Investment advisory services provide personalized financial guidance and assistance to individuals and organizations, helping them make informed investment decisions and manage their portfolios. These services typically involve analyzing financial goals, risk tolerance, and investment objectives to develop customized investment strategies. Investment advisory services are important because they can help investors navigate complex financial markets, reduce risk, and potentially improve returns. …

Read More »John Dealove

Discover the Secrets to Securing Small Business Loans!

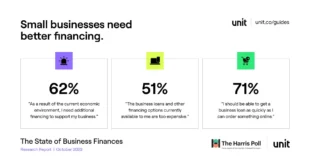

A small business loan process refers to the series of steps and procedures involved in obtaining financing for a small business. It typically includes submitting a loan application, providing financial documentation, undergoing credit checks, and potentially securing collateral. The process can vary depending on the lender and the specific loan program. Small business loans can be crucial for entrepreneurs and …

Read More »Unlock the Power of Asset Allocation: Discoveries and Insights for Wealth Management

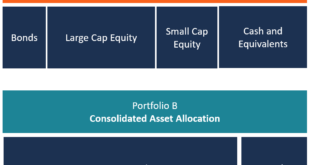

Asset allocation strategies refer to the practice of dividing an investment portfolio among various asset classes such as stocks, bonds, real estate, and cash equivalents. The goal of asset allocation is to optimize the risk-return profile of the portfolio by diversifying investments across different asset classes that exhibit varying levels of risk and return characteristics. Asset allocation strategies are often …

Read More »Uncover Mortgage Secrets: Your Guide to Expert Insights

An online mortgage calculator is a tool that allows you to estimate the monthly payments on a mortgage loan. It takes into account factors such as the loan amount, interest rate, loan term, and property taxes. This can be helpful in determining how much you can afford to borrow and in comparing different loan options. Online mortgage calculators are easy …

Read More »Uncover the Secrets to Streamline Business Payments

Business payment solutions encompass the tools, technologies, and processes that facilitate the movement of funds between businesses. They provide a secure and efficient means to make and receive payments, streamline financial operations, and enhance cash flow. Examples of business payment solutions include electronic fund transfers (EFTs), credit card processing, automated clearing house (ACH) payments, and mobile payment systems. Business payment …

Read More »Unlock the Secrets of Small Business Loan Approval: A Comprehensive Guide to Success

Small business loan approval refers to the process by which a small business obtains financing from a lender. This type of loan is specifically designed to meet the needs of small businesses, which may have different financial requirements and risk profiles compared to larger companies. The approval process typically involves an assessment of the business’s creditworthiness, financial history, and repayment …

Read More »Unlock the Power of Merchant Services for Business Success

Merchant services for businesses encompass a range of financial and technological solutions that facilitate payment processing, allowing merchants to accept various payment methods from their customers. These services are typically provided by payment processors or merchant account providers and include credit and debit card processing, mobile payments, online payments, invoicing, and other value-added services. Merchant services play a crucial role …

Read More »Unlock the Secrets of Portfolio Management: Discover Insights and Grow Your Wealth

Portfolio management services encompass the professional management of financial assets, tailored to meet the unique investment objectives and risk tolerance of individual or institutional clients. These services involve constructing, monitoring, and adjusting investment portfolios to align with the client’s financial goals, time horizon, and risk appetite. The significance of portfolio management services lies in the expertise and guidance provided by …

Read More »Unveil the Power of Online Credit Card Applications: Unlocking Financial Freedom

An online credit card application is a digital form that allows individuals to apply for a credit card over the internet. These applications typically require personal information, such as name, address, and Social Security number, as well as financial information, such as income and employment history. Once submitted, the application is processed by the credit card issuer, who will then …

Read More »Unlock Financial Growth: Insider Secrets for a Powerful Small Business Loan Application

Small business loan application refers to the process by which a small business requests financing from a lender. This typically involves completing an application form that outlines the business’s financial situation, credit history, and loan request. Lenders use this information to assess the business’s creditworthiness and determine whether to approve the loan. Small business loans can be used for a …

Read More »Unveiling the Secrets of Online Loan Applications: Discover the Gateway to Financial Freedom

An online loan application is a digital platform that allows individuals to apply for loans through the internet. It involves filling out an online form with personal and financial information, submitting required documents, and receiving a loan decision without visiting a physical branch. Online loan applications offer several benefits over traditional in-person applications. They provide convenience and accessibility, enabling individuals …

Read More »Uncover Tax Optimization Secrets for Enhanced Wealth Management

Tax optimization strategies encompass a range of techniques employed to minimize tax liability while adhering to all applicable laws and regulations. These strategies involve leveraging deductions, credits, and other provisions within the tax code to reduce the amount of taxes owed. Effective tax optimization strategies can yield significant financial benefits for individuals and businesses alike. By reducing tax liability, organizations …

Read More »Unlock the Secrets of Business Credit Cards: Discover Hidden Gems and Boost Your Business

Business credit cards are a type of credit card designed specifically for businesses. They offer a range of benefits that can help businesses manage their finances more effectively, including the ability to earn rewards, build business credit, and track expenses. One of the most important benefits of business credit cards is the ability to earn rewards. Many business credit cards …

Read More »Unlocking the Secrets to Small Business Loan Approval

Small business loan requirements are the criteria that lenders use to assess the creditworthiness of a small business loan applicant. These requirements can vary from lender to lender, but they typically include factors such as the business’s financial history, credit score, and collateral. Meeting small business loan requirements can be challenging for some businesses, especially those that are just starting …

Read More »Retire with Confidence: Uncover Hidden Insights with Retirement Planning Advisors

Retirement planning advisors are professionals who provide guidance and advice to individuals on how to plan for their retirement. They can help you develop a retirement plan that takes into account your financial situation, retirement goals, and risk tolerance. Retirement planning advisors can also help you make investment decisions, manage your retirement savings, and navigate the complexities of retirement planning. …

Read More »Unlock the Secrets of Online Account Opening: Discoveries and Insights

Online account opening refers to the process of creating a new account with a financial institution or other service provider through the internet, without the need for a physical visit to a branch or office. Online account opening offers numerous benefits, including convenience, speed, and accessibility. It allows customers to open accounts from anywhere with an internet connection, at any …

Read More »Unlock Your Business's Potential: Unveil the Secrets of Business Loans and Lines of Credit

Business loans and lines of credit are financial products designed to provide businesses with access to capital. Business loans are typically one-time lump sum payments that are repaid over a fixed period of time, while lines of credit are revolving loans that can be drawn upon and repaid as needed. Both business loans and lines of credit can be valuable …

Read More »Discover the Secrets of Business Savings Accounts for Financial Success

A business savings account is a type of deposit account that is designed to help businesses save money and earn interest. Business savings accounts typically offer a higher interest rate than traditional savings accounts, and they may also offer other benefits, such as free business checking, online banking, and mobile banking. Business savings accounts can be a valuable tool for …

Read More »Uncover the Secrets of Online Money Transfer: A Comprehensive Guide

Online money transfer refers to the electronic transfer of funds from one person or entity to another through the internet. Unlike traditional methods like cash or checks, online money transfer is a digital process that enables individuals to send and receive money conveniently and securely. Online money transfer has gained immense popularity in recent years due to its numerous advantages. …

Read More »Unlock the Power of Small Business Loans: Discover Funding Insights

Small business loan programs provide financing to small businesses that may not qualify for traditional bank loans. These programs are offered by a variety of lenders, including banks, credit unions, and government agencies. Small business loan programs can be a valuable resource for small businesses that need financing to start or grow their operations. These programs offer a variety of …

Read More » Ini Balikpapan All about Banking Finance

Ini Balikpapan All about Banking Finance