Mobile banking app security refers to the protective measures implemented within mobile banking applications to safeguard user data and financial transactions. These measures aim to prevent unauthorized access, protect sensitive information, and ensure the integrity of banking operations conducted through mobile devices. Mobile banking apps have become increasingly popular, offering convenience and accessibility for managing finances on the go. However, …

Read More »Andy Coleman

Unlock the Secrets: Unraveling Home Equity Loan Payments

Home equity loan payments are a type of loan that allows homeowners to borrow money against the equity they have built up in their homes. The amount of money that can be borrowed is typically based on the home’s appraised value and the amount of outstanding mortgage debt. Home equity loan payments are typically made monthly and are calculated based …

Read More »Unleash Your Financial Power: Discover the Secrets of Mobile Banking App Notifications

Mobile banking app notifications are alerts sent by a financial institution to a customer’s mobile device to inform them about account activity, such as deposits, withdrawals, and payments. These notifications can be customized to the customer’s preferences and can be sent via text message, email, or push notification. Mobile banking app notifications provide several benefits to customers. They can help …

Read More »Uncover Hidden Risks of Home Equity Loans: A Comprehensive Guide

Home equity loans or second mortgages are secured loans that use your home equity as collateral. Home equity loans are popular because they offer lower interest rates than personal loans. However, there are some risks associated with home equity loans that you should be aware of before you take one out. Importance of Understanding Home Equity Loan Risks

Read More »Unlock the Power of Mobile Banking Alerts: Discoveries and Insights Revealed

Mobile banking app alerts are notifications sent by a bank or financial institution through a mobile banking app to inform customers about account activity, potential fraud, and other important updates. These alerts can be customized to the customer’s preferences, allowing them to receive notifications for specific types of transactions, such as deposits, withdrawals, or balance changes. Mobile banking app alerts …

Read More »Unveil the Hidden Truths: Home Equity Loan Pitfalls Revealed

Home equity loan disadvantages refer to the potential drawbacks and risks associated with this type of loan, which allows homeowners to borrow against the equity they have built up in their property. These loans are secured by the home itself, meaning that if the borrower defaults on the loan, the lender can foreclose on the property. There are several key …

Read More »Unlock the Secrets: Home Equity Loan Advantages You Never Imagined

A home equity loan is a type of secured loan that allows homeowners to borrow money against the equity they have built up in their homes. Home equity loans can be used for a variety of purposes, such as home improvements, debt consolidation, or education expenses. They typically have lower interest rates than personal loans, but they also come with …

Read More »Unlock Financial Freedom: Discover the Secrets of Mobile Banking App Budgeting

Mobile banking applications have revolutionized personal finance management by allowing users to track their spending, create budgets, and manage their accounts from their smartphones. The budgeting feature in these apps is particularly useful as it helps users categorize their expenses, set financial goals, and monitor their progress towards those goals. The importance of mobile banking app budgeting cannot be overstated. …

Read More »Uncover the Transformative Power of Mobile Banking App Bill Pay

Mobile banking app bill pay is a service that allows users to pay their bills electronically using a mobile banking app. This can be a convenient and efficient way to manage finances, as it eliminates the need to write checks or visit a bank in person. There are many benefits to using mobile banking app bill pay. First, it is …

Read More »Unlock Hidden Gems: Surprising Home Equity Loan Benefits Revealed!

A home equity loan is a type of secured loan that allows homeowners to borrow money against the equity they have built up in their homes. Home equity loans can be used for a variety of purposes, such as home improvements, debt consolidation, or education expenses. There are many benefits to taking out a home equity loan. Home equity loans …

Read More »Unlock Smart Borrowing: Unraveling Home Equity Loan Offers

Home equity loan offers are a type of loan that allows homeowners to borrow money against the equity they have built up in their homes. This can be a great way to access cash for a variety of purposes, such as home renovations, debt consolidation, or education expenses. Home equity loan offers typically have lower interest rates than personal loans …

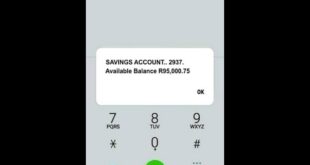

Read More »Uncover the Secrets of Mobile Banking App Balance Checks

A mobile banking app balance check is a feature offered by many banks and credit unions that allows customers to view their account balances and transaction history on their mobile devices. This service is typically accessed through a mobile banking app, which can be downloaded from the app store associated with the customer’s mobile device. Mobile banking app balance checks …

Read More »Unveiling the Secrets: Mobile Banking App Withdrawals Unveiled

Mobile banking app withdrawals refer to the process of taking out money from a bank account using a mobile banking app. This method of withdrawal has become increasingly popular due to its convenience and accessibility, allowing users to access their funds 24/7 from anywhere with an internet connection. Mobile banking app withdrawals offer several advantages over traditional methods. They are …

Read More »Uncover the Secrets of Home Equity Loan Preapproval: A Guide to Homeownership Success

Home equity loan preapproval is a conditional commitment from a lender to extend a home equity loan up to a specified amount, subject to the home appraisal and the borrower’s financial situation remaining the same. It involves a preliminary assessment of the borrower’s creditworthiness, income, and property value. Preapproval can strengthen a home offer and provide peace of mind during …

Read More »Uncover the Secrets of Mobile Banking App Deposits: Game-Changing Insights

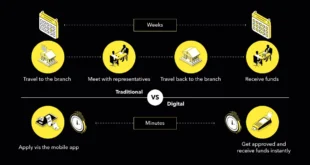

Mobile banking app deposits refer to the feature offered by banking institutions that allows customers to deposit checks or cash into their accounts using a mobile banking app. This innovation has revolutionized banking by providing convenience, security, and time-saving benefits. Customers can make deposits anytime, anywhere, without visiting a physical bank branch. It eliminates the need to carry physical checks, …

Read More »Unravel the Secrets of Home Equity Loan Repayment: Discoveries and Insights

Home equity loan repayment refers to the gradual settlement of a loan secured against the equity in a residential property. This type of loan allows homeowners to borrow against the difference between the current market value of their home and the amount they still owe on their mortgage. Home equity loans can be a valuable source of financing for various …

Read More »Unveil the Hidden Truths: Home Equity Loan Fees Demystified

Home equity loan fees are charges associated with obtaining a home equity loan, a type of secured loan that allows homeowners to borrow against the equity they have built up in their homes. These fees can include application fees, appraisal fees, origination fees, lender fees, and other closing costs. These fees can vary depending on the lender, the loan amount, …

Read More »Unlock the Secrets of Mobile Banking App Transfers: Discoveries & Insights

Mobile banking app transfers refer to the electronic transfer of funds between bank accounts using a mobile banking application. These transfers can occur within the same bank or between different banks, enabling users to send and receive money conveniently from their mobile devices. Mobile banking app transfers offer a range of advantages. They provide a secure and efficient way to …

Read More »Uncover the Secrets: Mobile Banking App Payments Unveiled

Mobile banking app payments refer to financial transactions conducted through mobile banking applications on smartphones or other mobile devices. These payments enable users to send and receive money, pay bills, and manage their finances conveniently and securely from anywhere with an internet connection. Mobile banking app payments offer numerous advantages over traditional payment methods. They provide convenience, as users can …

Read More »Unveiling the Secrets of Home Equity Loan Eligibility

Home equity loan eligibility refers to the criteria that a borrower must meet in order to qualify for a home equity loan, which is a type of secured loan that is backed by the borrower’s home equity. Lenders will typically consider factors such as the borrower’s credit score, debt-to-income ratio, and the amount of equity that the borrower has in …

Read More » Ini Balikpapan All about Banking Finance

Ini Balikpapan All about Banking Finance