Home equity loan deferment programs are financial assistance options that allow homeowners to temporarily pause or reduce their mortgage payments due to financial hardship. These programs are designed to provide relief to homeowners who are facing unexpected financial challenges, such as job loss, medical emergencies, or natural disasters. Home equity loan deferment programs can offer a range of benefits to …

Read More »Andy Coleman

Unlock the Secrets of Mobile Banking App Assistance: Discoveries That Will Empower You

Mobile banking app assistance refers to the support and guidance provided to users of mobile banking applications. This assistance can come in various forms, including FAQs, tutorials, live chat, and email support. Mobile banking app assistance plays a crucial role in enhancing the user experience and ensuring customer satisfaction. It empowers users to navigate the app’s features, resolve issues, and …

Read More »Unlock Financial Freedom: Discover the Secrets of Home Equity Loan Refinancing

Home equity loan refinance programs allow homeowners to replace existing home equity loans with a new loan, typically at a lower interest rate or with better terms. Refinancing a home equity loan can save money on monthly payments, reduce the loan term, or access additional cash. Some homeowners choose to refinance to consolidate debt, make home improvements, or pay for …

Read More »Unlock the Secrets of Exceptional Mobile Banking App Customer Service

Mobile banking app customer service encompasses the support provided to users of mobile banking applications. These services typically include assistance with account management, troubleshooting technical issues related to using the app, answering inquiries, and resolving customer concerns or complaints. Mobile banking apps have become increasingly popular in recent years, offering convenience, accessibility, and a wide range of financial services at …

Read More »Unveiling the Path to Home Equity Loan Relief: Discoveries and Insights

Home equity loan forgiveness programs are designed to help homeowners who are struggling to make their mortgage payments. These programs can provide financial relief to homeowners who are facing economic hardship, and can help them to avoid foreclosure. There are a number of different home equity loan forgiveness programs available, and the eligibility requirements vary depending on the program. One …

Read More »Unveiling the Secrets of Mobile Banking App Technical Support

Mobile banking app technical support refers to the assistance provided to users of mobile banking applications when they encounter technical issues or require guidance using the app’s features. This support can be offered through various channels, including phone, email, live chat, or an in-app help center. Mobile banking app technical support is crucial for ensuring a seamless and positive user …

Read More »Unlock Home Equity Loan Modification Secrets: Discover Unseen Opportunities

Home equity loan modification programs are designed to help homeowners who are struggling to make their mortgage payments. These programs can offer a variety of benefits, such as reducing the interest rate, extending the loan term, or even forgiving a portion of the debt. Home equity loan modification programs are becoming increasingly important as more and more homeowners face financial …

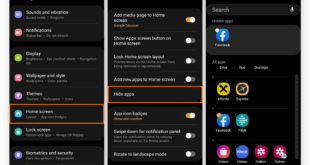

Read More »Uncover the Secrets: Ultimate Guide to Mobile Banking App Troubleshooting

Mobile banking app troubleshooting refers to the process of identifying and resolving issues that may arise when using a mobile banking application. It involves diagnosing the root cause of the problem and implementing appropriate solutions to restore the app’s functionality. Mobile banking apps have become increasingly popular due to their convenience and ease of use. However, like any software, they …

Read More »Unveiling Home Equity Loan Assistance: Discoveries to Save Your Home

Home equity loan assistance programs are designed to help homeowners who are struggling to make their mortgage payments. These programs can provide financial assistance in the form of reduced interest rates, extended loan terms, or even grants. Home equity loan assistance programs can be a valuable resource for homeowners who are facing financial hardship. There are a number of different …

Read More »Unlock Home Equity Secrets: Discover Relief and Insights

Home equity loan relief involves modifying the terms of an existing home equity loan, typically to lower the interest rate or monthly payments. This can help homeowners avoid foreclosure and stay in their homes. Home equity loan relief can be a valuable tool for homeowners who are struggling to make their mortgage payments. It can help them avoid foreclosure, save …

Read More »Unveiling the Secrets of Mobile Banking App Outages: A Journey Towards Stability

Mobile banking app outages occur when a mobile banking application experiences a disruption in service, making it temporarily unavailable to users. These outages can be caused by various factors, such as technical glitches, software updates, or server maintenance. Mobile banking app outages can have significant consequences for users who rely on these apps to manage their finances. During an outage, …

Read More »Unveiling the Secrets of Mobile Banking App Downtime: Insights and Solutions

Mobile banking app downtime refers to the period when a mobile banking application is unavailable or inaccessible to users. This can be caused by various factors, including technical glitches, scheduled maintenance, or network outages. Mobile banking app downtime can be a significant inconvenience for users who rely on these apps to manage their finances, make payments, or access account information. …

Read More »Discover Home Equity Loan Forbearance Secrets to Weather Financial Storms

Home equity loan forbearance is a temporary pause on mortgage payments, allowing homeowners to postpone payments during periods of financial hardship. Unlike deferment, forbearance does not add the missed payments to the end of the loan term, making it a valuable option for those facing short-term financial challenges. Forbearance programs typically last for a few months and can provide much-needed …

Read More »Unveil the Hidden Truths: Home Equity Loan Foreclosure Demystified

Home equity loan foreclosure is a legal proceeding that allows a lender to seize and sell a property that is secured by a home equity loan if the borrower defaults on the loan. This can happen when the borrower fails to make payments on the loan, fails to maintain the property, or violates other terms of the loan agreement. Home …

Read More »Unveiling the Secrets of Mobile Banking App Uptime: A Journey to Seamless Banking

Mobile banking app uptime refers to the period during which a mobile banking application is operational and accessible to its users. It measures the reliability and availability of the mobile banking service, indicating the extent to which customers can depend on it for their banking needs. Maintaining high mobile banking app uptime is crucial for several reasons. Firstly, it ensures …

Read More »Unlocking the Secrets of Mobile Banking App Stability: A Journey of Discovery

Mobile banking app stability refers to the ability of a mobile banking application to function consistently and reliably without experiencing frequent crashes, errors, or interruptions in service. Stable mobile banking apps are essential for providing users with a positive and seamless banking experience. They help to build trust and confidence in the app and the bank it represents. Stable apps …

Read More »Discover Ingenious Solutions to Avoid Home Equity Loan Default and Protect Your Home

Home equity loan default occurs when a borrower fails to make payments on a loan secured by their home. When this happens, the lender may foreclose on the property, meaning they will sell the home to recoup the money they are owed. Home equity loan defaults can have serious consequences for borrowers, including damage to their credit score, loss of …

Read More »Discover the Secrets of Home Equity Loan Deferment: Insights and Strategies for Financial Relief

Home equity loan deferment refers to the postponement of principal and interest payments on a home equity loan for a specific period of time. This financial strategy allows homeowners to temporarily pause their loan payments, providing relief during times of financial hardship or unexpected circumstances. Home equity loan deferment options and eligibility criteria may vary among lenders, so it’s essential …

Read More »Unlocking Mobile Banking App Reliability: Discoveries & Insights for Seamless Banking

Mobile banking app reliability refers to the extent to which a mobile banking application functions as intended, without errors or interruptions. A reliable mobile banking app allows users to access their accounts, conduct transactions, and manage their finances seamlessly and securely. Mobile banking app reliability is of paramount importance as it directly impacts user experience, trust, and the overall reputation …

Read More »Unlock the Secrets to Mobile Banking App Responsiveness: A Comprehensive Guide

Mobile banking app responsiveness refers to the ability of a mobile banking application to react promptly and efficiently to user inputs and requests. It encompasses various aspects, including app load time, UI responsiveness, and the speed at which the app processes transactions or retrieves information. In today’s fast-paced digital landscape, mobile banking app responsiveness is crucial for several reasons. Firstly, …

Read More » Ini Balikpapan All about Banking Finance

Ini Balikpapan All about Banking Finance