Online banking rewards are financial incentives offered by banks and credit unions to customers who use their online banking services. These rewards can take various forms, such as cash back, points, miles, or discounts on products and services. Online banking rewards are essential for several reasons. Firstly, they can help customers save money on their everyday banking needs. Secondly, they …

Read More »John Dealove

Unlock the Secrets to Small Business Loan Documentation: A Guide to Success

Small business loan documentation encompasses the various financial statements, legal agreements, and other documents required to apply for and secure a loan from a lender. These documents serve as a comprehensive overview of the business’s financial health, operations, and creditworthiness, enabling lenders to assess the risk associated with providing financing. Properly prepared small business loan documentation is crucial for several …

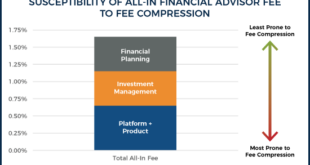

Read More »Unveiling the Investment Advisory Edge: Discoveries and Insights

Investment advisory firms provide financial advice and investment management services to individuals and institutions. They offer a range of services, including portfolio management, financial planning, and investment research. Investment advisory firms are typically regulated by government agencies to ensure that they operate in a fair and ethical manner. Investment advisory firms can provide a number of benefits to their clients. …

Read More »Discover Unbeatable Strategies for Online Banking Promotions

Online banking promotions are incentives offered by banks and financial institutions to encourage customers to sign up for or use their online banking services. These promotions can take various forms, such as cash bonuses, gift cards, or discounts on products and services. Online banking promotions are a valuable tool for banks and customers alike. For banks, they can help to …

Read More »Unveiling the Secrets: A Comprehensive Guide to Small Business Loan Applications

A small business loan application process is a series of steps that a small business owner must take in order to apply for a loan. This process can vary depending on the lender, but there are some general steps that are common to most applications. These steps typically include gathering the necessary documentation, completing an application form, and submitting the …

Read More »Unveiling Late Payment Penalties: Your Guide to Avoid Costly Surprises in Business Loans

Late payments on business loans often result in penalties, which can significantly impact a company’s financial health. These penalties vary depending on the lender and the specific loan agreement, but they typically range from a flat fee to a percentage of the overdue amount. Late payment penalties are designed to discourage borrowers from falling behind on their payments and to …

Read More »Unlock the Secrets of Wealth Management with Registered Investment Advisors (RIAs)

Registered investment advisors (RIAs) are financial professionals who provide personalized investment advice and portfolio management services to individuals and institutions. RIAs are required to register with the U.S. Securities and Exchange Commission (SEC) or with state securities regulators, and they must adhere to a fiduciary duty, which means they are legally obligated to act in the best interests of their …

Read More »Unveiling Business Loan Closing Costs: Unlocking Savings and Clarity

Business loan closing costs are the expenses associated with obtaining a business loan. These costs can include loan origination fees, appraisal fees, attorney fees, and title insurance. Business loan closing costs are important because they can impact the overall cost of your loan. It is important to factor these costs into your budget when you are considering taking out a …

Read More »Uncover the Secrets to Financial Success with Certified Financial Planners (CFPs)

Certified financial planners (CFPs) are professionals who have met certain education, experience, and ethical requirements and have passed a rigorous examination. CFPs are committed to providing their clients with objective, ethical, and professional financial advice that is in the best interests of their clients. CFPs can help individuals and families with a wide range of financial planning needs, including retirement …

Read More »Unlocking the Secrets of Online Banking Offers: Discoveries and Insights Await

Online banking offers refer to the various promotions and incentives provided by banks to encourage customers to use their online banking services. These offers can include sign-up bonuses, cash back rewards, and discounts on banking fees. Online banking offers can be a great way to save money and get rewarded for using your bank’s online services.

Read More »Unlock the Secrets of Small Business Loan Approval: A Journey to Funding Success

Small business loans are crucial for entrepreneurs and small business owners seeking capital to start or expand their operations. The approval process for these loans typically involves a thorough review of the business’s financial health, creditworthiness, and repayment ability. Lenders assess various factors during the approval process, including the business plan, financial statements, credit history, and collateral. They evaluate the …

Read More »Small Business Loan Payments: Unlocking Financial Insights for Growth

Small business loans are a crucial form of financing that can empower entrepreneurs and small business owners to start, expand, or sustain their operations. These loans are designed to meet the specific needs of small businesses, providing access to capital that might not be readily available through traditional lending channels. Small business loan payments, therefore, represent the regular installments made …

Read More »Uncover the Secrets of Financial Success with Independent Financial Advisors

Independent financial advisors are financial professionals who provide personalized financial advice to individuals and families, tailored to their unique financial situations and goals. Unlike brokers or agents who are tied to specific financial products or companies, independent financial advisors have a fiduciary duty to act in the best interests of their clients, providing unbiased and objective advice. Independent financial advisors …

Read More »Unlock the Secrets of Business Loan Origination Fees: A Path to Financing Success

When securing a business loan, borrowers may encounter a fee known as a “business loan origination fee.” This fee compensates the lender for the administrative and underwriting costs associated with processing and approving the loan application. The origination fee is typically calculated as a percentage of the loan amount, ranging from 1% to 5%. For instance, if a business borrows …

Read More »Unveil the Secrets: Online Banking Interest Rates Decoded

Online banking interest rates refer to the interest rates offered by banks on deposits made through online banking platforms. These rates can vary depending on the bank, the type of account, and the current economic climate. Online banking interest rates offer a number of benefits over traditional brick-and-mortar banking. First, they are often higher than the rates offered by traditional …

Read More »Unlock the Secrets of Business Loan Fees: Uncover Hidden Costs and Maximize Savings

Business loan fees and charges are costs associated with obtaining and maintaining a business loan. These may encompass origination fees, underwriting fees, closing costs, and ongoing charges such as maintenance fees or late payment penalties. Understanding business loan fees and charges is crucial for businesses seeking financing as they can significantly impact the overall cost of borrowing. Carefully evaluating and …

Read More »Unveiling the Secrets of Fee-Only Investment Advisors

Fee-only investment advisors are financial professionals who provide investment advice to clients on a fee-only basis. This means that they do not receive any commissions or other incentives from the sale of financial products. As a result, fee-only advisors are able to provide objective advice that is in the best interests of their clients. Fee-only investment advisors typically charge a …

Read More »Unlocking the Secrets of Small Business Loan Risks: A Guide to Informed Decisions

A small business loan risk is a potential loss that a lender may face when providing a loan to a small business. These risks can include the possibility that the business will not be able to repay the loan, that the business will fail, or that the value of the business’s assets will decline. Small business loans are an important …

Read More »Uncover the Secrets: Online Banking Charges Unveiled!

Online banking charges refer to the fees levied by banks for using their online banking services. These charges may vary depending on the bank, the type of account, and the specific services used. Common types of online banking charges include monthly maintenance fees, transaction fees, and overdraft fees. Online banking charges can be a significant expense for businesses and individuals …

Read More »Unveiling the Secrets of Business Loan Interest Rate Negotiation

Business loan interest rate negotiation involves discussing and potentially reducing the interest rate on a business loan. This can be a crucial step for businesses seeking financing, as even a small reduction in the interest rate can lead to significant savings over the life of the loan. There are several benefits to negotiating a lower interest rate on a business …

Read More » Ini Balikpapan All about Banking Finance

Ini Balikpapan All about Banking Finance