Small business banking charges are the fees levied by banks on small businesses for maintaining accounts and conducting financial transactions. These charges can include monthly maintenance fees, transaction fees, overdraft fees, and other miscellaneous fees. Understanding small business banking charges is important for business owners as they can impact the profitability of the business. By being aware of the different …

Read More »Andy Coleman

Banking on Success: Unveiling the Secrets of Investment Banking Salaries

Investment banking salary refers to the compensation earned by professionals working in the investment banking division of financial institutions. It typically includes a base salary, bonus, and other forms of incentives. Investment banking salaries are generally considered to be high, as they reflect the demanding nature of the work and the specialized skills required. Investment bankers work long hours and …

Read More »Uncover Hidden Truths: Your Guide to Mastering Small Business Banking Fees

Small business banking fees are service charges levied by financial institutions on small businesses for maintaining accounts and accessing financial services. These fees may include monthly maintenance fees, transaction fees, overdraft fees, and fees for using certain services, such as check printing or online banking. Understanding small business banking fees is crucial for business owners to manage their finances effectively. …

Read More »Unveiling the Secrets: Investment Banking Associate Mastery

An investment banking associate is a professional who works in the investment banking division of a financial institution. Investment banking associates are responsible for a variety of tasks, including financial analysis, preparing pitch books, and executing transactions. They typically work long hours and are expected to be highly motivated and results-oriented. Investment banking associates play an important role in the …

Read More »Unveiling the Secrets of Investment Banking: A Journey into the World of Financial Expertise

An investment banking analyst is a professional who provides financial advice to corporations and governments. They help companies raise capital, make acquisitions, and manage their finances. Investment banking analysts typically have a strong understanding of accounting, finance, and economics. They also have excellent communication and interpersonal skills. Investment banking analysts play an important role in the global financial system. They …

Read More »Unveiling the Secrets: Small Business Banking Transactions Decoded

Small business banking transactions encompass the financial activities conducted between small businesses and financial institutions. These transactions include deposits, withdrawals, transfers, loan payments, and other banking services tailored to meet the specific needs of small businesses. Small business banking transactions play a vital role in managing business finances effectively. They facilitate the smooth flow of funds, allowing businesses to make …

Read More »Unlock the Secrets of Investment Banking Internships: Insights and Discoveries Await

Investment banking internships are short-term work experiences offered by investment banks to students and recent graduates seeking to gain practical experience in the field of investment banking. These internships provide valuable opportunities for individuals to learn about the industry, develop professional skills, and build a network of contacts. Investment banking internships are highly competitive, and successful candidates typically have strong …

Read More »Home Equity Loan Default: Uncover Proven Strategies for Success

A home equity loan default strategy is a plan that homeowners can use to avoid foreclosure if they default on their home equity loan. There are a number of different strategies that homeowners can use, and the best strategy will vary depending on the individual circumstances. Some common strategies include selling the home, refinancing the loan, or working with a …

Read More »Unlock the Power of Small Business Banking: Discover Products That Drive Success

Small business banking products are financial products and services designed specifically to meet the needs of small businesses. These products can include everything from basic checking and savings accounts to more complex products like loans and lines of credit. Small business banking products can be a valuable resource for small businesses, providing them with the financial tools they need to …

Read More »Unlock Hidden Home Equity Loan Deferment Secrets

Home equity loan deferment tips can provide homeowners with much-needed financial relief during times of hardship. A home equity loan deferment allows the borrower to temporarily stop making payments on their loan, giving them time to get back on their feet financially. There are a number of different home equity loan deferment programs available, and the best option for a …

Read More »Unveiling the Secrets of Small Business Accounts: A Guide to Financial Success

Small business accounts are specialized financial accounts designed to meet the unique banking needs of small businesses. These accounts typically offer a range of services tailored to the specific requirements of small business owners, such as business loans, lines of credit, and merchant services. Small business accounts can provide a number of important benefits to small business owners. They can …

Read More »Unveiling Mobile Banking's Reward Secrets: Discoveries and Insights

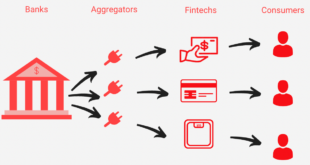

Mobile banking app reward experience refers to the incentives and benefits offered by mobile banking apps to encourage customer engagement and loyalty. These rewards can include cash back, points, discounts, and other perks. Providing a rewarding experience for mobile banking app users is crucial for banks and financial institutions. It helps them attract and retain customers, increase app usage, and …

Read More »Unveiling the Lucrative World of Investment Banking: Discoveries and Insights Await

Investment banking careers encompass a wide range of roles within the financial industry, primarily focused on providing advisory and underwriting services to corporations, governments, and institutions. Investment bankers play a crucial role in facilitating capital raising, mergers and acquisitions, and other complex financial transactions. They possess a deep understanding of financial markets, regulations, and industry trends, enabling them to provide …

Read More »Unleash the Power of Your Home Equity: Uncover Insider Refinancing Tips

A home equity loan refinance is a new loan taken out against your home equity, which is the difference between what your home is worth and what you owe on your mortgage. Refinancing your home equity loan can be a great way to get a lower interest rate, shorten your loan term, or get cash out to pay for home …

Read More »Unlock the Secrets: Transform Mobile Banking with Rewarding Innovations

Mobile banking app reward fulfillment encompasses strategies employed by financial institutions to incentivize and reward customers for using their mobile banking apps. These rewards come in various forms, including cash back, points, discounts, and exclusive offers. Reward fulfillment plays a pivotal role in driving customer engagement, loyalty, and overall satisfaction with mobile banking services. By offering tangible rewards for actions …

Read More »Unveiling Home Equity Loan Forgiveness Secrets: Discoveries and Insights

Home equity loan forgiveness tips refer to strategies or advice on how to potentially have a portion or all of a home equity loan forgiven, typically by the lender. These tips can involve understanding loan forgiveness programs, negotiating with the lender, and exploring alternative options. Home equity loan forgiveness can provide significant benefits to homeowners, including reducing or eliminating debt, …

Read More »Unlock Home Equity Loan Modification Secrets: Discover Expert Tips and Proven Strategies!

A home equity loan modification is a change to the terms of your existing home equity loan. This can include lowering your interest rate, extending your loan term, or reducing your monthly payments. If you’re struggling to make your home equity loan payments, a modification may be a good option for you. There are many benefits to getting a home …

Read More »Unveiling the Secrets of Investment Banking: Uncover Lucrative Career Paths

Investment banking jobs involve providing financial advice and services to corporations, governments, and institutions. These services can include underwriting new debt and equity securities, advising on mergers and acquisitions, and providing strategic advice on capital structure and financial planning. Investment banking is a vital part of the global financial system. It helps companies raise capital to fund their operations and …

Read More »Discover the Secrets to Business Banking Accounts for Small Business Success

In today’s fast-paced business environment, having a dedicated business banking account is crucial for managing your company’s finances effectively. A business banking account is a type of bank account specifically designed to meet the unique needs of businesses, offering a wide range of services tailored to help streamline financial operations, manage cash flow, and facilitate growth. Business banking accounts provide …

Read More »Unlock the Secrets of Mobile Banking App Reward Success

Mobile banking app reward success refers to the positive outcomes and benefits gained from implementing reward programs within mobile banking applications. These rewards can incentivize users to engage with the app, perform specific actions, and increase overall customer satisfaction and loyalty. Reward programs can take various forms, such as points-based systems, cash-back offers, or exclusive discounts. By offering rewards, banks …

Read More » Ini Balikpapan All about Banking Finance

Ini Balikpapan All about Banking Finance