Business asset management (BAM) is a critical function for organizations of all sizes. It involves the systematic management of an organization’s assets, including physical assets such as property, plant, and equipment, as well as intangible assets such as intellectual property, goodwill, and customer relationships. BAM is important because it helps organizations to track, control, and optimize the use of their …

Read More »Business Banking

Unlock the Secrets to Business Wealth Management: Discoveries & Insights

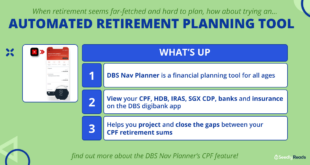

Business wealth management encompasses strategies designed to preserve and grow the financial assets of businesses. It involves a range of services, including investment management, estate planning, tax planning, and retirement planning. Effective business wealth management is crucial for businesses of all sizes, as it helps ensure their long-term financial stability and success. By proactively managing their wealth, businesses can mitigate …

Read More »Uncover the Secrets of Business Retirement Plans: A Path to Financial Freedom

Business retirement plans are employer-sponsored programs that help employees save for their retirement. These plans offer tax advantages and can help employees accumulate a significant nest egg for their golden years. There are two main types of business retirement plans: defined benefit plans and defined contribution plans. Defined benefit plans promise employees a specific monthly benefit at retirement. The employer …

Read More »Unveiling Business Insurance Secrets: Discoveries & Insights

Business insurance services provide financial protection to businesses from potential risks and uncertainties. These services encompass a wide range of coverage options, including property insurance, liability insurance, business interruption insurance, and many more. Business insurance is crucial for organizations of all sizes, as it helps mitigate financial losses resulting from unforeseen events. It ensures business continuity, protects against legal liabilities, …

Read More »Unlock Lucrative Business Investment Options: Discoveries and Insights Await

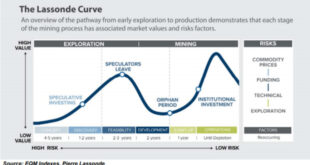

Business investment options refer to the various financial instruments and strategies that companies can utilize to grow and expand their operations. These options may include stocks, bonds, real estate, or other assets that have the potential to generate returns or appreciation in value over time. Business investment options are crucial for companies seeking to stay competitive, innovate, and expand their …

Read More »Unlock Business Growth: Discover the Secrets of Business Credit Solutions

Business credit solutions are financial products and services designed to help businesses establish, build, and maintain their creditworthiness. These solutions can include credit cards, lines of credit, and loans, as well as access to credit monitoring and reporting services. Business credit solutions are important for businesses of all sizes, as they can help to improve cash flow, fund growth, and …

Read More »Unlock the Secrets of Business Treasury Services: Discoveries and Insights

Business treasury services encompass the financial processes and strategies employed by organizations to manage their cash flow, investments, and financial risks. These services are crucial for ensuring the efficient and secure handling of an organization’s financial resources. Effective business treasury services provide numerous benefits, including optimized cash flow, enhanced investment returns, and mitigated financial risks. Historically, treasury services have evolved …

Read More »Unlock Hidden Gems: The Ultimate Guide to Business Deposit Products

Business deposit products encompass a range of financial services offered by banks and other financial institutions tailored to meet the specific needs of businesses. These products provide a secure and convenient way for businesses to manage their finances and optimize their cash flow. The most common types of business deposit products include checking accounts, savings accounts, and money market accounts. …

Read More »Unlock the Power of Business Mobile Banking: Discoveries and Insights for the Future

Business mobile banking allows business owners to manage their finances remotely using a mobile device or tablet. It offers a range of services, including the ability to check account balances, transfer funds, deposit checks, and pay bills. Business mobile banking is becoming increasingly popular as it offers a number of benefits over traditional banking methods. These benefits include convenience, time …

Read More »Discover the Secrets of Business Online Banking: A Gateway to Financial Empowerment

Business online banking refers to the suite of digital financial services that banks provide to business customers for managing their finances conveniently and securely over the internet. It empowers businesses to conduct various banking transactions, such as checking account balances, initiating fund transfers, processing payments, and accessing financial reports, from anywhere with an internet connection. Business online banking offers numerous …

Read More »Unlock the Gold Mine of Business Cash Management: Discoveries and Insights

Business cash management encompasses the processes and strategies employed by businesses to effectively manage their cash flow and liquidity. It involves forecasting cash inflows and outflows, optimizing cash balances, and minimizing the risk of cash shortfalls. A robust cash management system is essential for businesses to maintain financial stability, maximize profitability, and achieve long-term growth. Effective business cash management offers …

Read More »Unlock the Power of Business Financing: Discover the Wealth of Options

Business financing options refer to the various methods businesses can use to raise capital for their operations and growth. These options can range from traditional bank loans to alternative financing sources such as venture capital or crowdfunding. Choosing the right financing option is crucial for businesses as it can impact their financial stability, growth potential, and overall success. There are …

Read More »Uncover the Secrets to Streamline Business Payments

Business payment solutions encompass the tools, technologies, and processes that facilitate the movement of funds between businesses. They provide a secure and efficient means to make and receive payments, streamline financial operations, and enhance cash flow. Examples of business payment solutions include electronic fund transfers (EFTs), credit card processing, automated clearing house (ACH) payments, and mobile payment systems. Business payment …

Read More »Unlock the Power of Merchant Services for Business Success

Merchant services for businesses encompass a range of financial and technological solutions that facilitate payment processing, allowing merchants to accept various payment methods from their customers. These services are typically provided by payment processors or merchant account providers and include credit and debit card processing, mobile payments, online payments, invoicing, and other value-added services. Merchant services play a crucial role …

Read More »Unlock the Secrets of Business Credit Cards: Discover Hidden Gems and Boost Your Business

Business credit cards are a type of credit card designed specifically for businesses. They offer a range of benefits that can help businesses manage their finances more effectively, including the ability to earn rewards, build business credit, and track expenses. One of the most important benefits of business credit cards is the ability to earn rewards. Many business credit cards …

Read More »Unlock Your Business's Potential: Unveil the Secrets of Business Loans and Lines of Credit

Business loans and lines of credit are financial products designed to provide businesses with access to capital. Business loans are typically one-time lump sum payments that are repaid over a fixed period of time, while lines of credit are revolving loans that can be drawn upon and repaid as needed. Both business loans and lines of credit can be valuable …

Read More »Discover the Secrets of Business Savings Accounts for Financial Success

A business savings account is a type of deposit account that is designed to help businesses save money and earn interest. Business savings accounts typically offer a higher interest rate than traditional savings accounts, and they may also offer other benefits, such as free business checking, online banking, and mobile banking. Business savings accounts can be a valuable tool for …

Read More »Unlock the Power of Business Checking Accounts for Ultimate Business Success

A business checking account is a type of bank account that is designed specifically for businesses. It allows businesses to deposit and withdraw money, as well as write checks and make other payments. Business checking accounts typically offer a variety of features and benefits that are tailored to the needs of businesses, such as online banking, mobile banking, and merchant …

Read More »Unlock the Secrets of Corporate Banking Services: A Journey to Financial Empowerment

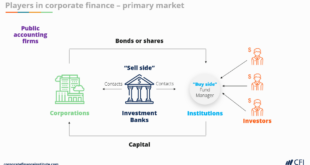

Corporate Banking Services are a suite of financial solutions tailored to meet the complex and evolving needs of businesses and corporations. These services go beyond traditional banking products and encompass a wide range of specialized offerings designed to facilitate growth, manage risk, and optimize financial performance. Corporate Banking Services play a vital role in supporting businesses of all sizes, from …

Read More »Unlock the Power of Commercial Banking Solutions

Commercial banking solutions encompass a range of financial services tailored to meet the specific requirements of businesses. These solutions are designed to facilitate efficient cash flow management, support growth strategies, and optimize financial performance. Examples of commercial banking solutions include business loans, lines of credit, cash management services, and investment products. Commercial banking solutions play a crucial role in supporting …

Read More » Ini Balikpapan All about Banking Finance

Ini Balikpapan All about Banking Finance