Home equity loan limits are maximum amounts that you can borrow against the equity in your home. The limit is based on a percentage of your home’s appraised value, typically 80% to 90% for first mortgages and 80% or less for second mortgages. For example, if your home is appraised at $200,000, you may be able to borrow up to …

Read More »Andy Coleman

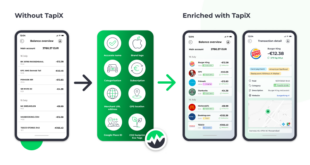

Unleash the Power of Mobile Banking App Transactions: Uncover Hidden Insights

Mobile banking app transactions refer to financial transactions conducted through a mobile banking application on a smartphone or tablet. These transactions encompass a wide range of banking activities, including account balance inquiries, fund transfers, bill payments, check deposits, and more. Mobile banking app transactions offer numerous advantages, including convenience, accessibility, and security. They allow users to manage their finances from …

Read More »Discover the Secrets of Mobile Banking App Navigation

Mobile banking app navigation refers to the user interface design and functionality that allows users to interact with their mobile banking apps. It encompasses the layout, menus, buttons, and other elements that enable users to access and manage their financial accounts, perform transactions, and utilize various banking services through their mobile devices. Effective mobile banking app navigation is crucial for …

Read More »Discover Home Equity Loan Secrets for Guaranteed Approval

Home equity loan approval refers to the process of getting a loan against the equity you have built up in your home. It entails meeting certain criteria set by lenders to determine your eligibility for the loan. These criteria often include factors like your credit score, debt-to-income ratio, and the amount of equity you have in your home. Home equity …

Read More »Unveiling the Secrets of Mobile Banking App Interfaces: A Comprehensive Guide to Enhance Usability, Security, and Innovation

A mobile banking app interface is the user interface of a mobile banking app. It allows users to access their bank accounts and perform various banking transactions using a mobile device, such as a smartphone or tablet. A well-designed mobile banking app interface should be easy to use, intuitive, and visually appealing. It should also be secure and protect users’ …

Read More »Unveiling the Secrets of Home Equity Loans: A Comprehensive Guide to Qualifications

Home equity loan qualifications refer to the criteria that lenders use to assess an applicant’s eligibility for a home equity loan. These qualifications typically include factors such as the applicant’s credit score, debt-to-income ratio, and the amount of equity they have in their home. Qualifying for a home equity loan can be important for homeowners who need to access cash …

Read More »Unlock the Secrets of Effortless Banking: Discover the Power of Easy-to-Use Banking Apps

In today’s digital age, easy-to-use banking apps are essential for managing finances on the go. These apps allow users to check account balances, transfer funds, deposit checks, and pay bills, all from the convenience of their smartphones or tablets. Easy-to-use banking apps offer a number of benefits over traditional banking methods. First, they are more convenient. Users can access their …

Read More »Unveiling the Secrets: A Comprehensive Guide to Home Equity Loan Applications

A home equity loan application is a request for a loan that is secured by the equity in your home. The equity in your home is the difference between the value of your home and the amount you owe on your mortgage. Home equity loans can be used for a variety of purposes, such as home improvements, debt consolidation, and …

Read More »Unlock the Power of Fast Mobile Banking: Discoveries and Insights

Fast mobile banking apps are a type of financial software designed to make banking more convenient and accessible to users. They allow users to conduct a variety of banking transactions from their mobile devices, including checking balances, transferring funds, paying bills, and depositing checks. Fast mobile banking apps offer a number of benefits over traditional banking methods. They are more …

Read More »Unlock Hidden Truths: Home Equity Loan Closing Costs Decoded

When you take out a home equity loan or a second mortgage, you’re borrowing against the equity you have in your home. In addition to the interest you’ll pay on the loan, you’ll also have to pay closing costs. These costs can add up to several thousand dollars, so it’s important to factor them into your budget when you’re considering …

Read More »Discover the Secrets of Reliable Mobile Banking: Unlocking Financial Freedom

Reliable mobile banking apps allow users to manage their finances conveniently and securely from their smartphones or tablets. These apps offer a range of features, including account balances, transaction history, bill payments, and mobile check deposits. Mobile banking apps provide several benefits over traditional banking methods. They are more convenient, as users can access their accounts 24/7 from anywhere with …

Read More »Unlock Home Equity Secrets: Discover Hidden Opportunities with Refinancing

A home equity loan refinance is a type of secured loan that allows homeowners to borrow money against the equity they have built up in their homes. This can be a great way to access cash for large expenses, such as home renovations, debt consolidation, or education costs. Home equity loans typically have lower interest rates than personal loans and …

Read More »Discover the Transformative Power of Innovative Banking Apps

Innovative banking apps utilize cutting-edge technologies to enhance the traditional banking experience, offering convenience, efficiency, and personalized services to users. These apps leverage advancements in mobile technology, artificial intelligence, and data analytics to provide a wide range of benefits, including real-time account monitoring, secure and seamless transactions, personalized financial advice, and access to a suite of financial management tools. Historically, …

Read More »Unlock Home Equity Secrets: Home Equity Loans vs. HELOCs

A home equity loan and a home equity line of credit (HELOC) are both ways to borrow money using your home as collateral. However, there are some key differences between the two options. A home equity loan is a lump sum loan that is secured by your home. The interest rate on a home equity loan is typically fixed, and …

Read More »Uncover the Secrets of Convenient Banking Apps: A Revolutionary Guide

Convenient banking apps are mobile applications that allow users to access and manage their finances from anywhere at any time. These apps offer a range of services, including account management, bill pay, mobile check deposit, and even personal financial management tools. There are many benefits to using convenient banking apps. They can save you time and money, and they can …

Read More »Unlock Secrets and Insights: Your Guide to Home Equity Loan Interest Rates

Home equity loan interest rates refer to the interest charged on loans secured by a borrower’s home equity. Home equity is the difference between the current market value of a home and the amount owed on the mortgage. Home equity loans can be used for various purposes, such as home improvements, debt consolidation, or education expenses. The interest rate on …

Read More »Unveil the Secrets: A Deep Dive into Home Equity Loan Terms

Home equity loan terms refer to the conditions and stipulations associated with a home equity loan, a type of secured loan that allows homeowners to borrow against the equity they have built up in their property. Understanding home equity loan terms is crucial for making informed decisions about borrowing. These terms outline essential details such as the loan amount, interest …

Read More »Unlock the Secrets of User-friendly Banking Apps: Insights and Innovations

In today’s digital age, user-friendly banking apps have become essential for managing finances conveniently and efficiently. These apps provide a range of features and services that make banking accessible and intuitive for users of all levels. The importance of user-friendly banking apps cannot be overstated. They offer numerous benefits that enhance the banking experience. These apps provide real-time account information, …

Read More »Unlock Home Equity's Power: Unveil the Secrets of Home Equity Loans

A home equity loan process allows homeowners to borrow money against the equity they have built up in their homes. Home equity loans can be used for a variety of purposes, such as consolidating debt, making home improvements, or paying for college. They can be a good option for homeowners who have built up a significant amount of equity in …

Read More »Unlock the Secrets of Mobile Banking App Setup: A Guide to Digital Banking Mastery

Definition: Mobile banking app setup refers to the process of installing and configuring a mobile banking application on a smartphone or other mobile device. This typically involves downloading the app from an app store, creating an account, and linking it to a user’s bank account. Importance and Benefits: Mobile banking apps offer numerous benefits to users, including convenience, security, and …

Read More » Ini Balikpapan All about Banking Finance

Ini Balikpapan All about Banking Finance