Business loan compliance requirements are the rules and regulations that businesses must follow when they apply for and receive a loan. These requirements are designed to protect both the lender and the borrower and to ensure that the loan is used for its intended purpose. There are a number of different business loan compliance requirements, but some of the most …

Read More »Business Banking

Unlock Business Loan Portfolio Management Secrets for Enhanced Profitability

Business loan portfolio management is the process of overseeing a group of business loans. This includes tasks such as underwriting, approving, disbursing, servicing, and collecting on loans. Effective business loan portfolio management is essential for banks and other financial institutions to minimize risk and maximize profitability. There are a number of factors that banks and other financial institutions consider when …

Read More »Unlock Business Loan Performance Insights for Growth and Success

Business loan performance tracking is the process of monitoring and evaluating the performance of a loan portfolio. This involves collecting data on loan repayments, delinquencies, and defaults, and using this data to identify trends and patterns. Business loan performance tracking can help lenders to make informed decisions about their lending practices, and can also help them to identify and mitigate …

Read More »Unlock Business Loan Monitoring Insights: Supercharge Your Lending Strategy

Business loan monitoring services provide lenders with real-time visibility into a borrower’s financial performance, enabling them to identify potential problems early on and take proactive steps to mitigate risk. These services are becoming increasingly important as the lending landscape becomes more complex and competitive. By providing lenders with a comprehensive view of a borrower’s financial health, business loan monitoring services …

Read More »Unveiling Business Loan Due Diligence: A Gateway to Financial Success

Business loan due diligence is the process of investigating a business loan application to assess the risk of lending to the applicant. It involves reviewing the applicant’s financial statements, business plan, and other relevant documents to determine their ability to repay the loan. Due diligence is an important step in the loan approval process, as it helps lenders to make …

Read More »Unlock Your Business Loan: Discover the Secrets of Underwriting

A business loan underwriting process is a crucial step in securing financing for your business. It is the process by which a lender evaluates the creditworthiness of a business loan applicant to determine whether or not to approve the loan. The underwriting process typically involves a review of the applicant’s financial statements, business plan, and credit history. The importance of …

Read More »Uncover the Secrets of Business Loan Credit Analysis: A Deep Dive for Success

Business loan credit analysis is the process of assessing the creditworthiness of a business loan applicant. This involves evaluating a variety of factors, including the applicant’s financial history, business plan, and industry outlook. Credit analysis is important because it helps lenders make informed decisions about whether or not to approve a loan application. It also helps lenders determine the appropriate …

Read More »Unlock the Secrets of Business Loan Risk Assessment for Success

Business loan risk assessment is the process of evaluating the creditworthiness of a business loan applicant. This involves assessing the business’s financial health, management team, and industry outlook. Business loan risk assessment is important because it helps lenders make informed decisions about whether or not to approve a loan. It also helps businesses understand their own financial risks and take …

Read More »Uncover the Secrets of Business Loan Litigation Services

Business loan litigation services provide legal representation to businesses involved in disputes related to commercial loans. These disputes can arise from various issues, such as breach of contract, fraud, or loan defaults. Business loan litigation services assist businesses in navigating the complex legal landscape and protecting their interests. Engaging business loan litigation services offers numerous benefits. These services provide businesses …

Read More »Unlock the Secrets of Business Loans: Uncover the Power of Mediation Services

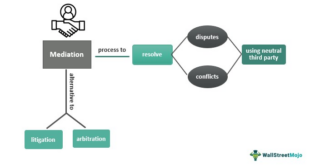

Business loan mediation services provide businesses with assistance in obtaining loans from lenders. These services can be helpful for businesses that do not have the time or expertise to navigate the loan process on their own. Business loan mediation services can help businesses in a number of ways. First, they can help businesses to identify the right lender for their …

Read More »Unlock the Power of Business Loan Arbitration: Discover Efficient Dispute Resolution Options

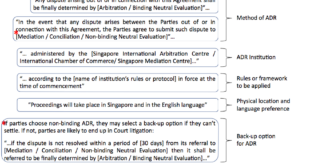

Business loan arbitration options provide a structured process for resolving disputes between businesses and lenders outside of court. Arbitration is a form of alternative dispute resolution (ADR) that involves the use of a neutral third party, known as an arbitrator, to make a binding decision on the dispute. This option can be beneficial for businesses as it is often less …

Read More »Unveiling the Hidden Truths: Business Loan Bankruptcy Implications

Business loan bankruptcy implications refer to the potential consequences and legal ramifications that businesses may face when they are unable to repay their outstanding business loans and subsequently declare bankruptcy. Bankruptcy can have severe implications for businesses, including the loss of assets, damage to reputation, and difficulty in obtaining future financing. In some cases, business owners may also be held …

Read More »Uncover the Secrets of Business Loans: Legal Implications Revealed

A business loan legal implication can be an agreement between a borrower and lender that outlines the terms of a loan. This can include the amount of the loan, the interest rate, the repayment schedule, and any other conditions that may apply. It is important to understand the legal implications of a business loan before signing anything, as it can …

Read More »Unveiling the Secrets of Business Loan Collections: A Comprehensive Guide to Maximizing Recovery

A business loan collections process is a set of procedures that a lender follows to collect outstanding debts from borrowers. This process typically involves sending invoices, making phone calls, and taking legal action if necessary. An effective business loan collections process is important for lenders because it helps them to maximize their recovery rates and minimize their losses. It can …

Read More »Uncover: The Ultimate Guide to Business Loan Recovery Options

Business loan recovery options refer to the strategies and mechanisms employed by lenders or creditors to reclaim unpaid debts from borrowers who have defaulted on their business loans. These options aim to mitigate losses and protect the financial interests of the lender. Loan recovery is crucial for maintaining the stability and health of the lending industry. Effective recovery options provide …

Read More »Uncover Hidden Gems: Master Business Loan Workout Solutions

When a business encounters financial difficulties, finding solutions to manage its loan obligations becomes essential. Business loan workout solutions are tailored strategies designed to assist businesses in resolving their debt challenges and restoring financial stability. These solutions can range from loan modifications, such as extending loan terms or reducing interest rates, to more comprehensive measures like debt restructuring or refinancing. …

Read More »Business Loan Restructuring: Uncover Hidden Options and Fuel Growth

When faced with financial hardship, businesses often consider business loan restructuring options to modify the terms of their existing loans and improve their cash flow. Restructuring can involve extending the loan term, reducing interest rates, or changing the repayment schedule. There are several benefits to business loan restructuring. First, it can help businesses avoid defaulting on their loans, which can …

Read More »Unveiling Late Payment Penalties: Your Guide to Avoid Costly Surprises in Business Loans

Late payments on business loans often result in penalties, which can significantly impact a company’s financial health. These penalties vary depending on the lender and the specific loan agreement, but they typically range from a flat fee to a percentage of the overdue amount. Late payment penalties are designed to discourage borrowers from falling behind on their payments and to …

Read More »Unveiling Business Loan Closing Costs: Unlocking Savings and Clarity

Business loan closing costs are the expenses associated with obtaining a business loan. These costs can include loan origination fees, appraisal fees, attorney fees, and title insurance. Business loan closing costs are important because they can impact the overall cost of your loan. It is important to factor these costs into your budget when you are considering taking out a …

Read More »Unlock the Secrets of Business Loan Origination Fees: A Path to Financing Success

When securing a business loan, borrowers may encounter a fee known as a “business loan origination fee.” This fee compensates the lender for the administrative and underwriting costs associated with processing and approving the loan application. The origination fee is typically calculated as a percentage of the loan amount, ranging from 1% to 5%. For instance, if a business borrows …

Read More » Ini Balikpapan All about Banking Finance

Ini Balikpapan All about Banking Finance