Home equity loan forgiveness is a program that allows homeowners to have their home equity loans forgiven, typically after a certain number of years of making on-time payments. This can be a great way for homeowners to save money and get out of debt faster. There are many benefits to home equity loan forgiveness. For one, it can help homeowners …

Read More »Andy Coleman

Unleash the Secrets to Blazing-Fast Mobile Banking: Discover Speed Optimization Techniques

Mobile banking app speed refers to the time it takes for a mobile banking app to perform various tasks, such as logging in, checking balances, and making transactions. Fast mobile banking app speed is important for a number of reasons. First, it can save users time. Second, it can help to improve the user experience. Third, it can help to …

Read More »Unlock Secrets: Home Equity Loan Modifications Demystified

A home equity loan modification is a change to the terms of your existing home equity loan. This can include changing the interest rate, the loan term, or the monthly payment amount. Home equity loan modifications can be a helpful way to make your home equity loan more affordable or to get out of a difficult financial situation. There are …

Read More »Unleash the Power of Mobile Banking: Discover Secrets to App Performance Success

Mobile banking app performance refers to the effectiveness and efficiency of a mobile banking application in carrying out its intended functions. It encompasses various aspects such as app stability, speed, responsiveness, user-friendliness, and security. Optimizing mobile banking app performance is crucial to ensure a seamless and satisfactory user experience. Excellent mobile banking app performance offers numerous benefits. It enhances customer …

Read More »Uncover Home Equity Loan Extensions: Secrets to Saving Your Home

A home equity loan extension extends the term of your existing home equity loan or line of credit, providing you with additional time to repay the borrowed funds. This can be beneficial if you are experiencing financial hardship and are unable to make your monthly payments on time. There are several benefits to extending your home equity loan. First, it …

Read More »Mobile Banking Revolutionized: Unveiling the Secrets of App Enhancements

Mobile banking app enhancements refer to improvements and upgrades made to mobile banking applications to enhance user experience, functionality, and security. These enhancements can range from introducing new features to optimizing existing ones, with the aim of providing customers with a more convenient, efficient, and secure mobile banking experience. Mobile banking app enhancements are crucial in today’s digital landscape, where …

Read More »Unlock Home Equity's Potential: Discoveries in Amortization

Home equity loan amortization is the gradual repayment of a loan secured by your home equity. It involves making regular payments that cover both the interest and principal of the loan, reducing the outstanding balance over time. Amortization is an important part of home equity loans as it allows you to pay off the loan in a structured and manageable …

Read More »Uncover the Future of Mobile Banking with Groundbreaking App Enhancements

Mobile banking app improvements refer to enhancements made to the functionality, user experience, and security of mobile banking applications. These improvements aim to provide users with a more convenient, secure, and efficient way to manage their finances on their mobile devices. Mobile banking app improvements have become increasingly important in recent years as the use of mobile devices for banking …

Read More »Unveiling Home Equity Loan Repayment Options: Insights to Empower Homeowners

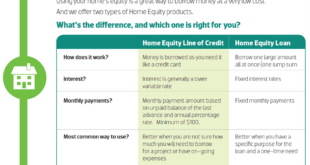

A home equity loan is a type of secured loan that allows homeowners to borrow money against the equity they have built up in their homes. Home equity loan repayment options refer to the different ways in which homeowners can repay their home equity loans. These options typically include fixed-rate loans, adjustable-rate loans, and interest-only loans. Choosing the right home …

Read More »Unlock Hidden Secrets: The Ultimate Guide to Home Equity Loan Payoff

A home equity loan payoff refers to the complete repayment of a loan taken out against the equity in a homeowner’s property. Home equity loans, also known as second mortgages, allow homeowners to borrow against the difference between their home’s current market value and the amount they still owe on their first mortgage. Paying off a home equity loan can …

Read More »Unlock the Secrets: Uncover Critical Mobile Banking App Bug Fixes

Mobile banking app bug fixes address errors or glitches within mobile banking applications. These fixes enhance the stability, security, and user experience of the app. Regular bug fixes are crucial for maintaining a well-functioning mobile banking app. They improve the app’s performance, prevent crashes, and protect user data. Moreover, bug fixes contribute to the overall reliability and trustworthiness of the …

Read More »Uncover Hidden Gems: Dive into Mobile Banking App Release Notes

Mobile banking app release notes provide information about new features, bug fixes, and other changes made to a mobile banking app. They are typically published on the app’s website or in the app store. Release notes are important because they help users stay informed about the latest changes to the app and can help them decide whether to update to …

Read More »Unleash Financial Freedom: Discover the Secrets of Home Equity Loan Consolidation

Home equity loan consolidation combines multiple home equity loans or lines of credit into a single, simplified loan. It streamlines monthly payments, potentially lowering interest rates and consolidating debt. Benefits include reduced interest expenses, simplified budgeting, improved credit scores, and increased home equity. Historically, homeowners have used home equity loans for various expenses like home renovations, education, and debt consolidation.

Read More »Unlock Unbeatable Home Equity Loan Refinancing Secrets

Home equity loan refinancing options allow homeowners to replace their existing mortgage with a new one, typically at a lower interest rate. This can result in significant monthly savings and can free up cash flow for other expenses. Refinancing a home equity loan can have several benefits, including:

Read More »Uncover the Secrets: Mobile Banking App Version Insights Revealed

Mobile banking app version refers to the specific iteration or release of a mobile banking application. It typically includes new features, bug fixes, security enhancements, or other updates to improve the user experience. Regular updates to mobile banking app versions are crucial for several reasons. They enhance the overall functionality and stability of the app, ensuring a smooth and secure …

Read More »Unveiling the Secrets: Exceptional Home Equity Loan Incentives

Home equity loan incentives are financial perks offered by lenders to encourage homeowners to take out home equity loans. These incentives can take various forms, such as reduced interest rates, closing cost credits, or cash bonuses. Lenders may offer these incentives during specific promotional periods or to attract new customers.

Read More »Unlock the Power of Mobile Banking: Uncover Hidden Insights with App Updates

Mobile banking app updates refer to the latest software enhancements and improvements made to mobile banking applications offered by financial institutions. These updates typically aim to enhance the user experience, add new features, improve security, and resolve any bugs or glitches. Regular mobile banking app updates are crucial for several reasons. They help to ensure that the app remains secure …

Read More »Uncover the Secrets of Mobile Banking App Compatibility

Mobile banking app compatibility refers to the ability of a mobile banking app to run on a particular mobile device or operating system. In other words, it is the degree to which the app is compatible with the device’s hardware and software. Mobile banking app compatibility is important for several reasons. First, it ensures that users can access their banking …

Read More »Unveiling the Secrets of Home Equity Loan Discounts: Discover the Path to Financial Freedom

Home equity loan discounts are a type of loan that allows homeowners to borrow money against the equity they have in their homes. These loans are typically offered at lower interest rates than other types of loans, making them a good option for homeowners who need to borrow money for home improvements, debt consolidation, or other expenses. Home equity loan …

Read More »Unlock the Secrets of Accessible Mobile Banking: Empowering All Users

Mobile banking app accessibility refers to the usability of mobile banking applications for individuals with disabilities. It ensures that these apps are accessible to everyone, regardless of their abilities or disabilities. Accessible mobile banking apps are essential for financial inclusion. They empower individuals with disabilities to manage their finances independently, access banking services, and participate fully in the digital economy. …

Read More » Ini Balikpapan All about Banking Finance

Ini Balikpapan All about Banking Finance