Online banking terms and conditions refer to the legally binding agreement between a bank and its customers that outlines the rules and regulations governing the use of online banking services. These terms and conditions typically cover a range of topics, including account access, security measures, transaction limits, fees, and dispute resolution procedures. By agreeing to the terms and conditions, customers …

Read More »John Dealove

Unlock Hidden Savings: Unravel the Secrets of Business Loan Refinancing

Business loan refinancing is the process of replacing an existing business loan with a new one, typically with more favorable terms, such as a lower interest rate, longer repayment period, or smaller monthly payments. Refinancing can be a strategic financial move for businesses looking to reduce their borrowing costs, improve their cash flow, or consolidate multiple loans into a single, …

Read More »Unveiling the Secrets of Online Banking: Your Ultimate Guide to FAQs

Online banking FAQs are a collection of frequently asked questions and answers about online banking services. They are typically found on the websites of banks and credit unions, and can provide information on a wide range of topics, such as how to open an account, how to transfer money, and how to use mobile banking. Online banking FAQs can be …

Read More »Discover the Secrets of Small Business Loan Assistance: Unlocking Growth and Success

Small business loan assistance encompasses financial aid programs designed specifically to support small businesses in obtaining loans. These loans typically offer favorable terms, such as lower interest rates and flexible repayment options, compared to traditional loans from banks or other lending institutions. Small business loan assistance plays a crucial role in fostering entrepreneurship and economic growth. It empowers small businesses …

Read More »Unlock the Secrets of Real Estate Investment Management

Real estate investment management is the professional management of real estate investments, encompassing a wide range of responsibilities, such as acquiring, developing, financing, and operating properties to generate income and capital appreciation. Effective real estate investment management can provide many benefits, including consistent cash flow, potential capital gains, tax advantages, diversification of investment portfolios, and inflation protection. Historically, real estate …

Read More »Unlock the Secrets of Online Banking: A Journey to Financial Empowerment

Online banking tutorials provide step-by-step guidance on how to use online banking services. These tutorials can cover a wide range of topics, from basic tasks like checking your balance to more complex tasks like setting up automatic payments or managing your investments. Online banking tutorials can be a valuable resource for people who are new to online banking or who …

Read More »Unlock the Secrets of Business Loan Repayment: Discover Insider Tips and Strategies

Business loan repayment options refer to the various ways in which a business can repay a loan it has taken from a lender. These options typically include a combination of principal and interest payments, and the specific terms of the repayment plan will vary depending on the type of loan, the lender, and the creditworthiness of the business. Importance, benefits, …

Read More »Unveiling the Secrets of Small Business Loan Specials: A Gateway to Growth

Small business loan specials are a type of loan offered by banks and other financial institutions that provide favorable terms and conditions to small businesses. These loans may offer lower interest rates, longer repayment terms, and more flexible eligibility requirements than traditional business loans. Small business loan specials can be a valuable source of funding for small businesses that are …

Read More »Uncover the Future of Wealth: Venture Capital Investments Decoded

Venture capital investments are a type of financial backing provided to early-stage, high-potential companies. Venture capitalists invest in companies that they believe have the potential to grow rapidly and generate significant returns. They typically provide funding in exchange for an equity stake in the company. Venture capital investments are an important source of funding for many startups. They provide companies …

Read More »Unveiling the Secrets of Private Equity: Discoveries and Insights for Savvy Investors

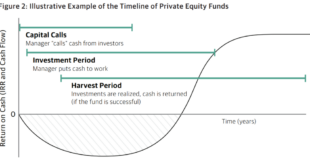

Private equity investments refer to investments made by private equity firms into companies that are not publicly traded. These investments are typically made in the form of equity or debt financing and are used to finance a variety of purposes, such as expansion, acquisitions, or recapitalizations. Private equity firms typically have a long-term investment horizon and are actively involved in …

Read More »Unlock the Secrets of Online Chat Support: A Journey of Discovery and Insight

Online chat support, a form of customer service that allows customers to communicate with a company in real-time through a chat interface, has become an increasingly popular way for businesses to provide support to their customers. Online chat support offers a number of benefits for businesses, including the ability to provide immediate assistance to customers, reduce customer wait times, and …

Read More »Unlock Your Funding Potential: Discover Unparalleled Small Business Loan Incentives

Small business loan incentives are financial perks or advantages offered to encourage small businesses to obtain loans. These incentives can take various forms, such as reduced interest rates, extended repayment periods, or loan forgiveness programs. The primary goal of these incentives is to make it more accessible and affordable for small businesses to access capital, which is crucial for their …

Read More »Uncover the Secrets: Business Loan Terms and Conditions Demystified

When applying for a business loan, it’s crucial to understand the terms and conditions associated with it. These terms outline the specific details of the loan, including the interest rate, repayment schedule, loan amount, and any other relevant factors. The importance of business loan terms and conditions cannot be overstated. By carefully reviewing these terms, business owners can make informed …

Read More »Unlock the Secrets of Hedge Fund Management: Discoveries and Insights Unveiled

Hedge fund management is an investment approach that utilizes advanced investment strategies to generate high returns. Hedge funds are actively managed pooled investment funds that use a wide range of strategies to enhance portfolio returns and mitigate risks. Hedge fund management has gained popularity due to its potential to generate superior returns compared to traditional investment strategies. Hedge funds employ …

Read More »Unveiling the Secrets of Business Loan Interest Rates: A Comprehensive Guide

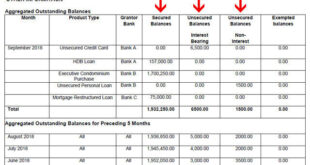

Business loan interest rates refer to the percentage charged by lenders for the use of borrowed funds in a business loan. These rates vary depending on several factors, including the loan amount, the borrower’s creditworthiness, and the current market interest rates. Understanding business loan interest rates is crucial for businesses as they significantly impact the overall cost of borrowing. Low …

Read More »Uncover the Secrets of Exceptional Online Customer Support

Online customer support is a form of customer service that is provided over the internet. It can take many forms, including email, live chat, and social media. Online customer support is becoming increasingly popular as more and more people shop and interact with businesses online. There are many benefits to using online customer support. It is convenient, as customers can …

Read More »Unlock the Power of Small Business Loan Discounts: Discover the Secrets to Financing Success

Small business loan discounts are financial incentives offered by lenders to encourage small businesses to borrow money. These discounts can take the form of lower interest rates, reduced fees, or other perks. Small business loan discounts can be a valuable tool for businesses that need to access capital to grow or expand their operations. There are a number of reasons …

Read More »Unlock the Hidden Treasure of Alternative Investment Management

Alternative investment management refers to the management of investments in asset classes that fall outside of traditional investments such as stocks, bonds, and cash equivalents. These alternative assets may include private equity, hedge funds, real estate, commodities, and infrastructure. Alternative investments have gained popularity among institutional and individual investors due to their potential to provide diversification, enhance returns, and hedge …

Read More »Unlock the Secrets to Business Loan Eligibility: Discoveries that Drive Success

Business loan eligibility criteria refer to the specific requirements that businesses must meet to qualify for a loan. These criteria are typically set by the lender and can vary depending on the type of loan, the lender’s risk appetite, and the financial health of the business. Meeting business loan eligibility criteria is of utmost importance as it increases a business’s …

Read More »Unveiling the Secrets of Small Business Loan Promotions

Small business loan promotions are special offers or incentives provided by lenders to attract new borrowers or encourage existing borrowers to take out additional loans. These promotions can take various forms, such as reduced interest rates, waived fees, or cash bonuses. Small business loan promotions can be an important tool for small businesses seeking financing. By taking advantage of these …

Read More » Ini Balikpapan All about Banking Finance

Ini Balikpapan All about Banking Finance