Legacy planning services encompass the guidance and tools needed to organize and manage an individual’s assets, ensuring their wishes are carried out after their passing. It involves creating a comprehensive plan that outlines the distribution of assets and personal affairs, including wills, trusts, powers of attorney, and healthcare directives. Legacy planning services also cover tax planning, estate administration, charitable giving, …

Read More »John Dealove

Unleash the Power: Uncover the Secrets of Online Business Loans

Online business loans refer to financial assistance provided to businesses through online platforms. These loans are designed to meet the specific needs and requirements of businesses operating primarily online, providing them with access to capital to support their growth and operations. Unlike traditional bank loans, online business loans often feature simplified application processes, quicker approval times, and flexible repayment options, …

Read More »Unlock the Secrets of Tax-Efficient Investing: Discover Proven Strategies for Wealth Creation

Tax-efficient investing is a strategy that involves investing in assets and utilizing investment strategies that minimize tax liability. The goal is to maximize after-tax returns by reducing the impact of taxes on investment earnings. Tax-efficient investing can take many forms, including investing in tax-advantaged accounts such as 401(k)s and IRAs, utilizing tax-loss harvesting to offset capital gains, and investing in …

Read More »Uncover the Secrets of Business Retirement Plans: A Path to Financial Freedom

Business retirement plans are employer-sponsored programs that help employees save for their retirement. These plans offer tax advantages and can help employees accumulate a significant nest egg for their golden years. There are two main types of business retirement plans: defined benefit plans and defined contribution plans. Defined benefit plans promise employees a specific monthly benefit at retirement. The employer …

Read More »Uncover the Secrets of Small Business Loan Repayment: A Comprehensive Guide

Small business loan repayment refers to the process of paying back a loan that has been borrowed by a small business. These loans are typically used to finance various business expenses, such as working capital, equipment purchases, or property acquisition. Repayment typically involves making regular monthly payments over a predetermined loan term. Small business loans can be a valuable source …

Read More »Unveiling Wealth Protection Secrets: Strategies That Will Transform Your Financial Future

Wealth protection strategies are financial and legal techniques used to safeguard assets from risks such as lawsuits, creditors, and market volatility. These strategies involve a range of measures, including trusts, offshore accounts, and insurance policies. Wealth protection is vital for high-net-worth individuals, business owners, and anyone concerned about preserving their assets. It can provide peace of mind, financial security, and …

Read More »Unlock Unparalleled Insights: Online Personal Loans

Online personal loans are a convenient and quick way to borrow money without having to go through a bank or other traditional lender. They are typically unsecured, meaning that you don’t have to put up any collateral. Online personal loans can be used for a variety of purposes, such as consolidating debt, making a large purchase, or covering unexpected expenses. …

Read More »Unlock Financial Freedom: Discover the Secrets of Small Business Loan Consolidation

Small business loan consolidation involves combining multiple business loans into a single loan with a single monthly payment. This can simplify loan management, potentially lower interest rates, and improve cash flow. It is a viable option for businesses with a good credit history and stable income. Consolidating business loans offers several advantages, including reducing the number of monthly payments, potentially …

Read More »Unveiling Business Insurance Secrets: Discoveries & Insights

Business insurance services provide financial protection to businesses from potential risks and uncertainties. These services encompass a wide range of coverage options, including property insurance, liability insurance, business interruption insurance, and many more. Business insurance is crucial for organizations of all sizes, as it helps mitigate financial losses resulting from unforeseen events. It ensures business continuity, protects against legal liabilities, …

Read More »Unlock Lucrative Business Investment Options: Discoveries and Insights Await

Business investment options refer to the various financial instruments and strategies that companies can utilize to grow and expand their operations. These options may include stocks, bonds, real estate, or other assets that have the potential to generate returns or appreciation in value over time. Business investment options are crucial for companies seeking to stay competitive, innovate, and expand their …

Read More »Unveiling Secrets: Discover the Art of Small Business Loan Refinancing

Small business loan refinancing is the process of replacing an existing small business loan with a new loan that has more favorable terms. This can be done to reduce the interest rate, shorten the loan term, or consolidate multiple loans into a single payment. There are many benefits to refinancing a small business loan. A lower interest rate can save …

Read More »Unveil the Secrets of Risk Management: Empowering Wealth Management

Risk management solutions empower organizations to identify, assess, and mitigate risks that could potentially hinder their performance, reputation, and financial stability. These solutions provide a structured approach to managing risks by integrating people, processes, and technology to proactively address uncertainties and challenges. Implementing risk management solutions offers several notable advantages. They enhance decision-making by providing a clear understanding of potential …

Read More »Uncover the Secrets of Online Money Market Accounts: A Journey to Financial Growth

Online money market accounts are a type of savings account that offers higher interest rates than traditional savings accounts. They are offered by banks and credit unions, and they typically require a minimum deposit to open. Online money market accounts can be a good option for savers who want to earn a higher return on their money without having to …

Read More »Uncover the Hidden Truths of Small Business Loan Interest Rates

Small business loan interest rates are the fees charged by banks and other lenders for the use of borrowed funds by small businesses. These rates are typically higher than those charged to larger businesses, as small businesses are seen as a higher risk by lenders. However, small business loans can be a valuable source of financing for businesses that need …

Read More »Unveiling the Secrets of Succession Planning: Insights and Discoveries for Wealth Management

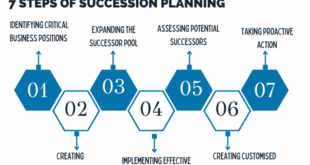

Succession planning services are a type of human capital management service that helps organizations identify and develop future leaders. This process involves assessing the current leadership team, identifying potential successors, and creating a plan for their development. Succession planning is important for ensuring that organizations have a strong leadership pipeline in place and can continue to operate smoothly in the …

Read More »Unlock Business Growth: Discover the Secrets of Business Credit Solutions

Business credit solutions are financial products and services designed to help businesses establish, build, and maintain their creditworthiness. These solutions can include credit cards, lines of credit, and loans, as well as access to credit monitoring and reporting services. Business credit solutions are important for businesses of all sizes, as they can help to improve cash flow, fund growth, and …

Read More »Discover the Secrets to a Secure Retirement: Unraveling the World of Online Retirement Accounts

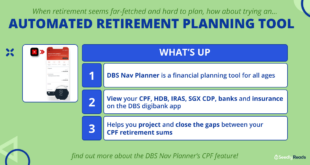

Online retirement accounts are investment accounts designed to help individuals save for retirement. These accounts offer tax benefits and investment options that can help you grow your savings over time. There are many different types of online retirement accounts, including 401(k)s, IRAs, and Roth IRAs. Each type of account has its own rules and benefits, so it’s important to choose …

Read More »Unlock the Secrets of Business Treasury Services: Discoveries and Insights

Business treasury services encompass the financial processes and strategies employed by organizations to manage their cash flow, investments, and financial risks. These services are crucial for ensuring the efficient and secure handling of an organization’s financial resources. Effective business treasury services provide numerous benefits, including optimized cash flow, enhanced investment returns, and mitigated financial risks. Historically, treasury services have evolved …

Read More »Unlock the Secrets to Multi-Generational Wealth Management: Discoveries and Insights

Multi-generational wealth management is a comprehensive approach to preserving and growing wealth for families across multiple generations. It involves developing and implementing a customized plan that considers the unique financial goals, values, and risk tolerance of each generation. Multi-generational wealth management offers numerous benefits, including providing financial security for future generations, reducing the tax burden, enhancing investment returns, and promoting …

Read More »Discover the Ultimate Guide to Small Business Loans: Unveil the Secrets of Loan Calculators

A small business loan calculator is an online tool that helps you estimate the monthly payments and total cost of a small business loan. It can be a valuable resource for business owners who are considering taking out a loan to fund their business. Small business loans can be a great way to get the financing you need to start …

Read More » Ini Balikpapan All about Banking Finance

Ini Balikpapan All about Banking Finance