Small business loan default settlement options refer to the various methods available to small business owners to resolve defaulted loans. When a small business fails to meet its loan obligations, it can enter into a settlement agreement with the lender to avoid legal action and potential bankruptcy. Exploring small business loan default settlement options is crucial for business owners facing …

Read More »Small Business Banking

Uncover the Secrets: Small Business Loan Default Credit Impact Strategies Revealed

Small business loan default credit impact strategies encompass the measures taken to mitigate the negative consequences of a small business loan default on the borrower’s credit history. When a small business fails to make timely payments on its loan, it can severely damage its credit score and make it difficult to obtain future financing. To avoid these negative consequences, small …

Read More »Unlock Default Reporting Secrets: Your Small Business Loan Lifeline

Small business loan default reporting strategies refer to the methods used by lenders to report defaulted loans to credit bureaus. When a small business fails to repay a loan according to the agreed-upon terms, the lender may report the default to credit bureaus such as Equifax, Experian, and TransUnion. Reporting loan defaults is important because it helps lenders assess the …

Read More »Unlock the Secrets of Small Business Loan Default Collection Strategies

Small business loan default collection strategies are the methods used by lenders to recover money from borrowers who have defaulted on their loans. These strategies can include a variety of tactics, such as contacting the borrower, sending demand letters, and initiating legal action. There are a number of reasons why a small business might default on a loan. Some of …

Read More »Unlock the Secrets of Small Business Loan Default Repossession Strategies

When a small business fails to repay a loan, the lender may have the right to repossess the assets that were used to secure the loan. This process, known as “small business loan default repossession,” can be a complex and challenging one for both the lender and the borrower. There are a number of different strategies that lenders can use …

Read More »Unlocking the Secrets: Masterful Strategies for Small Business Loan Default Foreclosure

Understanding “Small Business Loan Default Foreclosure Strategies” This guide will provide insights into strategies for dealing with small business loan defaults and potential foreclosure. These strategies can assist lenders in mitigating losses, and help borrowers navigate the challenges of loan default.

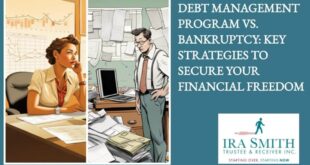

Read More »Unveiling Winning Strategies: Navigate Small Business Bankruptcy with Confidence

“Small business loan default bankruptcy strategies” refers to the various options and approaches available to small businesses facing financial distress and the potential default of their business loans. These strategies typically involve navigating complex legal and financial processes to manage debt obligations and potentially avoid or mitigate the consequences of bankruptcy. Understanding and exploring these strategies is crucial for small …

Read More »Uncover the Secrets: Navigating Small Business Loan Default Strategies

Small business loan default legal strategies refer to the legal options available to lenders when a borrower fails to make payments on a small business loan. These strategies can include filing a lawsuit, foreclosing on collateral, or pursuing other legal remedies to recover the outstanding debt. Lenders may also consider working with the borrower to modify the loan terms or …

Read More »Unlock Essential Small Business Loan Default Litigation Strategies

Small business loan default litigation strategies are legal tactics used by lenders to recover unpaid debts from businesses that have defaulted on their loans. These strategies can include filing a lawsuit, negotiating a settlement, or pursuing other legal remedies. Importance, benefits, and historical context:

Read More »Unveiling Breakthrough Strategies to Overcome Small Business Loan Default Challenges

Small business loan default mediation strategies are a set of techniques utilized by lenders and borrowers to work through and resolve loan defaults. These strategies can help businesses avoid bankruptcy and help lenders recover as much of the outstanding loan balance as possible. Loan default mediation can offer several benefits over traditional legal proceedings. It is typically less adversarial, less …

Read More »Unlock Secrets: Proven Strategies for Small Business Loan Default Negotiations

Small business loan default negotiation strategies refer to the tactics and approaches used by small businesses to negotiate favorable terms with lenders in the event of a loan default. When a small business is unable to repay a loan according to the original loan agreement, it may enter into negotiations with the lender to avoid foreclosure or other adverse consequences. …

Read More »Unlock the Secrets of Default-Proof Small Business Loans

Small business loan default management strategies encompass the practices and procedures that financial institutions employ to mitigate the risk of loan defaults among small businesses. These strategies involve proactive measures to prevent defaults, such as thorough credit analysis, prudent underwriting standards, and ongoing monitoring of loan performance. Effective default management strategies are crucial for financial institutions to maintain the health …

Read More »Unlock the Secrets to Small Business Loan Recovery: Discover Proven Strategies for Success

Small business loan default recovery strategies are a set of measures taken by lenders to minimize losses in the event that a small business borrower defaults on their loan. These strategies can include a variety of approaches, such as negotiating a repayment plan with the borrower, selling the borrower’s collateral, or pursuing legal action. Default recovery strategies are an important …

Read More »Unlock Default-Proof Strategies for Small Business Loans: Discoveries and Insights

Small business loan default prevention strategies are measures taken by lenders and small businesses to reduce the risk of a small business loan defaulting. Default prevention strategies can include underwriting guidelines, loan monitoring, and financial assistance programs. Default prevention strategies are important because they can help lenders avoid losses and protect the financial stability of small businesses. Small businesses that …

Read More »Unveiling the Secrets of Small Business Loan Default Assistance Programs

Small business loan default assistance programs are designed to help small businesses avoid defaulting on their loans. These programs can provide financial assistance, technical assistance, and other resources to help businesses stay afloat during difficult times. Small business loan default assistance programs are important because they can help businesses avoid the negative consequences of defaulting on a loan. Defaulting on …

Read More »Unlock the Secrets of Small Business Loan Default Relief: A Journey to Financial Freedom

Small business loan default relief programs are designed to provide financial assistance to small businesses that are struggling to repay their loans. These programs can offer a variety of benefits, such as reduced interest rates, extended repayment terms, and even loan forgiveness.Small business loan default relief programs are an important tool for helping small businesses stay afloat during difficult economic …

Read More »Uncover Secrets to Save Your Business: Small Business Loan Default Workout Guide

A small business loan default workout is an agreement between a lender and a borrower who is in default on a small business loan. The workout may involve a number of different options, such as extending the loan term, reducing the interest rate, or forgiving a portion of the debt. The goal of a workout is to help the borrower …

Read More »Uncover the Secrets of Small Business Loan Default Restructuring

Small business loan default restructuring is a type of debt relief that can help small businesses avoid bankruptcy. It involves working with a lender to modify the terms of a loan, such as the interest rate, payment schedule, or loan amount. This can make it easier for businesses to repay their debts and stay afloat. Small business loan default restructuring …

Read More »Unlock Secrets to Overcome Small Business Loan Defaults | Expert Insights

A small business loan default modification is a change to the terms of a loan made to a small business that is in default. This can include changes to the interest rate, the payment schedule, or the loan amount. Loan modifications are typically made to help the business get back on track and avoid foreclosure or bankruptcy. Small business loan …

Read More »Uncover the Secrets of Small Business Loan Default Repayment Plans

A small business loan default repayment plan is an agreement between a borrower and a lender that modifies the terms of a loan that is in default. The plan may extend the loan term, reduce the interest rate, or forgive a portion of the debt. The goal of a repayment plan is to help the borrower avoid foreclosure or bankruptcy …

Read More » Ini Balikpapan All about Banking Finance

Ini Balikpapan All about Banking Finance