Small business banking customer education equips small business owners with the knowledge and skills they need to effectively manage their finances and make informed financial decisions. It covers a wide range of topics, including financial statement analysis, budgeting, cash flow management, and loan applications. Educated small business owners are more likely to make sound financial decisions, which can lead to …

Read More »John Dealove

Unlock the Secrets of Small Business Banking Customer Empowerment

Small business banking customer empowerment refers to the initiatives and strategies employed by banks to equip their small business customers with the tools, resources, and support they need to effectively manage their finances and achieve their business goals. Empowering small business banking customers is of paramount importance as it enables them to make informed financial decisions, streamline their banking processes, …

Read More »Unlock the Secrets of Small Business Banking Customer Advocacy

Small business banking customer advocacy refers to the practices and policies that banks employ to ensure that the needs and concerns of their small business customers are met and addressed promptly and effectively. It involves proactively seeking feedback from small business customers, understanding their unique challenges and requirements, and tailoring products and services to meet their specific needs. Customer advocacy …

Read More »Unlock the Secrets: Uncover Hidden Truths and Solutions to Small Business Banking Grievances

Small business banking customer grievances refer to complaints and concerns raised by customers who use banking services tailored to small businesses. These grievances can encompass various issues related to account management, loan applications, transaction processing, customer service, and other aspects of banking operations that impact small businesses. Understanding and addressing small business banking customer grievances is crucial for financial institutions …

Read More »Unveiling the Secrets to Master Small Business Banking Customer Inquiries

Small business banking customer inquiries encompass a wide range of questions, requests, and concerns raised by small business owners and entrepreneurs regarding their banking products and services. These inquiries can cover diverse topics such as account management, loan applications, credit card usage, online banking, and financial advice. Addressing small business banking customer inquiries promptly and effectively is crucial for financial …

Read More »Unveiling the Truth: The Ultimate Guide to Small Business Banking Customer Complaints

Small business banking customer complaints are expressions of dissatisfaction from customers who have had negative experiences with the products or services offered by their small business bank. These complaints can cover a wide range of issues, including: High fees Poor customer service Difficulty accessing loans or other financial products Unauthorized transactions Identity theft Small business banking customer complaints are important …

Read More »Unlock the Secrets to Small Business Banking Success: Discoveries from Customer Feedback

Small business banking customer feedback refers to the feedback and opinions provided by customers of small business banking services. This feedback can be gathered through various channels such as surveys, online reviews, social media, and direct communication with bank representatives. Customer feedback is crucial for small business banks as it helps them understand their customers’ needs, preferences, and pain points. …

Read More »Unlock the Secrets of Thriving Small Business Banking Customer Engagement

Small business banking customer engagement refers to the interactions and relationships between a bank and its small business customers. It encompasses all touchpoints and communications, from account opening to ongoing support. Positive customer engagement leads to increased satisfaction, loyalty, and revenue for the bank. Engaging effectively with small business customers requires a deep understanding of their unique needs and challenges. …

Read More »Unlock the Secrets of Small Business Banking Customer Acquisition

Small business banking customer acquisition refers to the strategies and techniques used by financial institutions to attract and acquire new small business customers for their banking products and services. This can include a range of activities, such as developing targeted marketing campaigns, offering competitive rates and products, and providing personalized customer service. Acquiring new small business customers is crucial for …

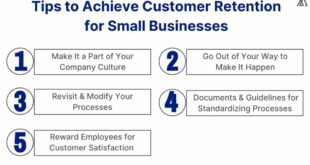

Read More »Unlock the Secrets to Small Business Banking Customer Retention

Small business banking customer retention refers to the strategies and practices employed by financial institutions to maintain and strengthen relationships with their small business customers. It involves understanding the unique needs of small businesses and providing them with tailored products, services, and support to meet those needs. Retaining small business customers is crucial for financial institutions as it contributes to …

Read More »Uncover the Secrets of Small Business Banking Customer Satisfaction

Small business banking customer satisfaction measures how happy small business customers are with their banking services. It is an important metric for banks because satisfied customers are more likely to stay with their bank and recommend it to others. There are many factors that can affect small business banking customer satisfaction, including the quality of customer service, the convenience of …

Read More »Unlock the Secrets of Small Business Banking Client Relations for Unstoppable Growth

Small business banking client relations encompass the interactions and services provided by banks specifically tailored to meet the unique financial needs of small businesses. These services range from basic deposit accounts and loans to specialized products like merchant services, cash management solutions, and advisory services. Building strong client relations is crucial for small business banking. By understanding the specific challenges …

Read More »Unlock the Secrets of Small Business Banking Customer Support: Uncover Growth Opportunities

Small business banking customer support refers to the financial services and assistance provided by banks specifically tailored to meet the unique needs of small businesses. It encompasses a range of services, including account management, loan processing, financial advice, and technical support. Small business banking customer support plays a crucial role in the success and growth of small businesses. It provides …

Read More »Unlock the Power of Small Business Banking: Customer Service Secrets Revealed

Small business banking customer service encompasses the financial services and support provided by banks specifically tailored to meet the needs of small businesses. These services range from basic deposit and loan products to specialized offerings such as cash management, merchant services, and business advisory. Providing excellent customer service to small businesses is of paramount importance for banks. Small businesses are …

Read More »Unlock the Secrets of Exceptional Small Business Banking

Small business banking user experience encompasses the interactions and experiences that small business owners have when using banking products and services. It plays a crucial role in shaping their satisfaction, loyalty, and overall perception of the financial institution. A seamless user experience can provide numerous benefits for small businesses, including increased efficiency, reduced costs, improved customer service, and enhanced financial …

Read More »Unlock the Secrets to Exceptional Small Business Banking Customer Experience

Small business banking customer experience encompasses the interactions and touchpoints between small businesses and their banking institutions. It encompasses various aspects, including the ease of account opening, loan application processes, digital banking capabilities, customer service responsiveness, and overall satisfaction with the banking services provided. Positive small business banking customer experience is paramount as it can foster loyalty, drive business growth, …

Read More »Uncover Hidden Profits: Small Business Banking Data Analytics Revealed

Small business banking data analytics refers to the use of data analysis techniques to improve the financial performance of small businesses. This data can be used to identify trends, develop strategies, and make informed decisions about lending, marketing, and operations. Small business banking data analytics is important because it can help businesses to:

Read More »Unlock the Secrets to Impeccable Small Business Banking Cybersecurity

Cybersecurity is the practice of protecting computer systems, networks, and data from unauthorized access or attack. For small businesses, banking cybersecurity is especially important because it can help protect their financial data and customer information from theft or fraud. There are a number of different cybersecurity measures that small businesses can take to protect themselves, including:

Read More »Unleash the Power of Biometrics: Transform Your Small Business Banking

Small business banking biometrics is the use of biometric technology to identify and authenticate small business owners and employees for banking purposes. This can include using fingerprints, facial recognition, or voice recognition to access accounts, make transactions, and more. Small business banking biometrics is becoming increasingly popular as a way to improve security and convenience for small businesses. There are …

Read More »Unlock the Power of Crypto for Your Small Business

Small business banking cryptocurrency leverages cryptocurrency and blockchain technology to provide financial services to small businesses. These services can include everything from accepting cryptocurrency payments to obtaining loans and managing finances. Small business banking cryptocurrency offers several advantages over traditional banking. First, it can be more convenient and efficient. Small businesses can open accounts and conduct transactions online, often without …

Read More » Ini Balikpapan All about Banking Finance

Ini Balikpapan All about Banking Finance