Financial wellness programs empower individuals to take control of their financial lives and achieve long-term financial well-being. They encompass a wide range of services such as financial education workshops, personalized financial counseling, debt management assistance, and retirement planning. These programs recognize the profound impact financial health has on overall well-being. By equipping individuals with the necessary knowledge, skills, and support, …

Read More »Wealth Management

Discover the Secrets to Holistic Financial Planning and Unlock Your Financial Future

Holistic financial planning is a comprehensive approach to financial management that considers all aspects of an individual’s financial life. It takes into account not only traditional financial goals like retirement planning and investment management but also factors like estate planning, tax planning, and insurance coverage. The goal of holistic financial planning is to create a financial plan that is tailored …

Read More »Unlock the Secrets of Integrated Wealth Management: Discoveries and Insights

Integrated wealth management is a comprehensive approach to financial planning that considers all aspects of a client’s financial situation, including investments, taxes, estate planning, and insurance. By taking an integrated approach, wealth managers can help clients make more informed decisions about their finances and achieve their financial goals more efficiently. For example, an integrated wealth manager might help a client …

Read More »Unlock Wealth Secrets: Comprehensive Financial Planning Unveiled

Comprehensive financial planning is a holistic approach to managing your finances that takes into account your entire financial situation, including your income, expenses, assets, and liabilities. It helps you to make informed decisions about how to use your money to achieve your financial goals. Comprehensive financial planning is important because it can help you to:

Read More »Uncover the Secrets of Customized Investment Portfolios: A Guide to Enhanced Returns and Reduced Risks

Customized investment portfolios are tailored to meet the specific needs and goals of individual investors. They consider factors such as risk tolerance, time horizon, and financial situation. Unlike off-the-shelf investment products, customized portfolios can be adjusted to align with an investor’s unique circumstances and preferences. The benefits of customized investment portfolios are numerous. They offer greater flexibility and control over …

Read More »Unlock Financial Empowerment: Discover the Secrets of Personalized Financial Planning

Personalized financial planning is a comprehensive approach to financial planning that takes into account an individual’s specific circumstances, goals, and risk tolerance. It involves working with a financial advisor to create a customized plan that addresses their unique needs. Personalized financial planning can help individuals achieve their financial goals, such as saving for retirement, buying a home, or paying for …

Read More »Unveiling the Secrets: High-Touch Wealth Management Revealed

High-touch wealth management is a personalized and comprehensive financial advisory service that caters to high-net-worth individuals and families. This service involves a dedicated relationship manager who provides tailored investment strategies, tax planning, estate planning, and other financial guidance based on the client’s unique needs and goals. High-touch wealth management differs from traditional wealth management in its focus on building long-term …

Read More »Unlock the Secrets of Concierge Wealth Management: Discover a World of Financial Empowerment

Concierge wealth management is a comprehensive and personalized financial advisory service designed to cater to the unique needs of high-net-worth individuals and families. This exclusive service provides clients with customized financial planning, investment management, tax strategies, and other specialized advice tailored to their specific goals and circumstances. Concierge wealth managers act as trusted advisors, offering ongoing support and guidance to …

Read More »Unlock Exclusive Insights: Private Banking Services for Wealth Management

Private banking services encompass specialized financial management and advisory services tailored to high-net-worth individuals and families. It extends beyond traditional banking, offering a comprehensive suite of services designed to meet the complex needs of affluent clients. The significance of private banking lies in its ability to provide customized solutions for wealth preservation, growth, and transfer. It caters to a clientele …

Read More »Unveiling the Secrets of Boutique Wealth Management: Discoveries and Insights for the Savvy Investor

Boutique wealth management firms are specialized financial advisory firms that cater to high-net-worth individuals, families, and institutions. Unlike large, impersonal banks, boutique firms offer a more personal and tailored approach to wealth management, with a focus on building long-term relationships with their clients. They typically employ experienced and knowledgeable advisors who provide comprehensive financial planning, investment management, and other wealth-related …

Read More »Unveiling the Investment Advisory Edge: Discoveries and Insights

Investment advisory firms provide financial advice and investment management services to individuals and institutions. They offer a range of services, including portfolio management, financial planning, and investment research. Investment advisory firms are typically regulated by government agencies to ensure that they operate in a fair and ethical manner. Investment advisory firms can provide a number of benefits to their clients. …

Read More »Unlock the Secrets of Wealth Management with Registered Investment Advisors (RIAs)

Registered investment advisors (RIAs) are financial professionals who provide personalized investment advice and portfolio management services to individuals and institutions. RIAs are required to register with the U.S. Securities and Exchange Commission (SEC) or with state securities regulators, and they must adhere to a fiduciary duty, which means they are legally obligated to act in the best interests of their …

Read More »Uncover the Secrets to Financial Success with Certified Financial Planners (CFPs)

Certified financial planners (CFPs) are professionals who have met certain education, experience, and ethical requirements and have passed a rigorous examination. CFPs are committed to providing their clients with objective, ethical, and professional financial advice that is in the best interests of their clients. CFPs can help individuals and families with a wide range of financial planning needs, including retirement …

Read More »Uncover the Secrets of Financial Success with Independent Financial Advisors

Independent financial advisors are financial professionals who provide personalized financial advice to individuals and families, tailored to their unique financial situations and goals. Unlike brokers or agents who are tied to specific financial products or companies, independent financial advisors have a fiduciary duty to act in the best interests of their clients, providing unbiased and objective advice. Independent financial advisors …

Read More »Unveiling the Secrets of Fee-Only Investment Advisors

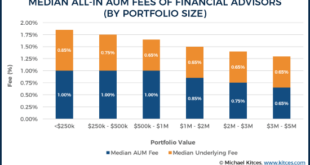

Fee-only investment advisors are financial professionals who provide investment advice to clients on a fee-only basis. This means that they do not receive any commissions or other incentives from the sale of financial products. As a result, fee-only advisors are able to provide objective advice that is in the best interests of their clients. Fee-only investment advisors typically charge a …

Read More »Unlock the Secrets of Fee-Based Financial Planning for Wealth Creation

Fee-based financial planning is a type of financial planning in which the financial planner charges a fee for their services, rather than receiving commissions from the sale of financial products. This fee is typically based on a percentage of the assets under management, and it covers the cost of the planner’s time, expertise, and advice. Fee-based financial planning is designed …

Read More »Unveil the Secrets of Fiduciary Wealth Management: Discoveries and Insights

Fiduciary wealth management is a specialized type of financial advice where the advisor is legally bound to act in the best interests of their client. This means that the advisor must put the client’s needs first and foremost, even if it means sacrificing their own. Fiduciary wealth managers are typically held to a higher standard of care than other financial …

Read More »Unlock the Power of Responsible Investing: Discoveries and Insights

Responsible investing services consider environmental, social, and governance (ESG) factors when making investment decisions. These services are designed to align investments with the values and goals of investors who want to make a positive impact on the world while also generating competitive returns. Responsible investing services can take many different forms, but they all share a common goal of promoting …

Read More »Discover the Transformative Power of Values-Based Investing

Values-based investing is an investment approach that incorporates an investor’s personal values and beliefs into their investment decisions. It involves screening potential investments based on their alignment with the investor’s values, such as environmental sustainability, social justice, or corporate governance. Values-based investing has gained popularity in recent years as investors seek to align their investments with their personal values. This …

Read More »Unlock Sustainable Investing Solutions for a Brighter Future

Sustainable investing solutions encompass financial products and strategies that align investments with environmental, social, and governance (ESG) factors. These may include renewable energy funds, green bonds, or companies with strong ESG performance. Sustainable investing aims to generate positive social and environmental impact alongside financial returns. It considers how investments affect climate change, resource depletion, labor practices, and other sustainability issues. …

Read More » Ini Balikpapan All about Banking Finance

Ini Balikpapan All about Banking Finance