Small business banking automation involves the use of technology to automate various banking tasks and processes, making it easier and more efficient for small businesses to manage their finances. This can include tasks such as account reconciliation, bill payment, and payroll processing. By automating these tasks, small businesses can save time and money, and reduce the risk of errors. There …

Read More »John Dealove

Unlock Secrets to Exceptional Small Business Banking Performance

Small business banking performance refers to the financial health and operational efficiency of banks that cater specifically to small businesses. It encompasses various metrics, including profitability, loan quality, customer satisfaction, and risk management. A strong small business banking performance is crucial for several reasons. Firstly, small businesses are a vital part of the economy, contributing significantly to job creation and …

Read More »Unlock the Secrets of Small Business Banking Effectiveness

Small business banking effectiveness refers to the ability of financial institutions to meet the unique needs of small businesses, providing tailored products, services, and support that enable them to succeed and grow. Effective small business banking goes beyond just offering basic financial services; it involves understanding the challenges and opportunities faced by small businesses and developing solutions that address their …

Read More »Uncover the Secrets to Uninterrupted Banking for Your Small Business

Continuity in banking refers to seamless and uninterrupted access to financial services, especially during periods of disruptions or emergencies. Small businesses often rely on banks for essential services like cash flow management, payments processing, and access to credit. Small business banking continuity plans ensure that these services are maintained, allowing businesses to continue operating smoothly even in challenging circumstances. Having …

Read More »Uncover the Secrets of Small Business Banking Stability: A Guide to Success

The strength and reliability of financial services provided to small businesses is referred to as “small business banking stability.” Small businesses can plan for the future more effectively, make better judgments, and prosper when they have access to dependable banking services. Stable banking for small businesses gives access to loans, lines of credit, and other financial goods that are essential …

Read More »Uncover the Secrets: Small Business Banking Data Protection Demystified

Small business banking data protection refers to the safeguarding of financial and customer information held by banks and other financial institutions that cater specifically to small businesses. This encompasses a wide range of measures and best practices employed to protect sensitive data from unauthorized access, theft, or misuse. In the current digital landscape, where small businesses increasingly rely on online …

Read More »Unlocking Hidden Gems: Discoveries and Insights in Small Business Banking Risk Management

Small business banking risk management encompasses the practices and strategies employed by financial institutions to mitigate risks associated with lending to small businesses. These risks can include credit risk, operational risk, and compliance risk. Effective risk management is crucial for small businesses and financial institutions alike. It helps small businesses access the capital they need to grow and prosper while …

Read More »Unveiling the Secrets of Small Business Banking Compliance: A Guide to Ensuring Compliance and Protecting Your Institution

Small business banking compliance officers are professionals responsible for ensuring that financial institutions comply with relevant laws and regulations. They play a critical role in managing risk, preventing financial crime, and protecting customer information. The importance of small business banking compliance officers has grown in recent years due to increasing regulatory scrutiny and the evolving threat landscape. These officers help …

Read More »Unveil the Secrets: Small Business Banking Regulatory Agencies' Impact on Your Success

Small business banking regulatory agencies are government agencies responsible for overseeing the activities of banks and other financial institutions that provide services to small businesses. These agencies help ensure that these institutions operate safely and soundly and that they comply with all applicable laws and regulations. Small business banking regulatory agencies play a vital role in protecting the financial interests …

Read More »Unlock the Secrets of Banking for Small Businesses: A Guide to Small Business Banking Standards

Small business banking standards are established rules and regulations that banks follow when providing financial services to small businesses. These standards help ensure that small businesses have access to fair and equitable banking services. They also help to protect small businesses from fraud and abuse. Small business banking standards are important because they help to create a level playing field …

Read More »Unveiling the Secrets of Money Mindset Podcasts: Discoveries for Wealth Management

“Money mindset podcasts” delve into the psychology and behavioral patterns surrounding our relationship with money and finances. These podcasts aim to help listeners challenge limiting beliefs, cultivate a positive mindset towards wealth, and develop practical strategies for financial success. Listening to money mindset podcasts offers numerous benefits. They can enhance financial literacy, promote mindful spending habits, reduce financial stress, and …

Read More »Unveiling the Secrets: Trustworthiness in Online Banking Rewards

Online banking reward trustworthiness refers to the confidence that customers have in online banking platforms and the rewards they offer. It encompasses the reliability and security of the platform, the fairness and transparency of the reward system, and the overall customer experience. Trustworthiness is crucial in online banking as it encourages customers to use the platform with confidence, knowing that …

Read More »Unlock Your Wealth Potential: Discover the Secrets of Wealth Consciousness Coaching

Wealth consciousness coaching programs assist individuals in shifting their mindsets and behaviors toward wealth and abundance. They provide a framework for examining and reframing limiting beliefs, developing a wealth mindset, and implementing practical strategies for financial growth. These programs emphasize the importance of understanding the psychology of wealth, cultivating a positive relationship with money, and developing a clear vision for …

Read More »Unveiling the Secrets of Online Banking Reward Dependability: Discoveries and Insights

Online banking reward dependability refers to the reliability and consistency of rewards offered by banks for using their online banking services. In today’s competitive banking landscape, banks are increasingly offering rewards to attract and retain customers. These rewards can range from cash back and points to discounts and exclusive offers. The dependability of these rewards is crucial for customers who …

Read More »Unlock the Secrets to Financial Success: Dive into the Mindset Revolution

Financial mindset courses empower individuals to cultivate a healthy and prosperous relationship with money. Rooted in cognitive behavioral therapy, these courses challenge limiting beliefs, establish positive financial habits, and guide participants toward long-term financial well-being. By reshaping their mindset, individuals can make informed financial decisions, reduce stress, and achieve their financial goals. Financial mindset courses offer numerous benefits. They enhance …

Read More »Unlock Business Loan Secrets: Discover the Key to Funding Success

A business loan customer is an individual or organization that has taken out a loan specifically designed for business purposes. Business loans can be used for a variety of purposes, such as starting a new business, expanding an existing business, or purchasing equipment or inventory. Business loan customers typically have good credit and a strong business plan. Business loans can …

Read More »Unveiling the Hidden Truths: A Deep Dive into Business Loan Customer Beliefs

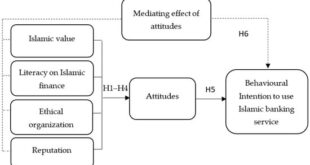

Business loan customer beliefs are the perceptions and attitudes that customers have towards business loans. These beliefs can influence customers’ decisions about whether or not to apply for a business loan, as well as the terms of the loan they choose. For example, a customer who believes that business loans are too expensive may be less likely to apply for …

Read More »Uncover the Secrets of Online Banking Rewards: Discoveries and Insights

Online banking reward quality is a measure of the attractiveness and value of the rewards offered by banks to their customers for using their online banking services. These rewards can include cash back, points, miles, discounts, and other benefits. Online banking rewards can be a valuable way for customers to save money and earn rewards on their everyday banking activities. …

Read More »Business Loan Customer Attitudes: Unveiling Surprising Insights and Strategies

Business loan customer attitudes refer to the perceptions, feelings, and beliefs that customers have towards business loans and the institutions that offer them. These attitudes can be influenced by a variety of factors, including the customer’s financial situation, past experiences with business loans, and the overall economic climate. Positive business loan customer attitudes are important for banks and other lending …

Read More »Unlock the Secrets of Online Banking: Rewards, Rewards and More!

Online banking reward superiority refers to the advantages and rewards associated with using online banking services compared to traditional banking methods. These rewards can include cash back, points, miles, and other incentives that encourage customers to conduct their banking transactions online. Online banking reward superiority has become increasingly important in recent years as more and more people switch to online …

Read More » Ini Balikpapan All about Banking Finance

Ini Balikpapan All about Banking Finance