Business loan reputation management refers to the strategies and techniques used to enhance and protect the reputation of businesses that offer loan services. It involves monitoring and responding to online reviews, managing social media presence, and addressing negative feedback to maintain a positive image and attract potential borrowers. In today’s digital landscape, reputation management is crucial for businesses, especially those …

Read More »Business Banking

Unlock the Secrets of Business Loan Crisis Management: Discoveries and Insights to Safeguard Your Financial Future

Business loan crisis management refers to the strategies and actions taken by businesses to mitigate and resolve financial distress or crisis situations involving outstanding loan obligations. It encompasses various measures aimed at preventing or addressing loan defaults, managing cash flow, and preserving business operations during challenging economic conditions or unexpected events. Effective business loan crisis management is crucial for maintaining …

Read More »Uncover the Secrets to Business Loan Contingency Planning: Insights and Strategies for Success

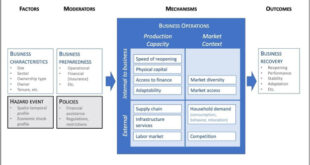

Business loan contingency planning outlines the steps a business can take to prepare for and manage unexpected events that could impact its ability to repay a loan. This plan serves as a roadmap for businesses to navigate financial challenges and maintain their financial stability during unforeseen circumstances. Contingency planning is a critical aspect of sound financial management for businesses. It …

Read More »Discoveries in Business Loan Disaster Recovery

Business loan disaster recovery refers to financial assistance provided to businesses impacted by natural disasters or other unforeseen events, enabling them to recover and rebuild. These loans play a critical role in supporting businesses during challenging times, offering benefits such as:

Read More »Unlock the Secrets of Business Loan Risk Mitigation: Discoveries and Insights

Business loan risk mitigation refers to the strategies and practices that lenders employ to reduce the risk of default on business loans. These strategies can include assessing the borrower’s creditworthiness, requiring collateral, and setting loan covenants. Risk mitigation is important for lenders because it helps them to protect their capital and maintain their profitability. It is also important for borrowers …

Read More »Uncover Business Loan Fraud: Secrets and Strategies Revealed

Business loan fraud detection is the process of identifying and preventing fraudulent activities related to business loans. It involves detecting suspicious patterns, analyzing financial data, and investigating potential cases of fraud. Fraudulent loan applications can result in significant financial losses for lenders and can also damage the reputation of the financial industry. Early detection of fraud can help mitigate these …

Read More »Unlock the Secrets of Business Loan Identity Verification: A Journey to Fraud Prevention and Trust

Business loan identity verification is the process of verifying the identity of a business loan applicant. This is typically done by reviewing the applicant’s financial statements, tax returns, and other relevant documents. Identity verification is an important part of the business loan process, as it helps to reduce the risk of fraud and ensures that the loan is being made …

Read More »Unveiling Business Loan Access Controls: A Gateway to Growth and Risk Mitigation

Business loan access controls refer to the policies and procedures that financial institutions implement to manage and mitigate the risks associated with lending money to businesses. These controls are designed to ensure that loans are made to creditworthy borrowers, that the terms of the loans are appropriate, and that the loans are properly documented and monitored. Business loan access controls …

Read More »Ensuring Trust and Security: Exploring Business Loan Authentication Methods

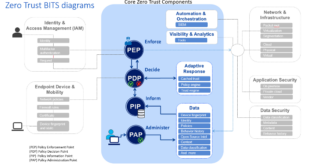

Business loan authentication methods are processes that lenders use to verify the identity of borrowers and the legitimacy of their loan applications. This is important to reduce the risk of fraud and protect lenders from financial losses.There are a variety of business loan authentication methods that lenders may use, including:

Read More »Unlock the Secrets of Business Loan Encryption: Uncover Security and Compliance

Business loan encryption standards refer to the security measures employed to protect sensitive information exchanged during business loan transactions. These standards ensure that data such as loan applications, financial statements, and personal information remain confidential and protected from unauthorized access or interception. Encryption algorithms and protocols are implemented to safeguard data during transmission and storage, adhering to industry-recognized guidelines and …

Read More »Unlock the Secrets of Business Loan Security: Uncover Hidden Opportunities

When a business applies for a loan, the lender will typically require some form of security to protect its investment. This security can take a variety of forms, such as a lien on the business’s assets, a personal guarantee from the business owner, or a pledge of collateral. Business loan security protocols are the procedures and policies that lenders use …

Read More »Unlock the Secrets: Business Loan Confidentiality Agreements Unveiled

A business loan confidentiality agreement is a legal contract between a lender and a borrower that outlines the terms of confidentiality for the loan application and approval process. This agreement is important because it protects the borrower’s sensitive financial information from being disclosed to third parties without their consent. Business loan confidentiality agreements typically include provisions that restrict the lender …

Read More »Unlock the Secrets of Business Loan Privacy Policies

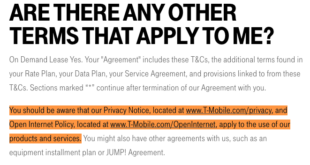

A business loan privacy policy is a legal document that outlines how a lender will collect, use, and protect the personal and financial information of its loan applicants and borrowers. This information may include name, address, Social Security number, income, and credit history. Lenders are required by law to have a privacy policy in place, and borrowers should carefully review …

Read More »Unveiling the Secrets: Business Loan Data Protection Insights

Business loan data protection refers to the security measures and protocols implemented to safeguard sensitive information related to business loan applications, approvals, and repayments. This includes protecting data from unauthorized access, disclosure, modification, or destruction. Protecting business loan data is crucial for several reasons. Firstly, it ensures compliance with regulations and industry standards, which often mandate the secure handling of …

Read More »Unveiling the Secrets: Empowering Business Loans with Cybersecurity

Cybersecurity measures are safeguards implemented by businesses to protect their information systems, networks, and data from unauthorized access, use, disclosure, disruption, modification, or destruction. In the context of business loans, cybersecurity measures are particularly important as they help protect sensitive financial information and prevent fraud. There are a number of different types of cybersecurity measures that businesses can implement, including:

Read More »Unveiling the Secrets: Business Loan Fraud Prevention

Business loan fraud prevention is the practice of safeguarding financial institutions from fraudulent loan applications and protecting borrowers from falling victim to predatory lending practices. It involves verifying the identity of loan applicants, assessing their creditworthiness, and scrutinizing loan applications for any signs of falsification or misrepresentation. Business loan fraud prevention is crucial because it helps lenders make informed decisions …

Read More »Unlock the Power of Business Loan Documentation Management: Discoveries and Insights

Business loan documentation management refers to the systematic process of organizing, storing, and managing loan-related documents throughout the loan lifecycle. It involves capturing, classifying, indexing, and storing loan documents in a secure and easily accessible manner, ensuring their integrity and facilitating efficient retrieval when needed. For instance, a well-structured documentation management system enables lenders to quickly locate loan agreements, financial …

Read More »Unveiling the Secrets: Business Loan Audit Procedures Unveiled

Business loan audit procedures refer to the systematic review and assessment of a business loan to ensure its compliance with applicable regulations and adherence to prudent lending practices. Auditors examine financial statements, loan documentation, and other relevant records to evaluate the loan’s eligibility, creditworthiness of the borrower, and the lender’s adherence to internal policies and external regulations. These procedures are …

Read More »Unlock Financial Clarity: Demystifying Business Loan Reporting Obligations

Business loan reporting obligations refer to the requirement for businesses to disclose information about their loans to regulatory bodies or other relevant parties. This can include details such as the loan amount, interest rate, repayment terms, and purpose of the loan. The specific reporting requirements can vary depending on the jurisdiction and the type of loan. Business loan reporting obligations …

Read More »Unlock the Secrets of Business Loan Regulation: A Guide to Compliance and Growth

Business loan regulatory standards refer to the rules and regulations that govern the lending of money to businesses. These standards are put in place to protect both lenders and borrowers by ensuring that all parties involved know what is expected before entering into a loan agreement. Business loan regulatory standards can vary from country to country, but they typically include …

Read More » Ini Balikpapan All about Banking Finance

Ini Balikpapan All about Banking Finance