Small business banking customer financial expansion refers to the growth of financial services and products offered by banks to small business customers. This includes traditional banking services such as checking and savings accounts, loans, and lines of credit, as well as newer offerings such as financial planning, investment advice, and cash management services. Small business banking customer financial expansion is …

Read More »John Dealove

Unlock Financial Success for Your Small Business: Discover the Hidden Gems of Banking Advancements

Small business banking customer financial advancement refers to the financial services and products offered by banks to help small businesses grow and prosper. These services can include loans, lines of credit, merchant services, and financial planning. Small business banking customer financial advancement is important because it can help small businesses access the capital they need to start or expand their …

Read More »Unlock Financial Insights: Transform Your Small Business Banking | Discoveries & Strategies

Small business banking customer financial improvement refers to the range of services and products offered by banks to help small business customers manage their finances more effectively and achieve their financial goals. These services can include everything from basic checking and savings accounts to more complex products like loans, lines of credit, and investment services. By taking advantage of these …

Read More »Discover the Secrets to Boost Your Small Business Finances

Small business banking customer financial enhancement encompasses a range of banking products and services tailored to help small businesses manage their finances more efficiently and effectively. These services can include everything from basic checking and savings accounts to more complex products like lines of credit and business loans. By partnering with a bank that offers a comprehensive suite of small …

Read More »Unlock Hidden Profits: Discover Financial Maximization Strategies for Small Businesses

Small business banking customer financial maximization is the practice of optimizing financial resources and services to enhance the financial performance and overall success of small businesses. It encompasses a range of strategies and solutions tailored to meet the specific needs of small business customers. By partnering with financial institutions that prioritize small business banking customer financial maximization, small businesses can …

Read More »Unleash Financial Success: Discoveries in Small Business Banking Productivity

Small business banking customer financial productivity refers to the efficiency with which small business customers manage their financial resources through banking services. It encompasses various aspects, including cash flow management, expense tracking, loan utilization, and investment optimization. Enhancing financial productivity is crucial for small businesses as it enables them to make informed financial decisions, optimize cash flow, reduce costs, and …

Read More »Unleash Financial Triumph: Discoveries in Small Business Banking Customer Efficiency

Small business banking customer financial efficiency refers to the ability of small businesses to effectively manage their financial resources using banking services. It encompasses practices that optimize cash flow, minimize costs, and maximize profits. Financial efficiency is crucial for small businesses to thrive in competitive markets. By streamlining financial processes, businesses can save time and resources, make informed decisions, and …

Read More »Unlock Financial Empowerment: A Guide to Small Business Banking Resourcefulness

Small business banking customer financial resourcefulness encompasses the skills and strategies that small business owners employ to manage their finances effectively. It involves understanding financial concepts such as budgeting, cash flow management, and financial planning. By leveraging these skills, small business owners can optimize their financial resources, make informed decisions, and navigate financial challenges. Financial resourcefulness is crucial for small …

Read More »Discover the Secrets of Small Business Banking Financial Ingenuity

Small business banking customer financial ingenuity is the knack for finding innovative ways to manage and leverage financial resources. This includes finding creative ways to save money, generate revenue, and access capital. Financially ingenious small businesses often have a competitive advantage over those that do not. There are many benefits to small business banking customer financial ingenuity. It can help …

Read More »Unlock the Secrets of Financial Creativity for Small Businesses

Small business banking customer financial creativity is a crucial aspect of financial management for small businesses. It refers to the innovative and strategic use of financial resources and services offered by banks to meet the unique challenges and opportunities faced by small businesses. This can involve leveraging various tools, such as lines of credit, loans, and cash management solutions, to …

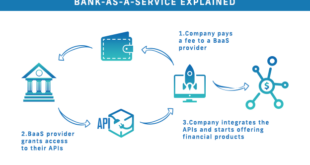

Read More »Unleashing Financial Innovation: Discoveries for Small Business Banking

Small business banking customer financial innovation refers to the development and implementation of new and improved financial products and services tailored to the specific needs of small business customers. This can include a range of offerings, such as specialized lending products, cash management solutions, and mobile banking platforms designed to streamline financial operations and promote business growth. In today’s rapidly …

Read More »Unlock Financial Agility: Discoveries in Small Business Banking Versatility

Small business banking customer financial versatility empowers small business owners with a range of financial products and services tailored to their unique needs, enabling them to manage their finances effectively and navigate financial challenges. Offering a comprehensive suite of solutions, small business banking customer financial versatility encompasses business loans, lines of credit, cash management services, and tailored financial advice. These …

Read More »Unlock Financial Agility: Discoveries for Small Business Banking Customers

Small business banking customer financial agility is the ability of small businesses to quickly and easily access financial services and products that meet their specific needs. This includes everything from basic banking services like checking and savings accounts to more complex products like loans and lines of credit. Small business banking customer financial agility is important because it allows small …

Read More »Unlock Financial Agility: Discover the Secrets of Small Business Banking Flexibility

Small business banking customer financial flexibility refers to the range of financial options and services offered by banks to small business customers that allow them to manage their finances effectively and adapt to changing business conditions. This can include a variety of products and services, such as lines of credit, term loans, cash management tools, and online banking platforms. Financial …

Read More »Unlock Financial Resilience: Discoveries in Small Business Banking Adaptability

Small business banking customer financial adaptability refers to the ability of small businesses to adjust their financial strategies in response to changing economic conditions. This can include adjusting spending, seeking new sources of financing, or negotiating with creditors. Financial adaptability is essential for small businesses because it allows them to weather economic downturns and take advantage of opportunities. Historically, small …

Read More »Unlock Financial Scalability: Empower Your Small Business Banking

Small business banking customer financial scalability refers to the ability of a small business banking customer to increase or adapt their financial capabilities as their business grows and changes. This can include access to a wider range of financial products and services, as well as the ability to customize those products and services to meet the specific needs of the …

Read More »Unlocking Financial Health: Essential Insights into Small Business Banking Customer Viability

Small business banking customer financial viability assesses the financial health and stability of small business customers to determine their ability to repay loans and manage their finances effectively. It is a crucial aspect of small business banking as it helps banks make informed lending decisions, mitigate risks, and provide tailored financial solutions to meet the specific needs of small businesses. …

Read More »Uncover the Secrets to Small Business Banking Customer Financial Feasibility

Assessing the financial feasibility of small business banking customers is a key step in determining their creditworthiness and ability to repay loans. It involves analyzing various financial factors, including income, expenses, assets, and liabilities, to determine the likelihood of a successful loan repayment. Evaluating financial feasibility is crucial for both the bank and the small business owner. For the bank, …

Read More »Discover the Secrets to Small Business Banking Customer Financial Affordability

Small business banking customer financial affordability refers to the ability of small business customers to meet their financial obligations to banks and other lenders. This includes being able to make loan payments on time, maintain a positive cash flow, and meet other financial commitments. Small business banking customer financial affordability is important for several reasons. First, it helps banks and …

Read More »Unlock Hidden Treasures: Unraveling Small Business Banking Financial Availability

Small business banking customer financial availability refers to the ability of small businesses to access financial services and products, such as loans, lines of credit, and cash management services, from banks and other financial institutions. This access to financial resources is crucial for small businesses, as it can help them to start and grow their operations, manage their cash flow, …

Read More » Ini Balikpapan All about Banking Finance

Ini Balikpapan All about Banking Finance