A certificate of deposit (CD) is a savings account with a fixed interest rate and a fixed term. Online CDs are CDs that can be opened and managed online. They offer the same benefits as traditional CDs, such as a fixed interest rate and a fixed term, but they are more convenient and flexible. One of the biggest benefits of …

Read More »John Dealove

Unlock the Secrets: Uncover the Best Small Business Loan Rates

Small business loan rates comparison is a process of evaluating and comparing the interest rates, fees, and terms of different small business loans to find the best financing option for a particular business. There are a number of factors that small business owners should consider when comparing loan rates, including the loan amount, the loan term, the type of loan, …

Read More »Discover the Secrets of Strategic Philanthropy

Philanthropic advisory services provide expert guidance to individuals, families, and organizations seeking to maximize the impact of their charitable giving. These services encompass a comprehensive range of support, including: Developing strategic philanthropic plans Identifying and evaluating charitable organizations Structuring charitable gifts for tax efficiency Managing donor advised funds and private foundations Philanthropic advisory services are essential for those who wish …

Read More »Unlock Financial Freedom: Discover the Secrets of Online Checking Accounts

An online checking account is a type of bank account that can be accessed and managed online. This means that you can view your balance, make deposits and withdrawals, and transfer money to and from other accounts, all without having to visit a physical bank branch. Online checking accounts are typically offered by banks and credit unions, and they usually …

Read More »Unlock Hidden Gems: The Ultimate Guide to Business Deposit Products

Business deposit products encompass a range of financial services offered by banks and other financial institutions tailored to meet the specific needs of businesses. These products provide a secure and convenient way for businesses to manage their finances and optimize their cash flow. The most common types of business deposit products include checking accounts, savings accounts, and money market accounts. …

Read More »Unlock the Power of Business Mobile Banking: Discoveries and Insights for the Future

Business mobile banking allows business owners to manage their finances remotely using a mobile device or tablet. It offers a range of services, including the ability to check account balances, transfer funds, deposit checks, and pay bills. Business mobile banking is becoming increasingly popular as it offers a number of benefits over traditional banking methods. These benefits include convenience, time …

Read More »Online Savings Account: Discover the Secrets to Smart Saving

An online savings account is a type of savings account that can be accessed and managed online, typically through a bank’s website or mobile app. Online savings accounts often offer higher interest rates than traditional savings accounts, as they have lower overhead costs for banks. They also offer the convenience of being able to deposit and withdraw money anytime, anywhere. …

Read More »Unlock the Secrets of Charitable Giving: Maximize Your Impact and Legacy

Charitable giving strategies involve planning and structuring donations to maximize their impact and align with the donor’s philanthropic goals. These strategies encompass various techniques, including donor-advised funds, charitable trusts, and pooled income funds, each tailored to specific financial situations and charitable objectives. The benefits of employing charitable giving strategies are multifaceted. They can provide tax advantages, such as deductions or …

Read More »Unveiling the Secrets of Small Business Loan Eligibility: Insights and Discoveries

Small business loan eligibility refers to the criteria and requirements that a small business must meet in order to qualify for a loan from a lender. These criteria can vary depending on the lender and the specific loan program, but there are some general factors that are commonly considered, such as the business’s financial history, creditworthiness, and ability to repay …

Read More »Unveiling the Secrets: A Journey into Online Investment Options

In the realm of finance, online investment options have emerged as a transformative force, empowering individuals with unprecedented access to a vast array of investment opportunities. These platforms provide a user-friendly interface, allowing investors to navigate the complexities of financial markets with ease. The benefits of online investment options are multifaceted. They offer convenience, flexibility, and cost-effectiveness, making investing more …

Read More »Unveil the Secrets: Master Small Business Loan Qualifications for Success

Small business loan qualifications encompass the eligibility requirements businesses must fulfill to secure financing. These qualifications, set by lenders, assess a business’s financial health, stability, and repayment capacity. The evaluation process involves scrutinizing factors like credit scores, financial statements, business plans, and collateral. Meeting these qualifications increases a business’s chances of loan approval. Understanding small business loan qualifications is crucial …

Read More »Discover the Secrets of Business Online Banking: A Gateway to Financial Empowerment

Business online banking refers to the suite of digital financial services that banks provide to business customers for managing their finances conveniently and securely over the internet. It empowers businesses to conduct various banking transactions, such as checking account balances, initiating fund transfers, processing payments, and accessing financial reports, from anywhere with an internet connection. Business online banking offers numerous …

Read More »Unlock the Secrets of Wealth Transfer Planning for Seamless Legacy Management

Wealth transfer planning, also known as estate planning, refers to the strategies and legal arrangements individuals undertake to manage the transfer of their assets and wealth during their lifetime and after their death. It involves planning for the distribution of assets to heirs, minimizing taxes, and ensuring the smooth transition of wealth according to the individual’s wishes. Wealth transfer planning …

Read More »Unlock the Gold Mine of Business Cash Management: Discoveries and Insights

Business cash management encompasses the processes and strategies employed by businesses to effectively manage their cash flow and liquidity. It involves forecasting cash inflows and outflows, optimizing cash balances, and minimizing the risk of cash shortfalls. A robust cash management system is essential for businesses to maintain financial stability, maximize profitability, and achieve long-term growth. Effective business cash management offers …

Read More »Uncover the Secrets of Online Financial Planning: A Journey to Financial Empowerment

Online financial planning is a comprehensive financial planning service provided over the internet. Also known as virtual financial planning, it allows individuals and families to access financial advice and planning remotely from experienced professionals. In the past, financial planning was traditionally done in person, requiring clients to meet with a financial advisor at their office. However, with the advent of …

Read More »Unlock the Secrets to Securing Optimal Small Business Loan Amounts

Small business loan amounts refer to the sums of money borrowed by small businesses from lenders to finance their operations, investments, or expansion plans. These loans can vary significantly in size, depending on the business’s needs and the lender’s assessment of its creditworthiness. Small business loans can be crucial for entrepreneurs and small business owners, providing them with the capital …

Read More »Unveiling the Secrets to Wealth Accumulation: Discover Proven Strategies to Grow Your Fortune

Wealth accumulation strategies refer to a set of methods and techniques used to increase one’s financial wealth over time. These strategies typically involve making sound investment decisions, saving money, and managing debt effectively. Effective wealth accumulation strategies can have several benefits. For individuals, they can help achieve financial independence, retire comfortably, and leave a legacy for future generations. On a …

Read More »Unlock the Secrets to Favorable Small Business Loan Terms: A Comprehensive Guide

Small business loan terms refer to the specific conditions and parameters that govern a loan agreement between a small business and a lender. These terms outline the loan amount, interest rate, repayment schedule, and other important details. Understanding small business loan terms is crucial for business owners as they impact the overall cost and feasibility of the loan. Favorable terms …

Read More »Uncover the Secrets to Financial Freedom with Online Budgeting Tools

Online budgeting tools are software or web applications that help individuals and businesses manage their finances more effectively. They offer a wide range of features, including budgeting, expense tracking, financial forecasting, and investment tracking. Online budgeting tools have become increasingly popular in recent years as more and more people seek to take control of their finances. These tools offer a …

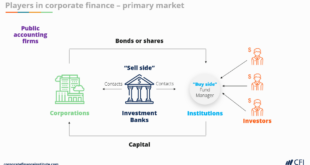

Read More »Unlock the Power of Business Financing: Discover the Wealth of Options

Business financing options refer to the various methods businesses can use to raise capital for their operations and growth. These options can range from traditional bank loans to alternative financing sources such as venture capital or crowdfunding. Choosing the right financing option is crucial for businesses as it can impact their financial stability, growth potential, and overall success. There are …

Read More » Ini Balikpapan All about Banking Finance

Ini Balikpapan All about Banking Finance