Business loan customer support encompasses the assistance provided to borrowers who have obtained business loans. This support can take various forms, including answering questions, resolving issues, and providing guidance throughout the loan process. Effective business loan customer support is crucial for several reasons. Firstly, it helps ensure that borrowers understand the terms and conditions of their loans, enabling them to …

Read More »Business Banking

Unlock Hidden Insights: Business Loan Customer Feedback for Success

Business loan customer feedback refers to the feedback or reviews provided by customers who have taken out business loans from a particular lender. This feedback can take various forms, such as online reviews, testimonials, surveys, or social media comments. Customer feedback is crucial for businesses as it provides valuable insights into the quality of their products and services. Positive feedback …

Read More »Unlock the Secrets: Business Loan Customer Experience Revolution

Business loan customer experience refers to the interactions and experiences that businesses have when applying for, obtaining, and managing business loans. It encompasses all aspects of the loan process, from the initial inquiry to the final repayment. A positive business loan customer experience is one that is efficient, transparent, and supportive, and that meets the needs of the business borrower. …

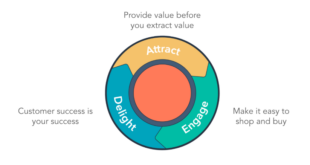

Read More »Unlock the Secrets of Business Loan Customer Engagement for Unprecedented Growth

Business loan customer engagement refers to the interactions between a business lender and its loan customers. These interactions can occur through various channels, including phone, email, online portals, and in-person meetings. The goal of customer engagement is to build and maintain strong relationships with customers, which can lead to increased loan volume, customer satisfaction, and loyalty. There are many benefits …

Read More »Unlock the Secrets of Business Loan Customer Loyalty

Business loan customer loyalty is a crucial aspect of financial institutions. It measures the extent to which customers remain committed to a particular lender for their business loan needs over time. Fostering customer loyalty in business lending offers numerous advantages. Repeat business from loyal customers reduces customer acquisition costs and generates a steady stream of revenue. Loyal customers are more …

Read More »Unlock the Secrets of Business Loan Customer Delight

Business loan customer satisfaction gauges how satisfied customers are with the products and services provided by business lenders. Many factors contribute to business loan customer satisfaction, including the ease of application, the speed of approval, the interest rates and fees, and the customer service provided. Business loan customer satisfaction is important for several reasons. First, satisfied customers are more likely …

Read More »Unlock the Secrets to Unstoppable Business Loan Customer Retention

Business loan customer retention refers to the strategies and practices that financial institutions employ to maintain relationships with their business loan customers and encourage repeat business. It involves building and nurturing long-term relationships with customers to increase their lifetime value and reduce customer churn. Importance and Benefits Customer retention is crucial for financial institutions because it is significantly less expensive …

Read More »Unlock the Secrets of Business Loan Customer Acquisition: Proven Strategies for Success

Business loan customer acquisition is a crucial aspect for financial institutions seeking to expand their customer base and drive revenue growth. In essence, it encompasses the strategies and techniques utilized to attract and onboard new customers for business loan products. For banks and other lenders, acquiring new business loan customers presents numerous advantages. Firstly, it contributes to loan portfolio diversification, …

Read More »Unveiling the Secrets of Business Loan Distribution Strategies: A Path to Growth

Business loan distribution strategies refer to the methods and criteria used by financial institutions to assess and distribute loans to businesses. These strategies involve evaluating a business’s creditworthiness, financial health, and ability to repay the loan. Lenders may also consider the purpose of the loan, industry trends, and economic conditions. Effective business loan distribution strategies help lenders manage risk, optimize …

Read More »Unveiling the Secrets of Business Loan Channel Management: Discoveries and Insights

Business loan channel management is the process of managing and optimizing the different channels through which businesses can access loans. This includes traditional channels such as banks and credit unions, as well as alternative channels such as online lenders and peer-to-peer lending platforms. Effective business loan channel management can help businesses get the financing they need quickly and efficiently, at …

Read More »Unlock the Secrets of Business Loan Alliance Management

Business loan alliance management is the practice of partnering with other financial institutions to offer loans to businesses. This can be a beneficial strategy for both the lender and the borrower. For the lender, it can help to reduce risk and increase loan volume. For the borrower, it can provide access to more favorable loan terms and a wider range …

Read More »Business Loan Strategic Partnerships: Unlocking Growth and Innovation

Business loan strategic partnerships are collaborations between businesses and financial institutions to provide tailored loan solutions to customers. These partnerships leverage the expertise of both entities, offering businesses access to competitive loan products and specialized services. Strategic partnerships can enhance a business’s ability to secure financing, streamline the loan application process, and benefit from customized loan terms. They foster innovation …

Read More »Discover the Secrets of Business Loan Vendor Relations for Maximum Success

Business loan vendor relations refer to the interactions and partnerships between businesses and vendors that provide loan services. These vendors can range from banks and credit unions to online lenders and alternative financing providers. Establishing strong business loan vendor relations is crucial for several reasons. Firstly, it ensures access to diverse financing options tailored to the specific needs of the …

Read More »Unveiling the Secrets of Business Loan Employee Relations

Business loan employee relations is a critical aspect of managing a successful business. It refers to the relationship between a business and its employees who have taken out business loans. This relationship is built on trust, transparency, and mutual respect. When business loan employee relations are positive, it can lead to increased employee morale, productivity, and loyalty. Positive business loan …

Read More »Unlock the Secrets of Business Loan Customer Relations: Discoveries and Insights Revealed

Business loan customer relations encompasses the interactions and communication between financial institutions and their business loan customers. It involves building and maintaining positive relationships, resolving inquiries and complaints, and providing ongoing support to ensure customer satisfaction and loyalty. Effective business loan customer relations are crucial for several reasons. Firstly, it helps financial institutions retain existing customers and attract new ones …

Read More »Business Loan Community Relations: Unlocking Opportunities, Building Bridges

Business loan community relations encompasses the efforts made by financial institutions to foster positive relationships with the communities they serve. It involves actively engaging with local organizations, businesses, and residents to support economic development, social well-being, and overall community growth. Engaging in business loan community relations is not only socially responsible but also strategically beneficial for financial institutions. By investing …

Read More »Unlock the Secrets of Business Loan Shareholder Relations | Discover Game-Changing Insights

Business loan shareholder relations refer to the interactions and communications between a business that has taken out a loan and the shareholders who have provided the financing. These relations are crucial for maintaining transparency, trust, and alignment between the company and its investors. Effective business loan shareholder relations involve regular communication, timely financial reporting, and clear disclosure of loan terms …

Read More »Unveiling the Secrets of Business Loan Investor Relations for Enhanced Growth

Business loan investor relations involve managing financial interactions between companies seeking loans and the investors providing those loans. These relationships are crucial for securing funding, ensuring transparency, and fostering long-term partnerships. Effective business loan investor relations build trust and confidence through open communication, timely reporting, and a shared understanding of goals. They also enhance a company’s reputation, increase its borrowing …

Read More »Unlock the Power of Business Loan Stakeholder Communications: Uncover Hidden Insights for Success

Stakeholder communications are crucial when it comes to business loan applications. Different stakeholders like potential investors, underwriters, and even employees need constant updates on the loan process. Effective communication with stakeholders can lead to a higher chance of loan approval, better terms, and a smoother overall process. In the context of business loans, clear communication can help build trust and …

Read More »Unlock the Secrets of Business Loan PR: Discoveries and Insights for Banking Success

Business loan public relations encompasses strategic communication initiatives aimed at fostering a positive reputation and building relationships with key stakeholders for businesses seeking or servicing business loans. Effective business loan PR involves crafting compelling narratives, managing media relations, and utilizing digital channels to showcase a company’s financial stability, industry expertise, and commitment to responsible lending or borrowing practices. It plays …

Read More » Ini Balikpapan All about Banking Finance

Ini Balikpapan All about Banking Finance