Small business banking customer financial recovery refers to the various financial assistance programs and resources offered by banks to help small businesses recover from financial distress. These programs can include loans, lines of credit, and advisory services. Small business banking customer financial recovery is important because it can help businesses to:

Read More »John Dealove

Uncover Hidden Financial Risks: A Guide to Small Business Banking Exposure

Small business banking customer financial exposure refers to the financial risk that a small business customer faces when conducting banking activities. This can include risks associated with fraud, cybercrime, and other financial threats. Small businesses are particularly vulnerable to these risks due to their limited resources and lack of experience in managing financial matters. There are a number of steps …

Read More »Uncover Financial Resilience: Empowering Small Businesses Against Vulnerability

Small business banking customer financial vulnerability refers to the susceptibility of small business banking customers to financial risks and challenges. These risks can arise from a variety of factors, including lack of access to capital, limited financial literacy, and exposure to fraud and cybercrime. Importance of Addressing Small Business Banking Customer Financial Vulnerability Addressing the financial vulnerability of small business …

Read More »Uncover Hidden Risks: Unlocking the Secrets of Small Business Banking

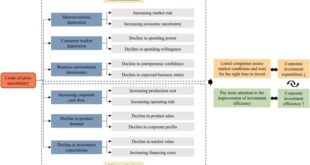

Small business banking customer financial risk is the potential for a small business to experience financial difficulty that could impact its ability to repay its debts. This can be caused by a variety of factors, including economic downturns, changes in the competitive landscape, poor management, or fraud. Small business banking customer financial risk is a major concern for banks, as …

Read More »Unlock Financial Security: Unveiling Hidden Insights for Small Business Banking Customers

Small business banking customer financial insecurity refers to the financial challenges faced by small business customers of banks. These challenges can include a lack of access to credit, high interest rates, and complex financial products. Financial insecurity can have a significant impact on small businesses. It can make it difficult for them to invest in their businesses, hire new employees, …

Read More »Unlocking Financial Clarity: A Deep Dive into Small Business Banking Customer Uncertainty

Financial uncertainty is a major concern for small businesses. A recent survey by the National Small Business Association found that 65% of small business owners are worried about their financial future. This uncertainty can be caused by a number of factors, including the economy, competition, and government regulations. Small businesses are particularly vulnerable to financial uncertainty because they have fewer …

Read More »Unveiling the Hidden Fears: Unlocking Financial Success for Small Business Banking Customers

Small business banking customer financial fear is a real concern that can have a significant impact on the success of a small business. It is the fear of not having enough money to cover expenses, or of making financial decisions that could lead to financial ruin. This fear is often caused by a lack of financial literacy, or by negative …

Read More »Unveiling the Enigma: Small Business Banking Customer Financial Anxiety

Small business banking customer financial anxiety is a growing concern for financial institutions. It is defined as the fear or worry that small business owners have about their financial situation. This can be caused by a number of factors, including the current economic climate, rising costs, and uncertainty about the future. Small business banking customer financial anxiety can have a …

Read More »Uncover the Hidden Truths: Tackling Small Business Banking Customer Financial Stress

Small business banking customer financial stress refers to the financial difficulties faced by small business customers of banks. It encompasses the challenges and strains that small businesses encounter in managing their financial affairs, including accessing capital, managing cash flow, and meeting financial obligations. Addressing small business banking customer financial stress is crucial for supporting the growth and stability of small …

Read More »Unveiling the Hidden Truths: Small Business Banking Customer Financial Worries

Small business banking customer financial worries encompass a wide range of concerns that small business owners have about their financial situation. These worries can include concerns about cash flow, access to capital, and managing debt. Small business banking customers may also worry about the impact of economic conditions on their business and personal finances. Small business banking customer financial worries …

Read More »Unlocking Financial Success for Small Businesses: Unraveling Customer Concerns

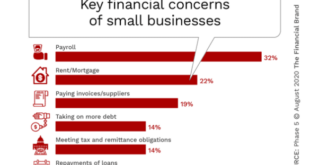

Small business banking customer financial concerns encompass a wide range of issues that can impact the financial health and stability of small businesses. These concerns can include: Access to capital: Small businesses often face challenges in obtaining loans and other forms of financing from traditional banks and lenders. This can make it difficult for them to grow and expand their …

Read More »Unlocking the Secrets: Small Business Banking Customer Financial Expectations Revealed

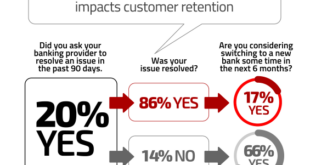

Small business banking customer financial expectations encompass the financial products and services that small business customers anticipate from their banking institution. Understanding these expectations is critical for banks to tailor their offerings and provide value to their small business customers. Meeting these expectations can lead to increased customer satisfaction, loyalty, and referrals.

Read More »Unlock Your Business's Financial Dreams: A Guide for Small Business Bankers

Small business banking customer financial dreams refer to the aspirations and goals that small business owners have for their financial well-being. These dreams can include achieving financial stability, growing their business, and securing their financial future. For many small business owners, financial success is a key component of their overall business goals. By achieving their financial dreams, they can create …

Read More »Unlock the Secrets: Empowering Small Businesses through Financial Fulfillment

Small business banking customer financial aspirations encompass the goals, objectives, and hopes that small business owners have for their financial well-being and the role that banking services play in achieving those aspirations. Understanding these aspirations is crucial for banks to tailor their products and services to meet the specific needs of small businesses. Key aspirations include access to capital, financial …

Read More »Uncover Hidden Opportunities: Small Business Banking Financial Secrets Revealed

Small business banking customer financial opportunities encompass a comprehensive suite of banking products and services tailored to meet the unique financial needs of small businesses. These opportunities are designed to help small businesses manage their cash flow, access capital, and grow their operations. By leveraging small business banking customer financial opportunities, small businesses can gain access to a range of …

Read More »Unlocking Financial Success for Small Businesses: Overcoming Banking Challenges

Small business banking customer financial challenges encompass a range of difficulties that small businesses face in managing their finances and accessing financial services from banks. These challenges can include: Limited access to capital High interest rates on loans Lack of financial literacy Difficulty managing cash flow Fraud and cybercrime These challenges can have a significant impact on the success of …

Read More »Unveiling the Financial Secrets: A Guide to Small Business Banking Customer Needs

Understanding the financial needs of small business banking customers is crucial for banks and financial institutions to develop tailored products and services that meet their specific requirements. Small businesses face unique challenges in managing their finances, including limited access to capital, fluctuating cash flow, and the need for specialized financial advice. By addressing these financial needs, banks can foster the …

Read More »Unveiling the Financial Priorities Driving Small Business Success

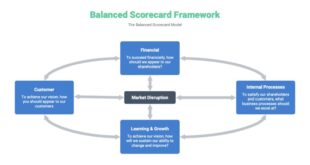

Small business banking customer financial priorities encompass the financial goals, objectives, and strategies that small business owners and managers focus on to ensure the financial health and success of their businesses. Understanding these priorities is critical for banks and financial institutions that serve small businesses, as it enables them to develop products, services, and solutions that meet their specific needs. …

Read More »Unlock the Secrets of Small Business Banking Customer Financial Objectives

Small business banking customer financial objectives are the specific financial goals that small businesses set for themselves. These objectives can include anything from increasing sales and profits to reducing debt and expenses. By understanding the financial objectives of their customers, banks can provide them with the products and services they need to achieve their goals. There are many different factors …

Read More »Unlock the Secrets to Achieving Small Business Banking Customer Financial Success

Small business banking customer financial goals refer to the specific objectives that small business owners have for their finances. These goals can vary depending on the individual business, but some common examples include increasing revenue, reducing expenses, and building a strong financial foundation. By setting and achieving financial goals, small business owners can improve their chances of success. There are …

Read More » Ini Balikpapan All about Banking Finance

Ini Balikpapan All about Banking Finance