Online banking holiday deals refer to special promotions and discounts offered by banks during holiday periods, typically around major holidays such as Christmas, Thanksgiving, and Black Friday. These deals may include reduced interest rates on loans, higher interest rates on savings accounts, and cash bonuses for new account openings. Online banking holiday deals can be a great way to save …

Read More »John Dealove

Unlock the Secrets of Business Loan Privacy Policies

A business loan privacy policy is a legal document that outlines how a lender will collect, use, and protect the personal and financial information of its loan applicants and borrowers. This information may include name, address, Social Security number, income, and credit history. Lenders are required by law to have a privacy policy in place, and borrowers should carefully review …

Read More »Unlock Financial Clarity: Discover the Secrets of Sound Decision-Making

Financial decision-making support encompasses a comprehensive range of services and technologies designed to assist individuals and organizations in making sound financial decisions. These services may include financial planning, investment advice, risk management, and tax planning, among others. By leveraging financial decision-making support, individuals can gain valuable insights into their financial situation, identify opportunities for growth, and mitigate potential risks. The …

Read More »Discover the Hidden Truths About Small Business Loan Default: Unveiling Insights for Success

What is a small business loan default? A small business loan default occurs when a small business fails to make its loan payments on time or fails to meet other loan obligations, such as providing financial statements or maintaining adequate insurance coverage. When a small business defaults on its loan, the lender may take legal action to collect the debt, …

Read More »Unlock the Secrets: Small Business Cosigner Release Unraveled

A small business loan cosigner release is a legal document that releases a cosigner from their obligation to repay a loan if the primary borrower defaults. Cosigners are typically required when a small business owner does not have sufficient credit history or collateral to qualify for a loan on their own. A cosigner release can be requested once the primary …

Read More »Unveiling the Secrets: Business Loan Data Protection Insights

Business loan data protection refers to the security measures and protocols implemented to safeguard sensitive information related to business loan applications, approvals, and repayments. This includes protecting data from unauthorized access, disclosure, modification, or destruction. Protecting business loan data is crucial for several reasons. Firstly, it ensures compliance with regulations and industry standards, which often mandate the secure handling of …

Read More »Discover Unbeatable Banking Perks: Unlocking Seasonal Offers Online

Online banking seasonal offers encompass limited-time promotions and incentives provided by financial institutions through their online banking platforms. These offers are designed to attract new customers, encourage existing customers to use their online banking services more frequently, and promote specific financial products or services. Seasonal offers can vary widely but often include cash bonuses, discounts on loan rates, higher interest …

Read More »Uncover Hidden Truths: Behavioral Finance Workshops for Smarter Investing

Behavioral finance workshops delve into the study of how psychological factors influence financial decision-making. These workshops are not just academic exercises; they are designed to help participants understand and apply behavioral finance principles to their own financial lives and professional settings. Behavioral finance workshops are important because they can help participants make better financial decisions. By understanding the psychological biases …

Read More »Uncover the Hidden Truths: Small Business Loan Cosigner Responsibilities Revealed

When a small business applies for a loan, they may need a cosigner to guarantee the debt. A cosigner is someone who agrees to repay the loan if the business cannot. This can be a risky proposition for the cosigner, so it is important to understand the responsibilities involved. As a cosigner, you are legally obligated to repay the loan …

Read More »Unlock the Secrets of Smarter Investing: Behavioral Investing Strategies

Behavioral investing strategies involve making investment decisions based on an understanding of human behavior and psychology. It recognizes that investors are not always rational actors and that their emotions and cognitive biases can influence their investment decisions. Behavioral investing strategies can help investors avoid common pitfalls such as overconfidence, anchoring bias, and the disposition effect. By understanding these biases, investors …

Read More »Unveiling the Secrets: Empowering Business Loans with Cybersecurity

Cybersecurity measures are safeguards implemented by businesses to protect their information systems, networks, and data from unauthorized access, use, disclosure, disruption, modification, or destruction. In the context of business loans, cybersecurity measures are particularly important as they help protect sensitive financial information and prevent fraud. There are a number of different types of cybersecurity measures that businesses can implement, including:

Read More »Unveiling a Treasury of Online Banking Special Promotions: Discoveries and Insights Await

Online banking special promotions are incentives offered by banks to attract new customers or encourage existing customers to use their online banking services. These promotions can take various forms, such as sign-up bonuses, cash back rewards, or discounts on banking fees. Online banking special promotions can be a great way to save money on banking fees and earn rewards for …

Read More »Unlock Exclusive Savings: Discover the Power of Online Banking Limited-Time Offers

Online banking limited-time offers are promotions offered by banks for a specific period of time to encourage customers to use their online banking services. These offers may include cash bonuses, discounts on products and services, and other incentives. Online banking limited-time offers can be a great way to save money and get rewarded for using your bank’s online services. However, …

Read More »Unveiling the Secrets: Business Loan Fraud Prevention

Business loan fraud prevention is the practice of safeguarding financial institutions from fraudulent loan applications and protecting borrowers from falling victim to predatory lending practices. It involves verifying the identity of loan applicants, assessing their creditworthiness, and scrutinizing loan applications for any signs of falsification or misrepresentation. Business loan fraud prevention is crucial because it helps lenders make informed decisions …

Read More »Unlock the Secrets of Small Business Loan Cosigner Requirements

When a small business applies for a loan, the lender will often ask for a cosigner. A cosigner is someone who agrees to repay the loan if the business cannot. This can be a helpful way for businesses to get approved for a loan, but it’s important to understand the requirements for cosigners. In general, cosigners must have good credit …

Read More »Uncover Market Insights: Unlock Profits with Sentiment Analysis

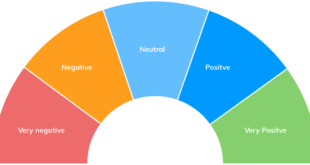

Market sentiment analysis is a technique in the finance industry that measures collective investor sentiment on the financial markets. It involves studying different sources of data such as news articles, social media feeds, and trading activity to gain insights into the overall market sentiment. Sentiment analysis is used to predict market trends and make informed investment decisions. By understanding the …

Read More »Unlock Hidden Savings: Discover Exclusive Online Banking Perks

Online banking exclusive offers are promotions and discounts offered exclusively to customers who bank online. These offers can include cash back, discounts on products and services, and other perks. Many banks offer these exclusive offers as a way to attract and retain customers. There are many benefits to taking advantage of online banking exclusive offers, such as:

Read More »Unveiling the Secrets of Investor Behavior: Uncover the Hidden Forces Shaping Investment Decisions

Investor behavior analysis is the study of how investors make decisions. It seeks to understand the psychological, cognitive, and emotional factors that influence investment choices. Investor behavior analysis is important because it can help investors make better decisions. By understanding the factors that influence their behavior, investors can avoid making costly mistakes. Additionally, investor behavior analysis can help financial advisors …

Read More »Unlock the Power of Business Loan Documentation Management: Discoveries and Insights

Business loan documentation management refers to the systematic process of organizing, storing, and managing loan-related documents throughout the loan lifecycle. It involves capturing, classifying, indexing, and storing loan documents in a secure and easily accessible manner, ensuring their integrity and facilitating efficient retrieval when needed. For instance, a well-structured documentation management system enables lenders to quickly locate loan agreements, financial …

Read More »Unlock the Secrets of Small Business Loan Cosigners

A cosigner is someone who agrees to repay a loan if the primary borrower defaults. Cosigners are often required for small business loans, especially if the business is new or has a poor credit history. Cosigners can be friends, family members, or even business partners. There are several benefits to having a cosigner on a small business loan. First, it …

Read More » Ini Balikpapan All about Banking Finance

Ini Balikpapan All about Banking Finance