A small business loan default credit score is a type of credit score that is used to assess the risk of a small business defaulting on a loan. It is based on a number of factors, including the business’s financial history, the owner’s credit score, and the industry in which the business operates. Lenders use this score to determine whether …

Read More »John Dealove

Discover the Secrets of Business Loan Vendor Relations for Maximum Success

Business loan vendor relations refer to the interactions and partnerships between businesses and vendors that provide loan services. These vendors can range from banks and credit unions to online lenders and alternative financing providers. Establishing strong business loan vendor relations is crucial for several reasons. Firstly, it ensures access to diverse financing options tailored to the specific needs of the …

Read More »Unlock Abundance: Discover the Secrets of Abundance Mindset Audiobooks

Abundance mindset audiobooks delve into the transformative power of embracing an abundance mindset, a belief system that views the world as having an infinite supply of opportunities and resources. These audiobooks offer practical strategies and inspiring stories to help listeners cultivate a mindset of abundance, overcoming limiting beliefs and unlocking their full potential. Abundance mindset audiobooks have gained significant popularity …

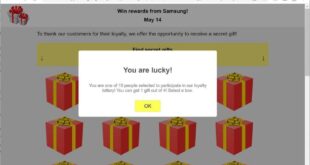

Read More »Unveiling the Secrets of Online Banking Reward Accuracy: Discoveries and Insights

Online banking reward accuracy refers to the correctness and reliability of the rewards and benefits offered by banks through their online banking platforms. It ensures that customers receive the rewards they are entitled to based on their account activity and other criteria. Accurate rewards tracking is crucial for maintaining customer satisfaction and trust. When customers feel confident that they are …

Read More »Unveiling the Secrets of Business Loan Employee Relations

Business loan employee relations is a critical aspect of managing a successful business. It refers to the relationship between a business and its employees who have taken out business loans. This relationship is built on trust, transparency, and mutual respect. When business loan employee relations are positive, it can lead to increased employee morale, productivity, and loyalty. Positive business loan …

Read More »Unlock the Secrets of Online Banking Rewards: Discover Insider Insights

Online banking reward disclosure refers to the practice of financial institutions providing clear and easily accessible information about the rewards and benefits associated with their online banking services. Reward disclosures typically include details about the types of rewards offered, such as cash back, points, or miles; the criteria for earning rewards; and any terms and conditions that apply to the …

Read More »Small Business Loan Defaults: Uncover the Credit Impact and Safeguard Your Business

Small business loan default credit impact refers to the negative consequences a business faces when it fails to repay a loan as agreed. This can include damage to the business’s credit score, making it more difficult and expensive to borrow money in the future. In severe cases, a loan default can lead to bankruptcy. There are a number of factors …

Read More »Unlock Financial Clarity: Discover Game-Changing Mindset Podcasts

Financial mindset podcasts delve into the realm of personal finance, exploring strategies and techniques to cultivate a healthy financial mindset. These podcasts empower listeners with practical advice, expert insights, and inspiring stories to help them achieve their financial goals. By fostering a positive financial mindset, individuals can overcome limiting beliefs, develop sound financial habits, and make informed decisions about their …

Read More »Unveil the Secrets to Wealth Consciousness: Insights for Financial Empowerment

Wealth consciousness books delve into the mindset and practices associated with financial abundance and prosperity. They explore the beliefs, attitudes, and habits that can shape an individual’s relationship with money and wealth. These books often emphasize the importance of developing a positive mindset towards money, recognizing its value while avoiding excessive attachment. They provide techniques for managing finances effectively, setting …

Read More »Uncover the Secrets of Online Banking Reward Transparency: A Path to Financial Empowerment

Online banking reward transparency refers to the clarity and accessibility of information regarding rewards offered by banks for using their online banking services. This includes details about the types of rewards available, the criteria for earning them, and the redemption process. Online banking reward transparency is important because it allows customers to make informed decisions about which bank to choose …

Read More »Unlock the Secrets of Business Loan Customer Relations: Discoveries and Insights Revealed

Business loan customer relations encompasses the interactions and communication between financial institutions and their business loan customers. It involves building and maintaining positive relationships, resolving inquiries and complaints, and providing ongoing support to ensure customer satisfaction and loyalty. Effective business loan customer relations are crucial for several reasons. Firstly, it helps financial institutions retain existing customers and attract new ones …

Read More »Unveil the Secrets of Small Business Loan Default Reporting: Insights and Discoveries

Small business loan default reporting is the process of tracking and reporting on small business loans that have defaulted. This information is used by lenders to assess the risk of lending to small businesses and to make informed decisions about which businesses to approve for loans. Small business loan default reporting is important because it helps lenders to identify high-risk …

Read More »Uncover the Secrets of Small Business Loan Default Collection

Small business loan default collection refers to the process of recovering unpaid debts from borrowers who have defaulted on their small business loans. Lenders may engage in default collection efforts to recoup the money they lent to the business. Default collection can be a complex and challenging process, as there are many factors that can contribute to a business defaulting …

Read More »Business Loan Community Relations: Unlocking Opportunities, Building Bridges

Business loan community relations encompasses the efforts made by financial institutions to foster positive relationships with the communities they serve. It involves actively engaging with local organizations, businesses, and residents to support economic development, social well-being, and overall community growth. Engaging in business loan community relations is not only socially responsible but also strategically beneficial for financial institutions. By investing …

Read More »Unlock Your Financial Potential: Discover the Secrets of Money Mindset Coaching

Money mindset coaching programs are designed to help individuals change their attitudes and beliefs about money. They can assist people in developing healthier financial habits, such as saving, budgeting, and investing. These programs often involve working with a coach who can provide guidance and support. Having a positive money mindset can have a number of benefits. It can help people …

Read More »Unlock the Secrets to Maximizing Your Rewards with Online Banking

Online banking reward reporting is a service that allows bank customers to track and manage their rewards points and other benefits associated with their accounts. This can be done through a secure online portal or mobile app, and typically provides users with a comprehensive view of their rewards activity, including points balances, transaction history, and redemption options. Online banking reward …

Read More »Unraveling the Mysteries of Small Business Loan Default and Repossession

Small business loan default repossession occurs when a small business fails to repay its loan and the lender repossesses the assets that were put up as collateral for the loan. This can include equipment, inventory, and even the business’s real estate. Defaulting on a small business loan can have serious consequences, including damage to the business’s credit rating, difficulty obtaining …

Read More »Unlock the Secrets of Online Banking Rewards: Discoveries and Insights Await

Online banking reward tracking enables users to monitor and manage the rewards associated with their bank accounts. It provides a consolidated view of all rewards earned, helping users maximize the value of their banking activities. Online banking reward tracking offers several benefits. It provides greater transparency and control over rewards, allowing users to make informed decisions about their banking choices. …

Read More »Unlock the Secrets of Business Loan Shareholder Relations | Discover Game-Changing Insights

Business loan shareholder relations refer to the interactions and communications between a business that has taken out a loan and the shareholders who have provided the financing. These relations are crucial for maintaining transparency, trust, and alignment between the company and its investors. Effective business loan shareholder relations involve regular communication, timely financial reporting, and clear disclosure of loan terms …

Read More »Unleash the Power of Wealth Mindset Affirmations: Discoveries and Insights

“Wealth mindset affirmations” refer to positive statements or beliefs that an individual regularly repeats to themselves with the intention of cultivating a mindset of wealth and abundance. These affirmations are often rooted in the idea that our thoughts and beliefs have a powerful influence on our reality, and by repeatedly affirming positive statements about wealth, we can reprogram our subconscious …

Read More » Ini Balikpapan All about Banking Finance

Ini Balikpapan All about Banking Finance