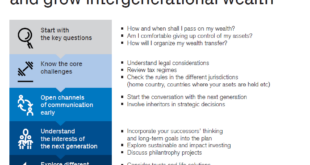

Multi-generational wealth management is a comprehensive approach to preserving and growing wealth for families across multiple generations. It involves developing and implementing a customized plan that considers the unique financial goals, values, and risk tolerance of each generation. Multi-generational wealth management offers numerous benefits, including providing financial security for future generations, reducing the tax burden, enhancing investment returns, and promoting …

Read More »Wealth Management

Discover the Secrets of Strategic Philanthropy

Philanthropic advisory services provide expert guidance to individuals, families, and organizations seeking to maximize the impact of their charitable giving. These services encompass a comprehensive range of support, including: Developing strategic philanthropic plans Identifying and evaluating charitable organizations Structuring charitable gifts for tax efficiency Managing donor advised funds and private foundations Philanthropic advisory services are essential for those who wish …

Read More »Unlock the Secrets of Charitable Giving: Maximize Your Impact and Legacy

Charitable giving strategies involve planning and structuring donations to maximize their impact and align with the donor’s philanthropic goals. These strategies encompass various techniques, including donor-advised funds, charitable trusts, and pooled income funds, each tailored to specific financial situations and charitable objectives. The benefits of employing charitable giving strategies are multifaceted. They can provide tax advantages, such as deductions or …

Read More »Unlock the Secrets of Wealth Transfer Planning for Seamless Legacy Management

Wealth transfer planning, also known as estate planning, refers to the strategies and legal arrangements individuals undertake to manage the transfer of their assets and wealth during their lifetime and after their death. It involves planning for the distribution of assets to heirs, minimizing taxes, and ensuring the smooth transition of wealth according to the individual’s wishes. Wealth transfer planning …

Read More »Unveiling the Secrets to Wealth Accumulation: Discover Proven Strategies to Grow Your Fortune

Wealth accumulation strategies refer to a set of methods and techniques used to increase one’s financial wealth over time. These strategies typically involve making sound investment decisions, saving money, and managing debt effectively. Effective wealth accumulation strategies can have several benefits. For individuals, they can help achieve financial independence, retire comfortably, and leave a legacy for future generations. On a …

Read More »Unlock the Secrets to Investment Success: Discover the Power of Advisory Services

Investment advisory services provide personalized financial guidance and assistance to individuals and organizations, helping them make informed investment decisions and manage their portfolios. These services typically involve analyzing financial goals, risk tolerance, and investment objectives to develop customized investment strategies. Investment advisory services are important because they can help investors navigate complex financial markets, reduce risk, and potentially improve returns. …

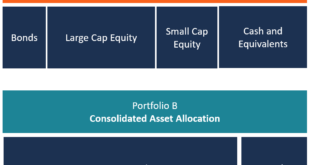

Read More »Unlock the Power of Asset Allocation: Discoveries and Insights for Wealth Management

Asset allocation strategies refer to the practice of dividing an investment portfolio among various asset classes such as stocks, bonds, real estate, and cash equivalents. The goal of asset allocation is to optimize the risk-return profile of the portfolio by diversifying investments across different asset classes that exhibit varying levels of risk and return characteristics. Asset allocation strategies are often …

Read More »Unlock the Secrets of Portfolio Management: Discover Insights and Grow Your Wealth

Portfolio management services encompass the professional management of financial assets, tailored to meet the unique investment objectives and risk tolerance of individual or institutional clients. These services involve constructing, monitoring, and adjusting investment portfolios to align with the client’s financial goals, time horizon, and risk appetite. The significance of portfolio management services lies in the expertise and guidance provided by …

Read More »Uncover Tax Optimization Secrets for Enhanced Wealth Management

Tax optimization strategies encompass a range of techniques employed to minimize tax liability while adhering to all applicable laws and regulations. These strategies involve leveraging deductions, credits, and other provisions within the tax code to reduce the amount of taxes owed. Effective tax optimization strategies can yield significant financial benefits for individuals and businesses alike. By reducing tax liability, organizations …

Read More »Retire with Confidence: Uncover Hidden Insights with Retirement Planning Advisors

Retirement planning advisors are professionals who provide guidance and advice to individuals on how to plan for their retirement. They can help you develop a retirement plan that takes into account your financial situation, retirement goals, and risk tolerance. Retirement planning advisors can also help you make investment decisions, manage your retirement savings, and navigate the complexities of retirement planning. …

Read More »Unveiling the Secrets of Wealth Preservation: Strategies for Long-Term Prosperity

Wealth preservation strategies refer to the techniques and approaches utilized by individuals and entities to protect and maintain the value of their assets over time. These strategies aim to safeguard wealth from various risks, such as inflation, market volatility, economic downturns, and legal challenges, among others. Wealth preservation is crucial for ensuring the long-term financial stability and security of individuals …

Read More »Family Office Services: Unveiling Hidden Truths and Empowering Wealth Management

Family office services encompass a wide range of personalized and tailored services designed to meet the complex needs of affluent families. These services are typically provided by specialized firms or institutions known as family offices. Family offices act as a central hub, coordinating and managing various aspects of a family’s wealth and affairs, including financial planning, investment management, tax advisory, …

Read More »Unlock the Secrets of Trust and Estate Management

Trust and estate management refers to the planning and administration of an individual’s assets during their life and after their death. It involves the creation of legal structures, such as trusts and wills, to ensure the orderly distribution of assets and the fulfillment of the individual’s wishes. Effective trust and estate management provides numerous benefits. It can minimize estate taxes, …

Read More »Uncover the Secrets of Estate Planning: Strategies for Wealth Preservation and Legacy Building

Estate planning strategies encompass a range of legal and financial techniques designed to manage and distribute an individual’s assets during their life and after their death. These strategies aim to ensure the efficient transfer of wealth while minimizing tax burdens and preserving the testator’s wishes. Estate planning offers numerous benefits. It provides individuals with control over the distribution of their …

Read More »Unlocking the Wealth Secrets of High-Net-Worth Individuals

High-net-worth individuals (HNWIs) are those with a high level of net worth, typically defined as having investable assets of $1 million or more, excluding their primary residence. This group represents a significant segment of the global economy, and their financial decisions can have a major impact on markets and economies around the world. HNWIs often have unique financial needs and …

Read More »Unlocking the Secrets of Private Wealth Management: Discoveries and Insights

Private wealth management is a specialized financial service that caters to high-net-worth individuals and families. It involves managing and preserving their wealth, providing tailored investment advice, and offering customized financial solutions. Private wealth management is essential for affluent individuals seeking to protect and grow their assets. It provides personalized strategies that align with their unique financial goals, risk tolerance, and …

Read More »Unlock the Secrets of Investment Management Firms: Discoveries to Transform Wealth Management

Investment management firms are companies that provide investment services to individuals and institutions. These services can include portfolio management, investment advisory services, and financial planning. Investment management firms can be either independent or affiliated with a bank or other financial institution. Investment management firms play an important role in the financial system by providing investors with access to a wide …

Read More »Uncover Hidden Gems: Financial Planning for Wealth Creation

Financial planning services encompass a range of professional guidance and advice designed to help individuals and organizations manage their financial resources effectively. These services typically involve assessing financial situations, setting financial goals, developing strategies to achieve those goals, and implementing and monitoring financial plans. Financial planning services can be invaluable for optimizing financial well-being and securing financial futures. They can …

Read More » Ini Balikpapan All about Banking Finance

Ini Balikpapan All about Banking Finance