Small business loan financing refers to financial assistance provided to small businesses to support their operations, growth, or specific projects. These loans are typically offered by banks, credit unions, and online lenders and come with varying terms, interest rates, and repayment schedules. Small business loan financing plays a crucial role in the success and growth of small businesses. It allows …

Read More »Small Business Banking

Discover the Secrets of Small Business Loan Assistance: Unlocking Growth and Success

Small business loan assistance encompasses financial aid programs designed specifically to support small businesses in obtaining loans. These loans typically offer favorable terms, such as lower interest rates and flexible repayment options, compared to traditional loans from banks or other lending institutions. Small business loan assistance plays a crucial role in fostering entrepreneurship and economic growth. It empowers small businesses …

Read More »Unveiling the Secrets of Small Business Loan Specials: A Gateway to Growth

Small business loan specials are a type of loan offered by banks and other financial institutions that provide favorable terms and conditions to small businesses. These loans may offer lower interest rates, longer repayment terms, and more flexible eligibility requirements than traditional business loans. Small business loan specials can be a valuable source of funding for small businesses that are …

Read More »Unlock Your Funding Potential: Discover Unparalleled Small Business Loan Incentives

Small business loan incentives are financial perks or advantages offered to encourage small businesses to obtain loans. These incentives can take various forms, such as reduced interest rates, extended repayment periods, or loan forgiveness programs. The primary goal of these incentives is to make it more accessible and affordable for small businesses to access capital, which is crucial for their …

Read More »Unlock the Power of Small Business Loan Discounts: Discover the Secrets to Financing Success

Small business loan discounts are financial incentives offered by lenders to encourage small businesses to borrow money. These discounts can take the form of lower interest rates, reduced fees, or other perks. Small business loan discounts can be a valuable tool for businesses that need to access capital to grow or expand their operations. There are a number of reasons …

Read More »Unveiling the Secrets of Small Business Loan Promotions

Small business loan promotions are special offers or incentives provided by lenders to attract new borrowers or encourage existing borrowers to take out additional loans. These promotions can take various forms, such as reduced interest rates, waived fees, or cash bonuses. Small business loan promotions can be an important tool for small businesses seeking financing. By taking advantage of these …

Read More »Unlock the Secrets of Small Business Loan Deals for Limitless Growth

Small business loan deals provide financing and support to small businesses, helping them to start, grow, and operate. These loans come in a variety of forms, such as term loans, lines of credit, and equipment loans, and can be used for a variety of purposes, such as purchasing inventory, expanding operations, or hiring new employees. Small business loan deals often …

Read More »Unlock the Secrets to Unstoppable Small Business Loan Offers

Small business loan offers are financial products designed to provide funding to small businesses. These loans can be used for a variety of purposes, such as starting a new business, expanding an existing business, or purchasing new equipment. Small business loan offers typically have lower interest rates and more flexible repayment terms than traditional bank loans. Small business loans can …

Read More »Unlock the Secrets of Small Business Loan Terms and Conditions

Small business loan terms and conditions refer to the specific stipulations and requirements that borrowers must adhere to when obtaining a loan from a lender. These terms and conditions outline the parameters of the loan agreement, including the loan amount, interest rate, repayment schedule, and any other relevant details. Understanding these terms and conditions is crucial for small business owners …

Read More »Unlock the Secrets of Small Business Loan Types: Discover the Path to Financial Success

Small business loans provide financial assistance to small businesses and startups. These loans come in various types, each tailored to specific business needs and circumstances. Small business loans play a crucial role in fostering entrepreneurship and economic growth. They enable businesses to access capital for expansion, innovation, working capital, and other essential purposes. Historically, small business loans have been a …

Read More »Discover Unmatched Refinancing Options for Your Small Business

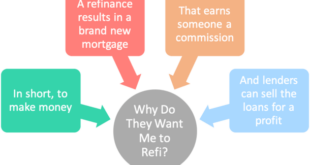

Small business loan refinancing options allow business owners to replace their existing business loans with a new loan, ideally with a lower interest rate, better terms, or both. Refinancing can be a smart financial move for businesses that have improved their creditworthiness since taking out their original loan or for those that want to consolidate multiple debts into a single …

Read More »Uncover the Secrets of Small Business Loan Repayment: A Comprehensive Guide

Small business loan repayment refers to the process of paying back a loan that has been borrowed by a small business. These loans are typically used to finance various business expenses, such as working capital, equipment purchases, or property acquisition. Repayment typically involves making regular monthly payments over a predetermined loan term. Small business loans can be a valuable source …

Read More »Unlock Financial Freedom: Discover the Secrets of Small Business Loan Consolidation

Small business loan consolidation involves combining multiple business loans into a single loan with a single monthly payment. This can simplify loan management, potentially lower interest rates, and improve cash flow. It is a viable option for businesses with a good credit history and stable income. Consolidating business loans offers several advantages, including reducing the number of monthly payments, potentially …

Read More »Unveiling Secrets: Discover the Art of Small Business Loan Refinancing

Small business loan refinancing is the process of replacing an existing small business loan with a new loan that has more favorable terms. This can be done to reduce the interest rate, shorten the loan term, or consolidate multiple loans into a single payment. There are many benefits to refinancing a small business loan. A lower interest rate can save …

Read More »Uncover the Hidden Truths of Small Business Loan Interest Rates

Small business loan interest rates are the fees charged by banks and other lenders for the use of borrowed funds by small businesses. These rates are typically higher than those charged to larger businesses, as small businesses are seen as a higher risk by lenders. However, small business loans can be a valuable source of financing for businesses that need …

Read More »Discover the Ultimate Guide to Small Business Loans: Unveil the Secrets of Loan Calculators

A small business loan calculator is an online tool that helps you estimate the monthly payments and total cost of a small business loan. It can be a valuable resource for business owners who are considering taking out a loan to fund their business. Small business loans can be a great way to get the financing you need to start …

Read More »Unlock the Secrets: Uncover the Best Small Business Loan Rates

Small business loan rates comparison is a process of evaluating and comparing the interest rates, fees, and terms of different small business loans to find the best financing option for a particular business. There are a number of factors that small business owners should consider when comparing loan rates, including the loan amount, the loan term, the type of loan, …

Read More »Unveiling the Secrets of Small Business Loan Eligibility: Insights and Discoveries

Small business loan eligibility refers to the criteria and requirements that a small business must meet in order to qualify for a loan from a lender. These criteria can vary depending on the lender and the specific loan program, but there are some general factors that are commonly considered, such as the business’s financial history, creditworthiness, and ability to repay …

Read More »Unveil the Secrets: Master Small Business Loan Qualifications for Success

Small business loan qualifications encompass the eligibility requirements businesses must fulfill to secure financing. These qualifications, set by lenders, assess a business’s financial health, stability, and repayment capacity. The evaluation process involves scrutinizing factors like credit scores, financial statements, business plans, and collateral. Meeting these qualifications increases a business’s chances of loan approval. Understanding small business loan qualifications is crucial …

Read More »Unlock the Secrets to Securing Optimal Small Business Loan Amounts

Small business loan amounts refer to the sums of money borrowed by small businesses from lenders to finance their operations, investments, or expansion plans. These loans can vary significantly in size, depending on the business’s needs and the lender’s assessment of its creditworthiness. Small business loans can be crucial for entrepreneurs and small business owners, providing them with the capital …

Read More » Ini Balikpapan All about Banking Finance

Ini Balikpapan All about Banking Finance