Business loan audit procedures refer to the systematic review and assessment of a business loan to ensure its compliance with applicable regulations and adherence to prudent lending practices. Auditors examine financial statements, loan documentation, and other relevant records to evaluate the loan’s eligibility, creditworthiness of the borrower, and the lender’s adherence to internal policies and external regulations. These procedures are …

Read More »John Dealove

Unlock the Secrets of Personal Guarantees for Small Business Loans

A personal guarantee for a small business loan is a legal document in which the owner of a business promises to repay the loan if the business is unable to do so. This type of guarantee is often required by lenders as a way to reduce their risk in the event of a default. There are a number of factors …

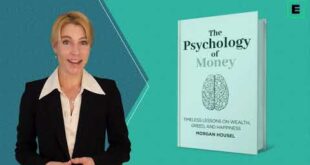

Read More »Unlock Your Cognitive Edge: Discoveries and Insights in Bias Awareness

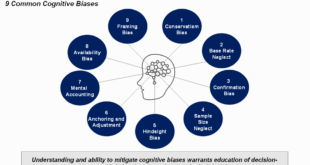

Cognitive biases awareness refers to the understanding and recognition of the systematic errors in thinking that can lead to irrational judgments and decision-making. It is crucial for individuals to be aware of their own cognitive biases, as these can have a significant impact on their thoughts, feelings, and behaviors. By understanding the different types of cognitive biases and how they …

Read More »Unlock the Secrets: Discover the Best Online Banking Welcome Offers

Online banking welcome offers are financial incentives provided by banks to attract new customers to open an account. These offers typically include cash bonuses, gift cards, or other rewards for completing specific actions, such as making a deposit or setting up direct deposit. Welcome offers can be a great way to save money on banking fees and earn extra cash. …

Read More »Unlock Funding Secrets: The Ultimate Guide to Small Business Loan Collateral

Small business loan collateral requirements refer to the assets or property that a small business must offer as security when applying for a loan. Collateral serves as a form of protection for the lender in case the borrower defaults on the loan, allowing the lender to seize and liquidate the collateral to recover the outstanding debt. Common forms of collateral …

Read More »Unlock Hidden Truths: Behavioral Economics Insights for Wealth Management

Behavioral economics insights are findings from the field of behavioral economics, which combines psychology and economics to understand how people make decisions. These insights have shown that people are not always rational actors, and that our decisions are often influenced by our emotions, biases, and social norms. Behavioral economics insights have important implications for businesses and policymakers. For example, businesses …

Read More »Unlock Financial Clarity: Demystifying Business Loan Reporting Obligations

Business loan reporting obligations refer to the requirement for businesses to disclose information about their loans to regulatory bodies or other relevant parties. This can include details such as the loan amount, interest rate, repayment terms, and purpose of the loan. The specific reporting requirements can vary depending on the jurisdiction and the type of loan. Business loan reporting obligations …

Read More »Discover the Secrets of Online Banking Signup Bonuses

Online banking signup bonuses are financial incentives offered by banks and credit unions to attract new customers. These bonuses typically come in the form of cash, gift cards, or other rewards and are designed to encourage individuals to open new accounts and switch their banking business to a new institution. Online banking signup bonuses have become increasingly common in recent …

Read More »Unlock Exclusive Online Banking Cash Incentives: Discover Hidden Gems and Maximize Your Earnings

Online banking cash incentives are a type of reward offered by banks to encourage customers to open new accounts, or to switch their existing accounts to the bank. These incentives can come in the form of cash bonuses, gift cards, or other rewards.Online banking cash incentives are a great way to save money on banking fees and to earn extra …

Read More »Unveiling the Secrets of Financial Freedom: Discoveries in Financial Therapy

Financial therapy services provide support for individuals and families struggling with financial issues. These services can help address a variety of concerns, including budgeting, debt management, and compulsive spending. Financial therapists can also help clients understand the emotional and psychological factors that can contribute to financial problems. Financial therapy services can be beneficial for people of all ages and backgrounds. …

Read More »Unlock Your Loan Potential: Unveiling the Secrets of Small Business Loan Collateral

Small business loan collateral is an asset or property that a borrower pledges as security for a loan. If the borrower defaults on the loan, the lender can seize and sell the collateral to recoup its losses. Collateral can include real estate, equipment, inventory, or other valuable assets. Collateral is important for small businesses because it reduces the lender’s risk …

Read More »Unlock the Secrets of Business Loan Regulation: A Guide to Compliance and Growth

Business loan regulatory standards refer to the rules and regulations that govern the lending of money to businesses. These standards are put in place to protect both lenders and borrowers by ensuring that all parties involved know what is expected before entering into a loan agreement. Business loan regulatory standards can vary from country to country, but they typically include …

Read More »Unlock the Secrets of Small Business Credit Checks: Your Guide to Uncover Hidden Opportunities

A small business loan credit check is a review of a borrower’s credit history and other financial information to assess their creditworthiness and determine their eligibility for a loan. Lenders use this information to evaluate the risk of lending money to the borrower and to set the interest rate and loan terms. A small business loan credit check is an …

Read More »Uncover the Secrets of Online Banking Rebates: Your Guide to Savings and Rewards

Online banking rebates are financial incentives offered by banks and credit unions to encourage customers to use their online banking services. These rebates can take various forms, such as cash back, discounts, or reduced fees, and are typically tied to specific actions or behaviors, such as signing up for online banking, making a certain number of transactions, or maintaining a …

Read More »Unlock Business Lending Success: Demystifying Compliance Requirements

Business loan compliance requirements are the rules and regulations that businesses must follow when they apply for and receive a loan. These requirements are designed to protect both the lender and the borrower and to ensure that the loan is used for its intended purpose. There are a number of different business loan compliance requirements, but some of the most …

Read More »Unlock the Secrets of Wealth Management: Discoveries in Wealth Psychology Counseling

Wealth psychology counseling is a specialized field that helps individuals and families understand and manage their relationship with money and wealth. It combines principles from psychology, financial planning, and behavioral economics to address the emotional and psychological aspects of wealth management. Wealth psychology counseling can help individuals overcome negative beliefs and behaviors around money, develop healthy financial habits, and make …

Read More »Unlock Unseen Truths: "Small Business Loan Credit Requirements" Revealed

Small business loan credit requirements are the criteria that lenders use to assess the creditworthiness of small businesses. These requirements can vary from lender to lender, but they typically include factors such as the business’s financial history, credit score, and debt-to-income ratio. Meeting small business loan credit requirements is important for several reasons. First, it can help businesses secure the …

Read More »Unlock Business Loan Portfolio Management Secrets for Enhanced Profitability

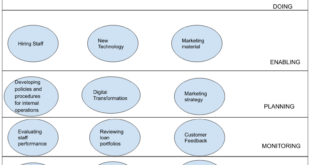

Business loan portfolio management is the process of overseeing a group of business loans. This includes tasks such as underwriting, approving, disbursing, servicing, and collecting on loans. Effective business loan portfolio management is essential for banks and other financial institutions to minimize risk and maximize profitability. There are a number of factors that banks and other financial institutions consider when …

Read More »Unlock the Power of Online Banking Vouchers: Discoveries and Insights

Online banking vouchers are a safe and convenient way to make payments and manage your finances online. They are typically issued by banks and can be used to pay bills, transfer funds, and make purchases online. Online banking vouchers offer a number of advantages over traditional payment methods. They are more secure, as they are not linked to your bank …

Read More »Uncover the Secrets to Smarter Financial Decision-Making with Behavioral Finance Coaching

Behavioral finance coaching is a specialized form of financial coaching that focuses on helping clients understand and manage the psychological factors that can influence their financial decision-making. It is based on the principles of behavioral finance, which is a field of study that examines the cognitive and emotional biases that can lead to irrational financial behavior. Behavioral finance coaching can …

Read More » Ini Balikpapan All about Banking Finance

Ini Balikpapan All about Banking Finance