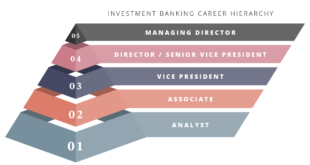

An investment banking resume is a specialized document tailored to showcase the skills, experience, and qualifications of individuals seeking employment in the investment banking industry. A well-crafted investment banking resume highlights an individual’s financial acumen, analytical prowess, and ability to navigate complex financial transactions. It serves as a crucial marketing tool, enabling candidates to present their capabilities and value proposition …

Read More »Andy Coleman

Unlock the Power of Small Business Banking Checks: Discoveries and Insights

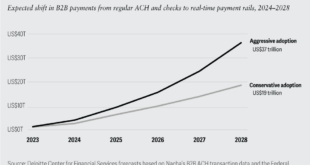

Small business banking checks are negotiable instruments used by businesses to make payments to vendors, employees, and other parties. They are similar to personal checks, but they are drawn on a business’s bank account and typically have the business’s name and logo printed on them. Small business banking checks offer a number of advantages over other payment methods, such as …

Read More »Unveiling the Secrets of Investment Banking: Experience Matters

Investment banking experience encompasses the skills and knowledge acquired through working in the investment banking industry. This includes expertise in financial analysis, valuation, and capital raising, as well as a deep understanding of capital markets and financial regulations. Investment banking experience is highly sought after by employers in the financial sector, as it provides a strong foundation for a career …

Read More »Unlock the Gateway to Investment Banking: Uncover the Essential Qualifications

Investment banking qualifications encompass the educational background, skills, and certifications required to work in the investment banking industry. These qualifications vary depending on the specific role and the country in which the investment banking professional is based. Investment banking qualifications are important because they provide individuals with the knowledge and skills necessary to succeed in the field. Investment banking is …

Read More »Small Business Banking Transfers: Uncover Hidden Gems and Insights

Small business banking transfers enable small businesses to manage their finances efficiently. These transfers allow businesses to move funds between their business accounts and other accounts, such as personal accounts, vendor accounts, or tax authorities. Small business banking transfers can be initiated online, through mobile banking apps, or in person at a bank branch. Small business banking transfers are important …

Read More »Unlock Hidden Insights: Master the Art of Small Business Banking Withdrawals

Small business banking withdrawals are financial transactions that reduce the balance of a small business’s bank account. These withdrawals can be made for a variety of reasons, such as paying for expenses, repaying loans, or distributing profits to owners. Small business banking withdrawals are an important part of managing a small business’s finances. They allow businesses to pay their bills, …

Read More »Unveiling the Secrets of Investment Banking: Skills for Success

Investment banking skills encompass the specialized knowledge and abilities required to work in the investment banking industry, which involves advising companies on mergers and acquisitions, capital raising, and other financial transactions. Investment banking skills are highly sought after due to their applicability in various financial roles and industries. They provide a solid foundation for a successful career in finance and …

Read More »Unveiling the Secrets of Investment Banking Interviews: Your Guide to Success

An investment banking interview is a formal meeting between an investment bank and a job candidate who is seeking a position at the bank. The purpose of the interview is for both parties to get to know each other and to assess whether the candidate is a good fit for the bank and the position. Investment banking interviews are typically …

Read More »Unlock the Secrets of Small Business Banking Deposits: A Journey to Financial Empowerment

Small business banking deposits refer to the funds that small businesses deposit into their bank accounts. These deposits can come from various sources, such as sales revenue, customer payments, and loan proceeds. Small business banking deposits are important for several reasons. First, they provide businesses with a safe and secure place to store their money. Second, deposits can earn interest, …

Read More »Unveil the Secrets of Small Business Banking Savings: Discoveries and Insights

What is Small Business Banking Savings? Small business banking savings are financial products designed specifically to meet the banking needs of small businesses. These accounts often offer competitive interest rates, low fees, and convenient features that can help small businesses manage their finances effectively.

Read More »Unveiling the Investment Banking Lifestyle: Discoveries and Insights

Investment banking lifestyle refers to the demanding and fast-paced work environment of investment banks. It is characterized by long working hours, high-pressure situations, and a competitive culture. Investment bankers typically work in teams to provide financial advice to corporations and governments, and they are involved in a wide range of activities, including mergers and acquisitions, capital raising, and trading. The …

Read More »Unveiling the Secrets: Transform Your Small Business with Banking Investments

Small business banking investments are financial products and services designed to meet the specific needs of small businesses. These investments can help small businesses grow and succeed by providing access to capital, managing cash flow, and protecting against financial risks. Small business banking investments are important because they can help small businesses:

Read More »Unveil the Secrets of Investment Banking Hours: Discoveries and Insights

Investment banking hours refer to the extended working hours typically associated with the investment banking industry. These hours often exceed the standard 40-hour workweek and can vary depending on factors such as deal flow, project deadlines, and market conditions. The long hours in investment banking are driven by the demanding nature of the work, which involves managing complex financial transactions, …

Read More »Unveiling the Secrets: Small Business Banking Credit Cards

Small business banking credit cards are a type of credit card designed specifically for small businesses. They offer a range of benefits that can help small businesses manage their finances and grow their operations. These benefits may include rewards points, cash back, and low interest rates. Small business banking credit cards can be a valuable tool for small businesses. They …

Read More »Unlock the Secrets of Small Business Banking Mortgages: A Guide to Success

Small business banking mortgages are specialized loans designed to help small businesses purchase or refinance commercial properties. These mortgages typically offer competitive interest rates, flexible repayment terms, and can be tailored to meet the specific needs of small businesses. Small business banking mortgages play a crucial role in supporting the growth and success of small businesses. They provide access to …

Read More »Unveiling the Enigmatic World of Investment Banking Culture

Investment banking culture is a set of values, beliefs, and behaviors that shape the work environment and interactions within investment banks. It encompasses the norms, expectations, and unwritten rules that govern how employees conduct themselves, collaborate, and make decisions. Investment banking culture is often characterized by long working hours, high pressure, and a competitive environment. However, it also emphasizes teamwork, …

Read More »Unveiling Investment Banking Compensation: Secrets and Strategies Revealed

Investment banking compensation refers to the financial rewards received by professionals working in the investment banking industry. Compensation typically includes a base salary, bonus, and other incentives, and can vary widely depending on factors such as experience, job title, and firm performance. Investment banking compensation is often substantial, reflecting the demanding nature of the work and the high level of …

Read More »Discover the Secrets to Unlocking Growth with Small Business Banking Loans

Small business banking loans are a crucial source of funding for small businesses, providing them with the capital they need to start, grow, and operate their businesses. These loans are typically offered by banks and credit unions and can vary in terms of loan amount, interest rate, and repayment period. Small business banking loans can be used for a variety …

Read More »Unlock the Secrets of Investment Banking Bonuses: Discoveries and Insights

Investment banking bonuses are a form of compensation paid to employees in the investment banking industry. They are typically paid out annually and are based on a variety of factors, including the employee’s performance, the bank’s overall profitability, and the current market conditions. Bonuses can be a significant part of an investment banker’s total compensation, and they can vary widely …

Read More »Unveiling the Secrets of Small Business Banking Interest Rates

Small business banking interest rates are the interest rates charged on loans and other financial products offered by banks to small businesses. These rates can vary depending on the bank, the type of loan, and the creditworthiness of the borrower. Small business banking interest rates are important because they can have a significant impact on the cost of borrowing for …

Read More » Ini Balikpapan All about Banking Finance

Ini Balikpapan All about Banking Finance