Financial peace of mind for small business banking customers refers to a state of financial security and confidence in which small business owners feel in control of their finances and have a clear understanding of their financial situation. This includes having access to the financial products and services they need to manage their businesses effectively, such as loans, lines of …

Read More »John Dealove

Unlock the Secrets to Small Business Banking Customer Financial Bliss

Small business banking customer financial happiness refers to the overall satisfaction of small business customers with the financial services they receive from their banks. This includes factors such as the quality of customer service, the range of products and services offered, the convenience of banking channels, and the overall value for money. Satisfied customers are more likely to remain loyal …

Read More »Unlock the Secrets to Delighting Small Business Banking Customers

Small business banking customer financial satisfaction measures how happy small business customers are with the financial services they receive from their bank. This includes factors such as the quality of customer service, the range of products and services offered, and the overall value for money. Small business banking customer financial satisfaction is important because it can impact a bank’s bottom …

Read More »Discover the Secrets to Small Business Banking Customer Financial Success

Small business banking customer financial success is a term that refers to the financial well-being and prosperity of small business customers who utilize banking services. These services may include business loans, lines of credit, checking and savings accounts, and other financial products tailored to the needs of small businesses. Ensuring the financial success of small business banking customers is of …

Read More »Unleash Financial Success: Transformative Insights for Small Business Banking Customer Health

Small business banking customer financial health refers to the overall financial well-being of small businesses that utilize banking services. It encompasses various aspects of a business’s financial situation, including cash flow, profitability, debt management, and financial planning. Maintaining good financial health is crucial for small businesses as it enables them to operate smoothly, make informed financial decisions, and achieve long-term …

Read More »Unveiling the Secrets of Small Business Banking Customer Financial Resilience

Small business banking customer financial resilience refers to the ability of small businesses to withstand and recover from financial shocks and challenges. It encompasses various aspects, including access to financial products and services, financial literacy, and risk management practices. Financial resilience is crucial for small businesses, as they are more vulnerable to financial setbacks than larger corporations. It allows them …

Read More »Unveiling the Secrets to Small Business Banking Customer Financial Stability

Small business banking customer financial stability refers to the financial health and well-being of small business customers who utilize banking services. It encompasses various aspects, including the ability to manage cash flow effectively, access credit when needed, and maintain a strong financial foundation to support business operations and growth. Ensuring the financial stability of small business banking customers is of …

Read More »Uncover the Secrets of Small Business Banking: Financial Responsibility Unveiled

Small business banking customer financial responsibility refers to the practices and behaviors that small business owners should adopt to manage their finances effectively and responsibly when dealing with banks and other financial institutions. Maintaining financial responsibility is of paramount importance for small businesses as it can have a significant impact on their overall financial health and success. Responsible financial management …

Read More »Unlock the Secrets of Small Business Banking Financial Freedom

Small business banking customer financial freedom refers to the ability of small business owners to manage their finances effectively and achieve their financial goals with the help of banking products and services tailored to their specific needs. This includes having access to financial tools and resources that enable them to make informed decisions, manage cash flow, and grow their businesses. …

Read More »Uncover the Secrets to Financial Independence for Small Business Banking Customers

Small business banking customer financial independence refers to the ability of small business owners to manage their finances effectively and make informed financial decisions without relying heavily on external financing or assistance. Financial independence for small business banking customers is crucial for several reasons. Firstly, it allows businesses to operate more autonomously and make decisions based on their own financial …

Read More »Unveiling the Blueprint for Small Business Financial Dominance: Discoveries and Insights

Small business banking customer financial empowerment refers to the initiatives and resources provided by banks to help their small business customers improve their financial literacy and management skills. This includes offering educational programs, financial planning tools, and access to affordable financial products and services. Financial empowerment is essential for small business owners to succeed. It can help them make informed …

Read More »Unlocking Financial Security: Empowering Small Businesses through Banking Innovation

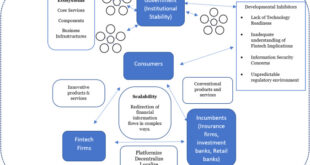

Small business banking customer financial security encompasses the measures and practices employed by banks to safeguard the financial well-being of their small business customers. It involves a comprehensive approach that addresses various aspects of financial management, risk mitigation, and proactive support. Ensuring customer financial security is paramount for banks as it fosters trust, builds long-term relationships, and contributes to the …

Read More »Unleash Your Business's Financial Potential: Discover the Secrets of Small Business Banking Customer Financial Management

Small business banking customer financial management refers to the financial services and tools offered by banks to help small business owners manage their finances effectively. These services can include business checking and savings accounts, loans, lines of credit, and merchant services. Small business banking customer financial management can help businesses track their income and expenses, manage their cash flow, and …

Read More »Unlock Financial Success: Discover the Secrets of Small Business Banking Financial Planning

Small business banking customer financial planning is a service offered by banks to help small business owners manage their finances. This service can include a variety of tasks, such as budgeting, cash flow management, and investment planning. By providing these services, banks can help small business owners make informed financial decisions and achieve their financial goals. There are many benefits …

Read More »Unlock Financial Wellness: A Guide to Small Business Banking Success

Small business banking customer financial wellness encompasses the financial health and well-being of customers who utilize banking services tailored to small businesses. It involves providing financial tools, resources, and guidance to help small businesses manage their finances effectively, make informed financial decisions, and achieve long-term financial success. Ensuring the financial wellness of small business banking customers is crucial for several …

Read More »Unlock the Secrets to Small Business Financial Literacy and Empower Your Success

Small business banking customer financial literacy refers to the knowledge and skills that small business owners possess in managing their financial resources effectively. It encompasses a range of financial concepts, such as budgeting, cash flow management, credit and debt management, and investment strategies. By understanding these concepts, small business owners can make informed financial decisions that can help their businesses …

Read More »Uncover the Secrets to Impeccable Small Business Banking Data Protection

Small business banking customer data protection refers to the security measures taken by banks to safeguard the sensitive information of their small business customers. This data includes financial transactions, account balances, personal information, and other confidential details. Protecting customer data is crucial for small businesses as it helps prevent unauthorized access, fraud, and identity theft. Strong data protection measures can …

Read More »Uncover the Secrets: Ultimate Guide to Small Business Banking Customer Privacy

Small business banking customer privacy refers to the protection of sensitive financial information belonging to customers of small business banks. This includes personal data, transaction details, and account balances. Maintaining customer privacy is crucial for small business banks for several reasons. First, it helps to build trust between the bank and its customers. When customers know that their information is …

Read More »Uncover the Secrets to Building Unbreakable Small Business Banking Customer Trust

Small business banking customer trust is the belief that a small business can rely on its bank to provide the financial services it needs to operate and grow. This trust is built on a number of factors, including the bank’s reputation, the quality of its customer service, and the competitiveness of its products and services. Small business banking customer trust …

Read More »Unlock the Secrets of Small Business Banking: Empower Your Business Today!

Small business banking customer awareness refers to the level of understanding and knowledge that small business owners and customers have about the banking products and services available to them. This includes their understanding of different types of accounts, loan products, and other financial services offered by banks. Having a high level of small business banking customer awareness is important because …

Read More » Ini Balikpapan All about Banking Finance

Ini Balikpapan All about Banking Finance