Small business loan default recovery strategies are a set of measures taken by lenders to minimize losses in the event that a small business borrower defaults on their loan. These strategies can include a variety of approaches, such as negotiating a repayment plan with the borrower, selling the borrower’s collateral, or pursuing legal action. Default recovery strategies are an important …

Read More »John Dealove

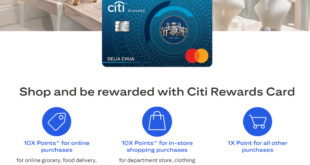

Unlock the Power of Online Banking Rewards: Discoveries and Insights Revealed

Online banking reward evaluation is the process of assessing the value and benefits of rewards offered by online banks. These rewards can include cash back, points, miles, and other perks. Evaluating online banking rewards can help consumers choose the best bank for their needs and maximize the value of their banking activities. There are a number of factors to consider …

Read More »Unlock the Secrets: Business Loan Customer Experience Revolution

Business loan customer experience refers to the interactions and experiences that businesses have when applying for, obtaining, and managing business loans. It encompasses all aspects of the loan process, from the initial inquiry to the final repayment. A positive business loan customer experience is one that is efficient, transparent, and supportive, and that meets the needs of the business borrower. …

Read More »Unlock Your Financial Potential: Discoveries From Financial Empowerment Conferences

Financial empowerment conferences are gatherings that provide individuals with the knowledge, skills, and resources they need to make informed financial decisions. These conferences typically feature presentations from financial experts, workshops, and networking opportunities. Attendees can learn about a variety of topics, including budgeting, saving, investing, and retirement planning. Financial empowerment conferences are important because they can help people improve their …

Read More »Unlock the Secrets of Business Loan Customer Engagement for Unprecedented Growth

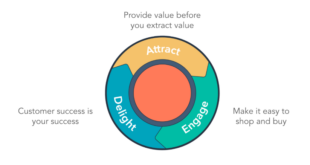

Business loan customer engagement refers to the interactions between a business lender and its loan customers. These interactions can occur through various channels, including phone, email, online portals, and in-person meetings. The goal of customer engagement is to build and maintain strong relationships with customers, which can lead to increased loan volume, customer satisfaction, and loyalty. There are many benefits …

Read More »Unlock Default-Proof Strategies for Small Business Loans: Discoveries and Insights

Small business loan default prevention strategies are measures taken by lenders and small businesses to reduce the risk of a small business loan defaulting. Default prevention strategies can include underwriting guidelines, loan monitoring, and financial assistance programs. Default prevention strategies are important because they can help lenders avoid losses and protect the financial stability of small businesses. Small businesses that …

Read More »Unlock the Secrets of Business Loan Customer Loyalty

Business loan customer loyalty is a crucial aspect of financial institutions. It measures the extent to which customers remain committed to a particular lender for their business loan needs over time. Fostering customer loyalty in business lending offers numerous advantages. Repeat business from loyal customers reduces customer acquisition costs and generates a steady stream of revenue. Loyal customers are more …

Read More »Unlock Financial Freedom: Discoveries from Money Mindset Coaching Retreats

Designed to help individuals transform their relationship with money, money mindset coaching retreats offer a transformative experience by providing a supportive and immersive environment where participants can delve deep into their financial beliefs and behaviors. These retreats often combine elements of financial education, mindset coaching, and experiential exercises to facilitate lasting change. They delve into the psychological aspects of money …

Read More »Unlock the Secrets of Online Banking Rewards: Discover Hidden Gems and Maximize Your Earnings

Online banking reward assessment is the evaluation of rewards offered by banks for using their online banking services. These rewards can include cash back, points, miles, and other benefits. Online banking reward assessments help consumers compare the different rewards programs offered by banks and choose the one that best meets their needs. Online banking reward assessments are important because they …

Read More »Unveiling the Secrets of Small Business Loan Default Assistance Programs

Small business loan default assistance programs are designed to help small businesses avoid defaulting on their loans. These programs can provide financial assistance, technical assistance, and other resources to help businesses stay afloat during difficult times. Small business loan default assistance programs are important because they can help businesses avoid the negative consequences of defaulting on a loan. Defaulting on …

Read More »Discover the Hidden Gems of Online Banking Rewards

Online banking reward analysis involves evaluating and understanding the rewards offered by financial institutions for using their online banking services. It assesses the value and benefits of these rewards to determine their attractiveness to customers. For instance, some banks may offer cash back, points, or discounts on purchases made using their online platforms. Analyzing these rewards helps customers make informed …

Read More »Unlock the Secrets to Wealth Creation: Discoveries and Insights from Wealth Mindset Seminars

Wealth mindset seminars focus on the idea that our beliefs and attitudes significantly impact our financial outcomes and overall prosperity. These seminars teach participants how to cultivate a mindset conducive to wealth creation and abundance. This is often achieved through a combination of cognitive reframing, affirmations, goal setting, and practical financial advice. Attending wealth mindset seminars has several potential benefits. …

Read More »Unlock the Secrets of Business Loan Customer Delight

Business loan customer satisfaction gauges how satisfied customers are with the products and services provided by business lenders. Many factors contribute to business loan customer satisfaction, including the ease of application, the speed of approval, the interest rates and fees, and the customer service provided. Business loan customer satisfaction is important for several reasons. First, satisfied customers are more likely …

Read More »Uncover Lucrative Online Banking Rewards: Compare and Conquer

Online banking reward comparisons allow consumers to evaluate the rewards offered by different banks for using their online banking services. These rewards can include cash back, points, miles, and other perks. By comparing the rewards offered by different banks, consumers can choose the bank that offers the best rewards for their needs. Online banking reward comparisons are important because they …

Read More »Unlock the Secrets of Small Business Loan Default Relief: A Journey to Financial Freedom

Small business loan default relief programs are designed to provide financial assistance to small businesses that are struggling to repay their loans. These programs can offer a variety of benefits, such as reduced interest rates, extended repayment terms, and even loan forgiveness.Small business loan default relief programs are an important tool for helping small businesses stay afloat during difficult economic …

Read More »Unlock the Secrets of Wealth Manifestation and Transform Your Financial Reality

Wealth manifestation workshops are immersive programs designed to help individuals develop the mindset, beliefs, and strategies necessary to attract wealth and abundance into their lives. These workshops typically incorporate principles from various disciplines, including psychology, spirituality, and financial planning, to provide a holistic approach to wealth creation. The importance of wealth manifestation workshops lies in their ability to empower individuals …

Read More »Uncover Secrets to Save Your Business: Small Business Loan Default Workout Guide

A small business loan default workout is an agreement between a lender and a borrower who is in default on a small business loan. The workout may involve a number of different options, such as extending the loan term, reducing the interest rate, or forgiving a portion of the debt. The goal of a workout is to help the borrower …

Read More »Unlock the Secrets to Unstoppable Business Loan Customer Retention

Business loan customer retention refers to the strategies and practices that financial institutions employ to maintain relationships with their business loan customers and encourage repeat business. It involves building and nurturing long-term relationships with customers to increase their lifetime value and reduce customer churn. Importance and Benefits Customer retention is crucial for financial institutions because it is significantly less expensive …

Read More »Unlock Financial Freedom: Discoveries from Financial Mindset Retreats

Financial mindset retreats are immersive experiences designed to shift participants’ beliefs and behaviors around money. These retreats often combine financial education with mindfulness practices to help individuals develop a healthier and more abundant relationship with their finances. Financial mindset retreats have gained popularity in recent years as more and more people realize the importance of financial well-being. These retreats can …

Read More »Discover the Secrets to Maximizing Your Online Banking Rewards

Online banking reward rankings are a system used to evaluate and compare the rewards offered by different online banks. These rankings are based on a variety of factors, including the types of rewards offered, the value of the rewards, and the ease of redeeming the rewards. Online banking reward rankings can be a valuable resource for consumers who are looking …

Read More » Ini Balikpapan All about Banking Finance

Ini Balikpapan All about Banking Finance