Small business loan default solutions offer a lifeline to businesses that are struggling to repay their loans. These solutions can include loan modifications, forbearance, and debt forgiveness. By working with a lender, businesses can explore options to avoid default and get back on track. Small business loans are an important source of financing for small businesses. However, businesses may default …

Read More »John Dealove

Unlock Lucrative Rewards: A Comprehensive Guide to Online Banking Tiers

Online banking reward tiers are programs offered by banks that allow customers to earn rewards for using their online banking services. These rewards can vary depending on the bank and the tier level, but they typically include things like cash back, points, and miles. Some banks also offer exclusive perks to customers in higher tiers, such as access to special …

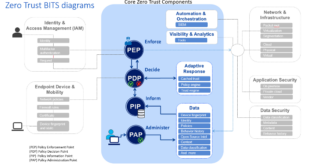

Read More »Unveiling Business Loan Access Controls: A Gateway to Growth and Risk Mitigation

Business loan access controls refer to the policies and procedures that financial institutions implement to manage and mitigate the risks associated with lending money to businesses. These controls are designed to ensure that loans are made to creditworthy borrowers, that the terms of the loans are appropriate, and that the loans are properly documented and monitored. Business loan access controls …

Read More »Unlock the Secrets of Wealth Creation: Discover the Power of Wealth Visualization

Wealth visualization exercises are a form of meditation that involves imagining oneself as wealthy and successful. These exercises can be used to improve one’s financial mindset and to attract more abundance into one’s life. There are many different ways to practice wealth visualization exercises. One simple technique is to sit in a comfortable place and close your eyes. Then, imagine …

Read More »Ensuring Trust and Security: Exploring Business Loan Authentication Methods

Business loan authentication methods are processes that lenders use to verify the identity of borrowers and the legitimacy of their loan applications. This is important to reduce the risk of fraud and protect lenders from financial losses.There are a variety of business loan authentication methods that lenders may use, including:

Read More »Discover the Secrets of Online Banking Loyalty Points

Online banking loyalty points are rewards offered by banks to their customers for using their online banking services. These points can be earned through various activities such as making online transactions, paying bills, or maintaining a certain account balance. Customers can redeem these points for a variety of rewards, including cash back, gift cards, travel miles, and merchandise. Online banking …

Read More »Unleash Hidden Insights and Unlock Default-Free Small Business Loans

Small business loan default assistance programs are designed to help small businesses avoid defaulting on their loans. These programs can provide financial assistance, technical assistance, and other resources to help businesses get back on track. Small business loan default assistance programs are typically offered by government agencies or non-profit organizations. Small business loan default assistance programs can be a valuable …

Read More »Unlock Abundance: Discover the Secrets to a Wealthy Mindset

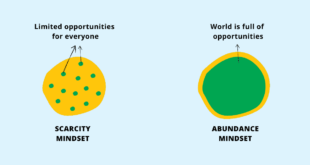

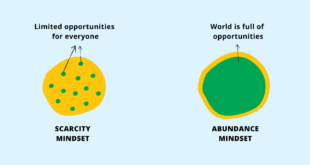

Abundance mindset development is a practice that involves shifting one’s mindset from a scarcity mindset to an abundance mindset. A scarcity mindset is characterized by the belief that there are not enough resources to go around, while an abundance mindset is characterized by the belief that there are more than enough resources for everyone. Developing an abundance mindset can have …

Read More »Unlock the Secrets of Online Banking Rewards Points: Discover Unbelievable Savings and Perks

Online banking rewards points are a type of loyalty program offered by banks to their customers. These points are typically earned when customers use their debit or credit cards for purchases, and can be redeemed for a variety of rewards, such as cash back, gift cards, or travel miles. There are many benefits to using online banking rewards points. For …

Read More »Unlock the Secrets of Business Loan Encryption: Uncover Security and Compliance

Business loan encryption standards refer to the security measures employed to protect sensitive information exchanged during business loan transactions. These standards ensure that data such as loan applications, financial statements, and personal information remain confidential and protected from unauthorized access or interception. Encryption algorithms and protocols are implemented to safeguard data during transmission and storage, adhering to industry-recognized guidelines and …

Read More »Unveiling Hidden Options: A Path to Overcome Small Business Loan Default

Small business loan default options refer to the various courses of action available to a small business owner who is unable to repay their loan. These options may include negotiating a payment plan with the lender, seeking loan forgiveness, or filing for bankruptcy. Exploring small business loan default options is crucial for business owners facing financial distress. Understanding the available …

Read More »Unlock Wealth Secrets: Discover Proven Manifestation Techniques

Wealth manifestation techniques are practices used to attract wealth and abundance into one’s life. These techniques are based on the belief that we can use our thoughts, emotions, and actions to create the reality we desire. There are many different wealth manifestation techniques, but some of the most common include:

Read More »Unlock the Secrets of Business Loan Security: Uncover Hidden Opportunities

When a business applies for a loan, the lender will typically require some form of security to protect its investment. This security can take a variety of forms, such as a lien on the business’s assets, a personal guarantee from the business owner, or a pledge of collateral. Business loan security protocols are the procedures and policies that lenders use …

Read More »Discover the Secrets of Wealth: Unlock Your Abundance Mindset

Wealth mindset coaching is a type of coaching that helps individuals develop a positive and abundant mindset about money and wealth. It is based on the idea that our thoughts, beliefs, and attitudes about money can have a significant impact on our financial success. Wealth mindset coaching can help individuals overcome negative beliefs about money, such as the belief that …

Read More »Unlock Default Prevention Secrets: Game-Changing Insights for Small Business Loans

Small business loan default prevention encompasses strategies and measures implemented by lenders and businesses to minimize the risk of a small business failing to repay its loan. It involves assessing the creditworthiness of borrowers, establishing clear loan terms and conditions, and providing ongoing support to businesses to ensure their financial stability. Default prevention is crucial for both lenders and small …

Read More »Uncover the Secrets of Online Banking Birthday Rewards

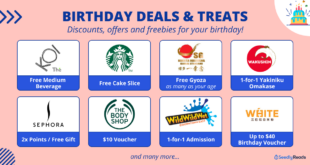

Online banking birthday rewards are incentives or perks offered by banks or financial institutions to their customers on their birthdays. These rewards can vary widely, ranging from cash bonuses to discounts on products and services. The primary purpose of online banking birthday rewards is to foster customer loyalty and appreciation, encouraging individuals to continue using the bank’s services. The importance …

Read More »Unlock Exclusive Perks: Discover the Secrets of Online Banking Anniversary Offers

Online banking anniversary offers are promotions and incentives provided by banks to celebrate the anniversary of their online banking services. These offers can include bonuses, discounts, and other perks for customers who sign up for or use online banking during the anniversary period. Online banking anniversary offers are important because they can help banks attract new customers and encourage existing …

Read More »Unlock the Secrets of Emotionally Intelligent Investing: Discoveries and Insights for Wealth Management

Emotionally intelligent investing is an investment approach that emphasizes the role of emotions in investment decision-making. Traditional investment approaches often focus solely on financial data and analysis, but emotionally intelligent investing recognizes that emotions can significantly impact investment behavior and outcomes. Emotionally intelligent investors are aware of their own emotions and how they can influence their investment decisions. They also …

Read More »Unveiling the Perils: A Deep Dive into Small Business Loan Default Consequences

When a small business fails to repay a loan, it is considered a loan default. The consequences of defaulting on a small business loan can be severe, both for the business and the owner. One of the most immediate consequences of default is that the lender will likely demand immediate repayment of the entire loan amount, plus any accrued interest …

Read More »Unlock the Secrets: Business Loan Confidentiality Agreements Unveiled

A business loan confidentiality agreement is a legal contract between a lender and a borrower that outlines the terms of confidentiality for the loan application and approval process. This agreement is important because it protects the borrower’s sensitive financial information from being disclosed to third parties without their consent. Business loan confidentiality agreements typically include provisions that restrict the lender …

Read More » Ini Balikpapan All about Banking Finance

Ini Balikpapan All about Banking Finance