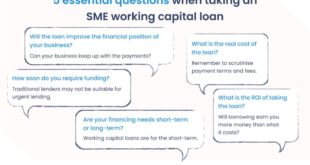

Small business loan disadvantages refer to the potential drawbacks and limitations associated with obtaining and using loans specifically designed for small businesses. These loans are typically provided by banks or other financial institutions to support the operations, growth, and expansion of small businesses. Understanding these disadvantages is crucial for business owners considering or currently utilizing small business loans. One of …

Read More »John Dealove

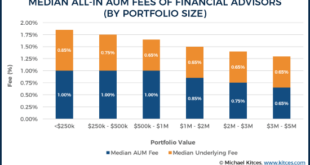

Unlock the Secrets of Fee-Based Financial Planning for Wealth Creation

Fee-based financial planning is a type of financial planning in which the financial planner charges a fee for their services, rather than receiving commissions from the sale of financial products. This fee is typically based on a percentage of the assets under management, and it covers the cost of the planner’s time, expertise, and advice. Fee-based financial planning is designed …

Read More »Uncover the Secrets of Online Banking Fees and Save

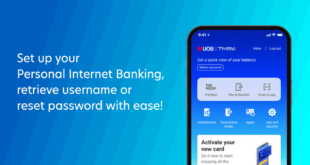

Online banking fees encompass various charges associated with electronic banking services. These fees may include monthly maintenance fees, transaction fees, overdraft fees, and fees for using ATMs outside of a bank’s network. Understanding online banking fees is crucial for consumers to manage their finances effectively. These fees can impact the overall cost of banking services and may vary depending on …

Read More »Unveiling the Secrets of Online Banking Limits: A Comprehensive Guide

Online banking limits refer to the restrictions imposed by financial institutions on the amount of money that can be transferred, withdrawn, or deposited through online banking channels. These limits are established to protect customers from unauthorized access to their accounts and to mitigate the risk of fraud and financial loss. Online banking limits can vary depending on the bank or …

Read More »Unlock Hidden Gems: Discover the Secret Advantages of Small Business Loans

Small business loans refer to financial assistance provided to small businesses to aid their operations and growth. These loans often come with flexible repayment terms and competitive interest rates, making them an attractive funding option for entrepreneurs and small business owners. Small business loans offer numerous advantages that can contribute to the success and sustainability of small businesses. Firstly, they …

Read More »Unveil the Secrets of Fiduciary Wealth Management: Discoveries and Insights

Fiduciary wealth management is a specialized type of financial advice where the advisor is legally bound to act in the best interests of their client. This means that the advisor must put the client’s needs first and foremost, even if it means sacrificing their own. Fiduciary wealth managers are typically held to a higher standard of care than other financial …

Read More »Unlock the Secrets of Business Loan Prepayment: Discover Options to Save & Optimize

Business loan prepayment options allow borrowers to pay off their loans early, potentially saving money on interest charges. These options vary depending on the lender and the specific loan agreement, but they typically include a prepayment penalty, which is a fee charged for paying off the loan before the maturity date. Prepayment penalties are usually calculated as a percentage of …

Read More »Uncover the Hidden Gems: Small Business Loan Benefits Unveiled!

Small business loans are specifically designed to help small businesses meet their financial needs. They can be used for a variety of purposes, such as purchasing equipment, expanding operations, or hiring new employees. There are many benefits to obtaining a small business loan. These benefits include:

Read More »Unlock the Power of Responsible Investing: Discoveries and Insights

Responsible investing services consider environmental, social, and governance (ESG) factors when making investment decisions. These services are designed to align investments with the values and goals of investors who want to make a positive impact on the world while also generating competitive returns. Responsible investing services can take many different forms, but they all share a common goal of promoting …

Read More »Unlock the Secrets of Business Loan Repayment: Strategies for Success

Business loan repayment strategies refer to the various approaches businesses can adopt to pay back their loans in a timely and efficient manner. These strategies play a critical role in ensuring the financial stability of a business and maintaining positive relationships with lenders. Importance and Benefits:

Read More »Uncover the Secrets of Online Banking: Your Guide to Secure and Smart Transactions

Online banking transactions refer to financial transactions conducted electronically over the internet through a bank’s website or mobile application. Online banking transactions offer several benefits and advantages, including convenience, accessibility, time-saving, and enhanced security features. Historically, online banking has revolutionized the banking industry, providing customers with greater control and flexibility over their finances.

Read More »Discover the Transformative Power of Values-Based Investing

Values-based investing is an investment approach that incorporates an investor’s personal values and beliefs into their investment decisions. It involves screening potential investments based on their alignment with the investor’s values, such as environmental sustainability, social justice, or corporate governance. Values-based investing has gained popularity in recent years as investors seek to align their investments with their personal values. This …

Read More »Uncover the Power of Online Banking Notifications: Your Guide to Smart Money Management

Online banking notifications are messages sent by banks to their customers to inform them about transactions, account activity, and other important information related to their bank accounts. These notifications can be sent via email, SMS, or through the bank’s mobile app. Online banking notifications are important because they help customers stay informed about their account activity and can help prevent …

Read More »Unlock Your Business Potential: Discover Groundbreaking Small Business Loan Opportunities

Small business loan opportunities are financial products designed to provide funding to small businesses. They can be used for a variety of purposes, such as starting a new business, expanding an existing business, or purchasing equipment or inventory. Small business loan opportunities can be a valuable resource for entrepreneurs and small business owners. They can provide the capital needed to …

Read More »Unlock the Secrets of Business Loan Utilization Strategies for Growth and Success

Business loan utilization strategies encompass the methods and techniques employed by businesses to maximize the effectiveness and efficiency of their loan utilization. These strategies involve planning, budgeting, and managing loan funds to optimize financial performance and achieve specific business objectives. A key aspect of business loan utilization strategies is aligning loan terms with business needs. This includes carefully considering the …

Read More »Unlock Sustainable Investing Solutions for a Brighter Future

Sustainable investing solutions encompass financial products and strategies that align investments with environmental, social, and governance (ESG) factors. These may include renewable energy funds, green bonds, or companies with strong ESG performance. Sustainable investing aims to generate positive social and environmental impact alongside financial returns. It considers how investments affect climate change, resource depletion, labor practices, and other sustainability issues. …

Read More »Uncover the Secrets of Business Loan Disbursement: A Guide to Success

A business loan disbursement process is a series of steps that a lender takes to release loan funds to a borrower. The process typically begins with the borrower submitting a loan application and providing the lender with financial documentation. The lender will then review the application and documentation to assess the borrower’s creditworthiness and ability to repay the loan. If …

Read More »Uncover Online Banking Secrets: Alerts That Protect Your Finances

Online banking alerts are notifications sent by banks to their customers to inform them about transactions, account activity, and potential fraud. These alerts can be sent via email, text message, or mobile app push notifications. Online banking alerts are an important tool for managing your finances and protecting your accounts from fraud. They can help you to:

Read More »Uncover the Secrets to Small Business Loan Success!

Small business loan solutions provide funding options for small businesses and entrepreneurs. These solutions can include traditional loans from banks or credit unions, as well as alternative lending options such as online lenders, peer-to-peer lending, and crowdfunding. Small business loans can be used for a variety of purposes, such as starting a new business, expanding an existing business, purchasing equipment, …

Read More »Unveiling the Business Loan Approval Process: Secrets Revealed

A business loan approval process is a set of steps that a lender takes to assess the creditworthiness of a business and determine whether or not to approve a loan. The process typically involves reviewing the business’s financial statements, credit history, and business plan. The lender will also consider the experience and qualifications of the business’s owners and management team. …

Read More » Ini Balikpapan All about Banking Finance

Ini Balikpapan All about Banking Finance