Online banking cashback offers are incentives provided by banks to encourage customers to use their online banking services. These offers typically take the form of a percentage of money back on purchases made using the bank’s online platform. Cashback offers can be a valuable way to save money on everyday purchases. They can also help to offset the fees associated …

Read More »John Dealove

Unlock the Secrets of Business Loan Risk Assessment for Success

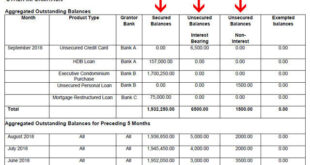

Business loan risk assessment is the process of evaluating the creditworthiness of a business loan applicant. This involves assessing the business’s financial health, management team, and industry outlook. Business loan risk assessment is important because it helps lenders make informed decisions about whether or not to approve a loan. It also helps businesses understand their own financial risks and take …

Read More »Empowering Financial Freedom: Discover the Transformative Power of Wellness Programs

Financial wellness programs empower individuals to take control of their financial lives and achieve long-term financial well-being. They encompass a wide range of services such as financial education workshops, personalized financial counseling, debt management assistance, and retirement planning. These programs recognize the profound impact financial health has on overall well-being. By equipping individuals with the necessary knowledge, skills, and support, …

Read More »Unveil the Secrets of Small Business Loan Interest Calculation

Small business loan interest calculation is the process of determining the amount of interest that will be charged on a loan borrowed by a small business. This calculation is important because it will affect the total cost of the loan and the monthly payments that the business will be responsible for. There are a number of factors that will affect …

Read More »Unveiling Smart Loan Repayment Strategies for Small Businesses

Small business loan repayment options refer to the various methods available to small business owners for repaying borrowed funds. These options typically involve structured plans with specific terms, interest rates, and repayment schedules tailored to the unique circumstances and financial capabilities of the business. Understanding and selecting the most suitable repayment option is crucial for managing cash flow, minimizing interest …

Read More »Discover the Secrets to Holistic Financial Planning and Unlock Your Financial Future

Holistic financial planning is a comprehensive approach to financial management that considers all aspects of an individual’s financial life. It takes into account not only traditional financial goals like retirement planning and investment management but also factors like estate planning, tax planning, and insurance coverage. The goal of holistic financial planning is to create a financial plan that is tailored …

Read More »Unveil the Power of Online Banking Referral Programs: Unlocking Growth and Rewards

Online banking referral programs incentivize existing customers to refer new customers to a bank or credit union. In exchange for a successful referral, the referrer typically receives a bonus or reward. Online banking referral programs are an important marketing tool for banks and credit unions. They can help to acquire new customers at a lower cost than traditional advertising methods. …

Read More »Uncover the Secrets of Business Loan Litigation Services

Business loan litigation services provide legal representation to businesses involved in disputes related to commercial loans. These disputes can arise from various issues, such as breach of contract, fraud, or loan defaults. Business loan litigation services assist businesses in navigating the complex legal landscape and protecting their interests. Engaging business loan litigation services offers numerous benefits. These services provide businesses …

Read More »Unlock the Secrets of Business Loans: Uncover the Power of Mediation Services

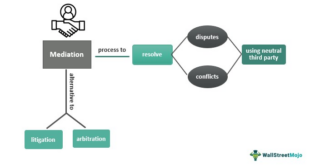

Business loan mediation services provide businesses with assistance in obtaining loans from lenders. These services can be helpful for businesses that do not have the time or expertise to navigate the loan process on their own. Business loan mediation services can help businesses in a number of ways. First, they can help businesses to identify the right lender for their …

Read More »Unveiling the Secrets: A Journey Through Small Business Loan Disbursement

A small business loan disbursement process refers to the steps involved in distributing funds from a lender to a small business borrower after a loan application has been approved. It typically involves several key stages, including loan agreement execution, funding approval, and the actual transfer of funds into the borrower’s business account. The disbursement process plays a crucial role in …

Read More »Unlock the Secrets of Integrated Wealth Management: Discoveries and Insights

Integrated wealth management is a comprehensive approach to financial planning that considers all aspects of a client’s financial situation, including investments, taxes, estate planning, and insurance. By taking an integrated approach, wealth managers can help clients make more informed decisions about their finances and achieve their financial goals more efficiently. For example, an integrated wealth manager might help a client …

Read More »Unveil the Secrets: Unlocking the Power of Online Banking Loyalty Programs

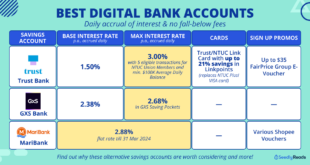

Online banking loyalty programs reward customers for their continued patronage of a particular bank’s online banking services. These programs typically offer points, miles, or cash back for activities such as logging in, making transactions, and referring new customers. Online banking loyalty programs can be a valuable way for banks to attract and retain customers. By offering rewards for everyday banking …

Read More »Unlock the Power of Business Loan Arbitration: Discover Efficient Dispute Resolution Options

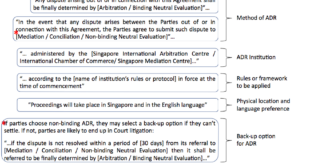

Business loan arbitration options provide a structured process for resolving disputes between businesses and lenders outside of court. Arbitration is a form of alternative dispute resolution (ADR) that involves the use of a neutral third party, known as an arbitrator, to make a binding decision on the dispute. This option can be beneficial for businesses as it is often less …

Read More »Uncover the Secrets: Online Banking Rewards Programs Revealed

Online banking rewards programs incentivize customers to use online banking services by offering rewards such as cash back, points, or miles. These programs are designed to encourage customers to conduct their banking transactions online, which can save banks money on operating costs. Rewards programs can also help banks attract new customers and increase customer loyalty. Online banking rewards programs have …

Read More »Discover the Secrets to Lightning-Fast Small Business Loan Funding

Small business loan funding time refers to the duration of time it takes for a small business to receive funding after applying for a loan. This can vary depending on the lender, the loan amount, and the complexity of the application. However, it is typically in the range of a few days to a few weeks. There are a number …

Read More »Unlock Wealth Secrets: Comprehensive Financial Planning Unveiled

Comprehensive financial planning is a holistic approach to managing your finances that takes into account your entire financial situation, including your income, expenses, assets, and liabilities. It helps you to make informed decisions about how to use your money to achieve your financial goals. Comprehensive financial planning is important because it can help you to:

Read More »Uncover the Secrets of Customized Investment Portfolios: A Guide to Enhanced Returns and Reduced Risks

Customized investment portfolios are tailored to meet the specific needs and goals of individual investors. They consider factors such as risk tolerance, time horizon, and financial situation. Unlike off-the-shelf investment products, customized portfolios can be adjusted to align with an investor’s unique circumstances and preferences. The benefits of customized investment portfolios are numerous. They offer greater flexibility and control over …

Read More »Unveiling the Hidden Truths: Business Loan Bankruptcy Implications

Business loan bankruptcy implications refer to the potential consequences and legal ramifications that businesses may face when they are unable to repay their outstanding business loans and subsequently declare bankruptcy. Bankruptcy can have severe implications for businesses, including the loss of assets, damage to reputation, and difficulty in obtaining future financing. In some cases, business owners may also be held …

Read More »Unveiling the Secrets: A Guide to Small Business Loan Closing Success

The small business loan closing process is the final stage in obtaining a small business loan. It involves the signing of the loan agreement and the disbursement of funds. The closing process can be complex and time-consuming, so it is important to be prepared. There are a number of important steps involved in the small business loan closing process. These …

Read More »Discover Lucrative Online Banking Specials: Unlock Savings & Perks

Online banking specials are promotions offered by banks to attract new customers or encourage existing customers to use their online banking services. These specials can include cash bonuses, free gifts, or discounts on banking fees. Online banking specials can be a great way to save money on your banking needs. By taking advantage of these specials, you can get cash …

Read More » Ini Balikpapan All about Banking Finance

Ini Balikpapan All about Banking Finance