotics refers to the application of robotic process automation (RPA) and artificial intelligence (AI) technologies to streamline and automate various banking processes specifically tailored to the needs of small businesses. The adoption of small business banking robotics offers numerous advantages, including enhanced operational efficiency, reduced costs, improved accuracy, and faster processing times. By automating repetitive and time-consuming …

Read More »Unlock the Secrets of Machine Learning in Small Business Banking: Discoveries and Insights

Small business banking machine learning utilizes machine learning algorithms to enhance the banking experience for small businesses. These algorithms analyze vast amounts of financial data to identify patterns, predict trends, and automate tasks, enabling banks to offer tailored services and make informed decisions. Machine learning in small business banking brings numerous benefits. It can improve loan approval processes by assessing …

Read More »Unleash the Power of AI: Revolutionizing Small Business Banking

Small business banking artificial intelligence (AI) is revolutionizing the banking industry by providing innovative solutions tailored to the unique needs of small businesses. By leveraging AI’s capabilities, banks can automate repetitive tasks, enhance decision-making, and deliver personalized experiences. AI-powered tools, such as automated loan processing and predictive analytics, can streamline operations, reducing costs and improving efficiency. Additionally, AI can analyze …

Read More »Unlock the Secrets of Small Business Banking Automation: Uncover Efficiency and Profitability

Small business banking automation involves the use of technology to automate various banking tasks and processes, making it easier and more efficient for small businesses to manage their finances. This can include tasks such as account reconciliation, bill payment, and payroll processing. By automating these tasks, small businesses can save time and money, and reduce the risk of errors. There …

Read More »Unlock Hidden Gems: Uncover the Secrets of Small Business Banking Digitalization

Small business banking digitalization is transforming the way small businesses manage their finances. It offers a range of benefits, including increased efficiency, reduced costs, and improved security. In the past, small businesses had to rely on traditional banking methods, such as visiting a branch in person or mailing checks. This could be time-consuming and expensive, especially for businesses that are …

Read More »Unlock the Secrets of Small Business Banking Technology: Discoveries & Insights Revealed!

Small business banking technology encompasses digital tools and platforms specifically designed to meet the unique financial needs of small businesses. These technologies streamline banking processes, enhance financial management, and provide tailored solutions to support business growth. The significance of small business banking technology lies in its ability to save time, reduce costs, and empower small businesses to make informed financial …

Read More »Unlock the Power of Small Business Banking Innovation: Discoveries & Insights

Small business banking innovation refers to the development and implementation of new products, services, and technologies tailored to meet the specific needs of small businesses. It encompasses a wide range of advancements, from digital banking platforms to specialized lending products and advisory services. The importance of small business banking innovation cannot be overstated. Small businesses are the backbone of the …

Read More »Unleash Your Small Business Banking Potential: Discoveries for Enhanced Productivity

Small business banking productivity encompasses the efficient management of banking services to optimize financial outcomes for small businesses. It involves streamlining processes, leveraging technology, and fostering collaboration between banks and their small business customers. Enhancing small business banking productivity is crucial for several reasons. Firstly, it enables small businesses to save time and resources by automating repetitive tasks and accessing …

Read More »Unlock Secrets to Exceptional Small Business Banking Performance

Small business banking performance refers to the financial health and operational efficiency of banks that cater specifically to small businesses. It encompasses various metrics, including profitability, loan quality, customer satisfaction, and risk management. A strong small business banking performance is crucial for several reasons. Firstly, small businesses are a vital part of the economy, contributing significantly to job creation and …

Read More »Unlock the Secrets of Small Business Banking Effectiveness

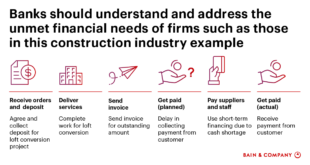

Small business banking effectiveness refers to the ability of financial institutions to meet the unique needs of small businesses, providing tailored products, services, and support that enable them to succeed and grow. Effective small business banking goes beyond just offering basic financial services; it involves understanding the challenges and opportunities faced by small businesses and developing solutions that address their …

Read More »Unleash the Secrets of Small Business Banking Efficiency: Discoveries and Insights

Small business banking efficiency refers to the ability of small businesses to manage their banking transactions and financial operations seamlessly and effectively. It encompasses various aspects of banking services, such as account management, loan processing, and online banking tools, that are tailored to meet the unique needs of small businesses. Enhancing small business banking efficiency is crucial for several reasons. …

Read More »Uncover the Secrets to Uninterrupted Banking for Your Small Business

Continuity in banking refers to seamless and uninterrupted access to financial services, especially during periods of disruptions or emergencies. Small businesses often rely on banks for essential services like cash flow management, payments processing, and access to credit. Small business banking continuity plans ensure that these services are maintained, allowing businesses to continue operating smoothly even in challenging circumstances. Having …

Read More »Unlocking the Secrets of Small Business Banking Resilience

Small business banking resilience refers to the ability of small businesses to withstand and recover from financial shocks and challenges. It encompasses a range of factors, including access to capital, financial management practices, and relationships with financial institutions. Small business banking resilience is crucial for several reasons. First, small businesses are more vulnerable to financial shocks than larger businesses. They …

Read More »Uncover the Secrets of Small Business Banking Stability: A Guide to Success

The strength and reliability of financial services provided to small businesses is referred to as “small business banking stability.” Small businesses can plan for the future more effectively, make better judgments, and prosper when they have access to dependable banking services. Stable banking for small businesses gives access to loans, lines of credit, and other financial goods that are essential …

Read More »Unveiling Secrets: The Ultimate Guide to Small Business Banking Reliability

Small business banking reliability refers to the dependability and consistency of banking services provided to small businesses. It encompasses factors such as the availability of financial products and services tailored to small businesses’ needs, the efficiency and speed of transactions, the security of funds, and the level of customer support provided by the bank. Reliable banking services are crucial for …

Read More »Unlock the Secrets to an Irresistible Small Business Banking Reputation

Small business banking reputation is the public perception of a bank’s services and products as they relate to small businesses. This reputation is built on factors such as customer service, fees, interest rates, and online and mobile banking capabilities. A positive reputation can attract new customers and encourage existing customers to stay with the bank. A negative reputation can do …

Read More » Ini Balikpapan All about Banking Finance

Ini Balikpapan All about Banking Finance