Small business loan deals provide financing and support to small businesses, helping them to start, grow, and operate. These loans come in a variety of forms, such as term loans, lines of credit, and equipment loans, and can be used for a variety of purposes, such as purchasing inventory, expanding operations, or hiring new employees. Small business loan deals often …

Read More »John Dealove

Online Identity Theft Prevention: Uncover the Secrets to Safeguarding Your Digital Identity

Online identity theft prevention refers to the measures taken to safeguard personal information from unauthorized access or misuse over the internet. Identity theft occurs when someone fraudulently obtains and uses another person’s identifying information, such as their name, Social Security number, or credit card information, to commit fraud or other crimes. Given the increasing reliance on online platforms for various …

Read More »Uncover Online Fraud Protection Secrets: Shield Your Finances and Identity

Online fraud protection encompasses a sophisticated set of technologies and strategies employed to safeguard individuals and businesses from various types of digital fraud. These measures aim to detect, prevent, and mitigate fraudulent activities conducted through online platforms, such as e-commerce websites, banking applications, and social media. In the rapidly evolving digital landscape, online fraud protection has become paramount to maintaining …

Read More »Uncover Wealth-Boosting Secrets with Investment Diversification Strategies

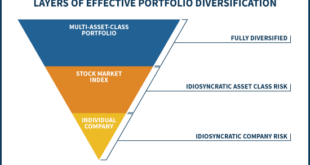

Investment diversification strategies are employed to reduce risk and enhance returns in a portfolio. Diversification involves allocating investments across a variety of asset classes, such as stocks, bonds, real estate, and commodities. By spreading investments across different asset classes, investors can reduce the impact of losses in any one asset class on the overall portfolio. Diversification is an important component …

Read More »Unlock Your Growth: Unraveling the Secrets of the Business Loan Application Process

A business loan application process is a procedure undertaken by a business seeking to obtain a loan from a lender. It typically involves submitting a loan application, providing financial statements, and undergoing a credit assessment. The process can vary depending on the lender and the type of loan being sought, but generally involves the following steps: 1. Loan application: The …

Read More »Uncover the Secrets of Business Risk Management: A Journey to Resilience and Growth

Business risk management is the process of identifying, assessing, and mitigating risks that could negatively impact a company’s operations, finances, or reputation. It involves understanding the potential threats to a business and developing strategies to minimize their impact. Risks can come from a variety of sources, including economic conditions, competition, changes in technology, and natural disasters. Business risk management is …

Read More »Unlock Wealth-Building Secrets: A Transformative Guide

Wealth building strategies encompass a range of financial practices and investments designed to increase one’s wealth over time. These strategies may include saving and investing, real estate ownership, business ventures, and other income-generating activities. Wealth building is essential for financial security and long-term financial well-being. By implementing effective wealth building strategies, individuals can secure their financial future, achieve financial independence, …

Read More »Uncover the Secrets of Online Credit Score Monitoring: Insights to Empower Your Financial Life

Online credit score monitoring is a service that allows you to track your credit score and receive alerts when there are any changes. This can be a valuable tool for managing your credit and protecting your identity. There are many different online credit score monitoring services available. Some of the most popular include Credit Karma, Credit Sesame, and NerdWallet. These …

Read More »Unlock the Secrets to Unstoppable Small Business Loan Offers

Small business loan offers are financial products designed to provide funding to small businesses. These loans can be used for a variety of purposes, such as starting a new business, expanding an existing business, or purchasing new equipment. Small business loan offers typically have lower interest rates and more flexible repayment terms than traditional bank loans. Small business loans can …

Read More »Uncover Financial Planning Secrets: Insights for Business Success

Business financial planning is the process of creating a roadmap for a company’s financial future. It involves setting financial goals, analyzing the company’s financial situation, and developing strategies to achieve those goals. Business financial planning is essential for any company that wants to succeed in the long term. There are many benefits to business financial planning. It can help companies …

Read More »Unlock the Secrets of Small Business Loan Terms and Conditions

Small business loan terms and conditions refer to the specific stipulations and requirements that borrowers must adhere to when obtaining a loan from a lender. These terms and conditions outline the parameters of the loan agreement, including the loan amount, interest rate, repayment schedule, and any other relevant details. Understanding these terms and conditions is crucial for small business owners …

Read More »Unlock the Secrets to Affordable Online Education: Discoveries in Online Student Loans

Online student loans are a type of loan specifically designed to help students pay for their education. They are typically offered by banks, credit unions, and other financial institutions, and can be used to cover tuition, fees, books, and other expenses. Online student loans offer several advantages over traditional student loans. First, they are more convenient, as they can be …

Read More »Unveil the Secrets of Financial Independence: Your Path to Freedom and Fulfillment

Financial independence planning is the process of creating a financial plan that allows you to live off your investments and savings, rather than relying on a paycheck. It involves setting financial goals, creating a budget, and investing your money wisely. There are many benefits to financial independence planning. It can give you peace of mind knowing that you have a …

Read More »Unleash the Power of Business Assets: Discoveries for Success

Business asset management (BAM) is a critical function for organizations of all sizes. It involves the systematic management of an organization’s assets, including physical assets such as property, plant, and equipment, as well as intangible assets such as intellectual property, goodwill, and customer relationships. BAM is important because it helps organizations to track, control, and optimize the use of their …

Read More »Unlock the Secrets of Small Business Loan Types: Discover the Path to Financial Success

Small business loans provide financial assistance to small businesses and startups. These loans come in various types, each tailored to specific business needs and circumstances. Small business loans play a crucial role in fostering entrepreneurship and economic growth. They enable businesses to access capital for expansion, innovation, working capital, and other essential purposes. Historically, small business loans have been a …

Read More »Uncover the Secrets to Financial Success: A Journey to Wealth Management

Financial goal setting is the process of creating a plan to achieve specific financial objectives. This may involve setting goals for saving, investing, or reducing debt. Financial goal setting can help you to make better financial decisions and achieve your long-term financial goals. There are many benefits to financial goal setting. Financial goal setting can help you to:

Read More »Unveiling the Secrets of Online Home Equity Loans: Your Gateway to Financial Freedom

Online home equity loans are a type of secured loan that allows homeowners to borrow money against the equity they have built up in their homes. These loans can be used for a variety of purposes, such as home improvements, debt consolidation, or unexpected expenses. Online home equity loans offer a number of advantages over traditional home equity loans. First, …

Read More »Unlock the Secrets to Business Wealth Management: Discoveries & Insights

Business wealth management encompasses strategies designed to preserve and grow the financial assets of businesses. It involves a range of services, including investment management, estate planning, tax planning, and retirement planning. Effective business wealth management is crucial for businesses of all sizes, as it helps ensure their long-term financial stability and success. By proactively managing their wealth, businesses can mitigate …

Read More »Discover Unmatched Refinancing Options for Your Small Business

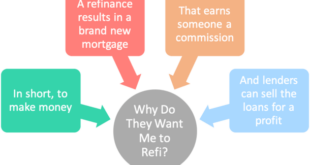

Small business loan refinancing options allow business owners to replace their existing business loans with a new loan, ideally with a lower interest rate, better terms, or both. Refinancing can be a smart financial move for businesses that have improved their creditworthiness since taking out their original loan or for those that want to consolidate multiple debts into a single …

Read More »Unlock the Secrets of Online Auto Loans: Discoveries and Insights

Online auto loans are a convenient and efficient way to get financing for a new or used car. With online auto loans, you can apply for a loan and get pre-approved in minutes, all from the comfort of your own home. This can save you a lot of time and hassle compared to going to a traditional bank or credit …

Read More » Ini Balikpapan All about Banking Finance

Ini Balikpapan All about Banking Finance